This article introduces my trading logic (trend-following method) to those who want to start FX trading or who are currently studying FX but have not been able to take profits steadily.

The FX market is not a world where there is an equal probability of whether the price goes up or down. Rather, there is a "momentum" which triggers the price to proceed to one way during a specific period of time. I have formulated my method in order to find the said momentum. All successful traders around me have various trading methods. But they all have one thing in common: Enter the market when the orders in one way increases.

In this article, I will explain how to follow this common point along with specific techniques.

*1 This article introduces one of the methods which enables you to steadily take profits in response to the trend. I hope it will be helpful to you. (There are many other trend-following trading methods. What is introduced here is just an example).

* 2 I am considering the expositions of other trading methods.

* 3 This article introduces how to conduct a buying entry as an example. In the case of conducting a selling entry, please imagine the opposite way.

Contents

- 1 Overview of My Trading Method

- 2 Details of the indicator (SMA)

- 3 How to Proceed the Trade

- 4 How I actually traded by utilizing the chart: Example 1

- 5 How I actually traded by utilizing the chart: Example 2

- 6 Back test result of this method (June - December 2020)

- 7 Supplement

- 8 What I want to tell beginners about my thoughts on trading

Overview of My Trading Method

・Conduct a buying entry in expectation of golden cross of short-term SMA and middle- or long-term SMA.

(Golden cross: The chart pattern which shows that the short-term SMA crosses above the longer-term SMA term)

・This trading method aims for minimizing the losses and enlarging profits as much as possible by setting the profit margin wider than stop-loss margin.

・This trading method aims for following the trend in reference to moving averages.

NOTE: This method should be interpreted not as "how to conduct a buying entry after the chart shows the sign of golden cross”, but as “how to conduct a buying entry in expectation of golden cross”.

Details of the indicator (SMA)

・Use a 15-minute chart.

・Draw two SMAs (20-period and 80-period) on the chart.

They are the 15-minute and hourly 20-period SMAs respectively.

(15-minute 80-period SMA is equal to hourly 20-period SMA.)

Chart

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

How to Proceed the Trade

① Entry to the market

・Target the moment of golden cross on the 15-minute chart in anticipation that 20-period SMA crosses above 80-period SMA.

・Targeting a golden cross means targeting a change of momentum. In this way, you can ride on the orders of loss-cuts and profit-taking arising from the conclusion of short-term downtrend and new buy orders in anticipation of an uptrend.

Loss-cut order by a short position trader = Buy order

New order by a trader aiming at the timing of buying entry= Buy order

In the FX market, there are so many transactions between buy and sell orders. However, the point at which the above two factors overlap correspond with the one at which the buy orders temporarily increase. In other words, this is the point where the rate may extend to the long direction. That is what this trading method targets.

・At the front, I mentioned "Enter the market when the orders in one way increases". That means that if you are considering a buying entry, you should aim for the point where the many short-position traders cut their losses.

・In order for the rate to be extended as expected, a breakthrough of a high-profile line is necessary. Targeting such a break to enter the market will increase your success rate.

② Stop-loss setting

I set the stop-loss point at the starting point of the wave at the time of entry. This setting is required to minimize the loss.

③ Profit-taking

At the same time when I enter the market, I usually set the profit-taking line at the level where the rate touches a high-profile line.

④Remarks

When the chart indicates that the stop-loss margin exceeds the gain margin, I decide to refrain from entering the market.

How I actually traded by utilizing the chart: Example 1

Here, I explain the entry point on the basis of my actual trading.

Chart settings

EUR/USD 15-minute chart

20-period SMA (Yellow)

80-Period SMA (White)

Result

+55.0 pips

Analysis

①A short-term downtrend has appeared with the 20-period SMA (yellow), as outlined with A in the green circle.

②I predicted that the above downtrend would reverse when the rate crossed above the level B.

③After confirming the above break at the area of ENTRY, I decided to place a buy order.

④At the same time, I set a stop-loss line at the level C to avoid the unexpected losses.

⑤I made a settlement at the area of EXIT as I gained the profit of 55.0 pips.

In this example, I utilized the moment when many buy orders flew in the markets all together as the short-position traders who had formed the downtrend as shown A placed stop-loss orders and the traders in anticipation of a new upward trend placed new orders.

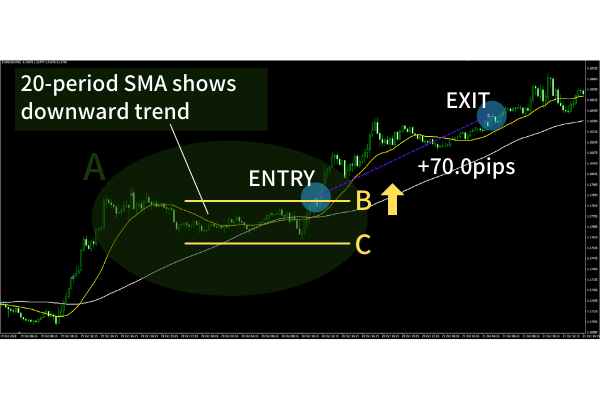

How I actually traded by utilizing the chart: Example 2

Result

+70.0 pips

The logic is the same as in Example 1.

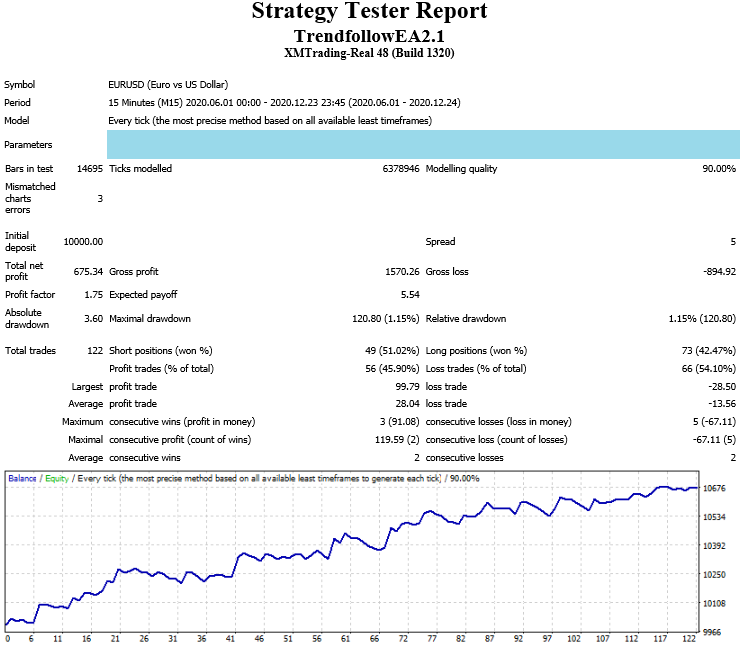

Back test result of this method (June - December 2020)

For a reference, I have systematized this method and conducted a back test.

Strategy Tester Report

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

Supplement

・How to arrange this trading method

You can improve the performance by taking the following factors into consideration.

①Use the different time-frame charts and adjust SMA settings in accordance with the currency pair

②Limit the applicable currency pair(s)

How to arrange the method is diverse and shows the taste of each trader. Also, using different time-frame charts helps you conduct swing trading or scalping. Please have a try to adjust the method and find your own style.

・Strength and weakness

This method works in the market environment where a certain trend is occurring. In other words, it is difficult to make a profit in a directionless market environment where the rate moves sideways. I do not believe that there is a method adaptable to every market environment. Therefore, in the case of a market environment where I am not good at conducting the trading, I have tried to mitigate the damage by cutting my losses. Instead, I have utilized other methods which can generate a profit.

・Focusing excessively on the golden cross will not generate profits.

Some say "You should conduct a buying entry as soon as the golden cross appears". But I do not recommend it. I believe that the trading method depending on the golden cross will not work without additional factors such as a clear line break and small-loss/large-profit transactions, as shown above.

What I want to tell beginners about my thoughts on trading

・Importance of utilizing multiple trading methods simultaneously

Unfortunately, it is not until the end of the year can we find the most successful trading method of the corresponding year. The trend-following method as described above will not work in the environment where the market moves sideways. There is nothing wrong as long as you are satisfied with "I had a good result this year" or "I don't care about what happens next year”. However, I will not be satisfied if I cannot steadily succeed every year.

For this reason, like many successful traders, I have made the most of multiple less-correlative methods simultaneously - trend-following method, contrarian method and indicator-responsive method - to avoid overlapping drawdowns. What is important is the ability to apply each method to your investment strategy in accordance with the market environment so that you can maximize the profits in the environment favorable to the method and minimize the losses in an unfavorable thereto. Having multiple trading methods helps you steadily secure the profit on an annual basis.

・What the successful traders around me are doing.

Looking around me, I have realized that improving the trading skills is not equal to becoming a "prophet" who can predict the future price movement. What the skilled traders are doing and thinking would be helpful to you. They are making all kinds of preparations for the unpredictable market environments and accumulate profits by responding appropriately to price movements. In fact, they care little about whether the price goes up or down in the near future.

Thank you for sparing your precious time to read this article.

Many people enter the world of FX trading to make money as much as possible and as fast as possible. But they tend to unnecessarily take excessive risks and as a result leave the market. I don't want you to follow suit. Rather, I hope you have a look at the few years ahead and the skills of time- and fund managements, instead of pursuing a short-term gain. Let's learn FX trading and accumulate profits steadily and carefully. I will keep studying as well.