People say that “FX trading is associated with high risk”. It is probably because many investors have taken big losses by FX and their experiences have been widely spread. On the other hand, it is obvious that there are many traders who have steadily earned money through FX. I believe that what is required to succeed in FX trading is “trading method”, “portfolio management”, “knowledge” and “experience”. This article emphasizes the importance of portfolio management by clarifying the differences of how successful and unsuccessful traders perform it.

To come right to the point, what is the most important in asset management is;

Even if the maximum drawdown occurs, you should make sure to conduct transactions with the same number of lots as the one held before the drawdown.

If you are following this principle now, it is safe to say that you have a great ability to manage your assets.

This article takes a look at the following contents. I hope it will be of help to you.

①How unsuccessful traders establish the trading pattern and why it is wrong.

②How successful traders establish the trading pattern.

③Other portfolio management methods

Contents

【Portfolio Management】 How unsuccessful traders establish the trading pattern.

Example 1:

Amount of Investment: USD 10,000

Leverage up to 1:50

Currency Pair: EUR/USD

Deposit Currency: USD

| No. | Transacted Amount | Result | Pips | Earning | Balance |

| 1 | EUR 100, 000 | Win | +10 | + USD 100 | USD 10,100 |

| 2 | EUR 100, 000 | Win | +10 | + USD 100 | USD 10,200 |

| 3 | EUR 100, 000 | Win | +10 | + USD 100 | USD 10,300 |

| 4 | EUR 100, 000 | Win | +10 | + USD 100 | USD 10,400 |

| 5 | EUR 100, 000 | Lose | -800 | -USD 8000 | USD 2,400 |

The above describes the most typical example of failure that forces beginner traders to quit FX trading. They are willing to take big risks only to achieve a series of small gains. Once a huge reversal occurs, that is, a great crash or a heavy rise, they wipe out the accumulated gains and additionally lose a big part of assets for investment. Sure, some brilliant traders can accumulate a series of small gains while hedging huge losses.

So what is the biggest mistake this trader made? After losing money through the fifth trading, the trader cannot hold the same position size as the one held before this trading (*). Why is it the problem? It is because it takes a lot of time to recover losses with the excessively reduced money. In the above example, the trader managed EUR 100,000 with USD 10,000 deposited in the account. However, after the failed investment reduced balance to USD 2,400, the amount of transacted currency shall be EUR 24,000, as long as the trader uses the same leverage ratio as the one before the loss in order to continue the investment.

(*) When there is USD 2,400 in the account whose maximum leverage ratio is 1:50, the trader cannot invest EUR 100,000 as a fresh position, depending on the rate.

<Calculation>

EUR 100,000 × USD 1.21000 (estimated rate) / USD 2,400 = 50.4 (executable leverage)

Example 2:

Amount of Investment: USD 10,000

Leverage up to 1:50

Currency Pair: EUR/USD

Deposit Currency: USD

| No. | Transacted Amount | Result | Pips | Earning | Balance |

| 1 | EUR 24,000 | Win | +10 | + USD 24 | USD 2,424 |

| 2 | EUR 24,000 | Win | +10 | + USD 24 | USD 2,448 |

| 3 | EUR 24,000 | Win | +10 | + USD 24 | USD 2,472 |

| 4 | EUR 24,000 | Win | +10 | + USD 24 | USD 2,496 |

| 5 | EUR 24,000 | Win | +10 | + USD 24 | USD 2,520 |

Example 2 describes the case where the trader who reduced the money to USD 2,400 uses the same leverage ratio as the one in Example 1 to continue transactions. Even if the trader succeeds in trading and earns profit five times a low, it is only a drop in the bucket. The trader earns only USD 120.00 in total, a far cry from the original amount.

Once a huge loss is posted, it is very difficult to recover it. And if the trader chooses to widen the ratio of leverage, aiming at the recovery, the same result will await and the trader will suffer another huge loss. This is how beginner traders lose all of their money and why FX trading is associated with high risk.

※ How to hedge the unconsidered loss in the case of the maximum drawdown

When an unexpected event triggers the uncontrollable price movement, traders are often forced to take a loss more than the amount of deposit or owe a deficiency balance. To hedge such a loss, I recommend you to choose the broker which provides “zero-cut system” or “negative balance protection (NBP)”, which systematically prevents the balance of the account from turning negative.

<Recommendable brokers in the light of competitive trading environment, including NBP>

・XM: In the great trading environment, asset for investment can be expanded by a bonus campaign. (Official site →)

・Tradeview: Great trading environment and lower spread cost are available. (Official site →)

【Portfolio Management】 How Successful Traders establish the trading pattern.

Next, we take a look at how the successful traders conduct transactions. They have mainly two trading patterns in mind.

①Adjust position size

②Adjust the margin of stop-loss order

①Adjust Position Size

This method intends to adjust the amount of transacted currency by setting the allowable stop-loss amount, like 1% of the invested amount, while conducting transactions with the variable stop-loss line. Many successful traders utilize this method to adjust the loss. Also, as the allowable stop-loss amount is raised, the amount of transacted currency can be increased, allowing the traders to conduct a high-risk-high-return investment. It is best to review your results of past trades to determine or adjust the percentage. In my opinion, many successful traders seem to set 3% or lower as the allowable loss.

Example 3

Amount of Investment: USD 10,000

Leverage up to 1:50

Currency Pair: EUR/USD

Deposit Currency: USD

| No. | Result | Profit (%) | Earning | Balance |

| 1 | Win | +2.0% | USD +200.00 | USD 10,200 |

| 2 | Win | +1.0% | USD +100.00 | USD 10,300 |

| 3 | Win | +1.0% | USD +100.00 | USD 10,400 |

| 4 | Win | +1.0% | USD +100.00 | USD 10,500 |

| 5 | Lose | -1.0% | USD -100.00 | USD 10,400 |

| 6 | Win | +1.7% | USD +170.00 | USD 10,570 |

| 7 | Lose | -1.0% | USD -100.00 | USD 10,470 |

| 8 | Win | +1.0% | USD +100.00 | USD 10,570 |

<Calculation>

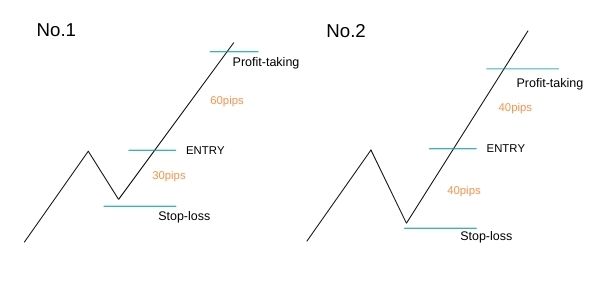

Case No.1

Stop-loss Line: 30 pips below the entry line

Amount of Investment: USD 10,000

Currency Pair: EUR/USD

Deposit Currency: USD

Estimated Stop-loss Amount: USD 100.00 (1% of the amount of investment)

Amount of Transacted Currency: USD 100.00 / 30 pips (USD 0.0030) = EUR 33,333

When the amount of transacted currency is EUR 33,333, a stop-loss line can be drawn at the level of 30 pips below the entry line and it will amount to a loss of $100.00. In this case, the trader luckily got 60 pips which amount to twice as much as the estimated stop-loss amount (1%).

Case No.2

Stop-loss Line: 40 pips below the entry line

Amount of Investment: USD 10,000

Currency Pair: EUR/USD

Deposit Currency: USD

Estimated Stop-loss Amount: USD 100.00 (1% of the amount of investment)

Amount of Transacted Currency: USD 100.00 / 40 pips (USD 0.0040) = EUR 25,000

①Adjust the margin of stop-loss order

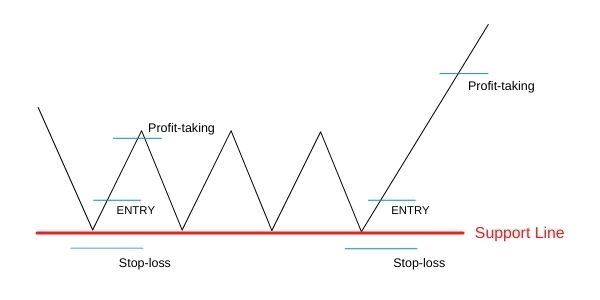

In this method, a trader has preliminarily set a stop-loss line at a certain level. So the amount of transacted currency won’t vary through all transactions. The method of fixing the stop-loss line can be seen in scalping trading. In comparison with the above method which requires the adjustment of position size, this method allows traders to make a more instantaneous entry to the market as the lot adjustment can be saved. I am using this method to manage my portfolio when conducting the scalping trading.

| NO. | Result | pips | Balance |

| 1 | Win | +5 | + USD 5.00 |

| 2 | Win | +10 | + USD 10.00 |

| 3 | Lose | -5 | - USD 5.00 |

| 4 | Win | +5 | + USD 5.00 |

| 5 | Lose | -5 | - USD 5.00 |

※ FYI on Scalping

If you are interested in scalping trading, Tradeview’s Innovative Liquidity Connector account will greatly help you since it provides the extremely low spread cost.

Both methods have in common that traders can estimate the amount of loss before taking a loss and can conduct transactions with the same number of lots as the one held when the maximum drawdown occurred. The amount of allowable loss per trade varies between traders. So first of all, I recommend you to understand how maximum drawdown occurs in your trading method and then set the allowable amount of loss.

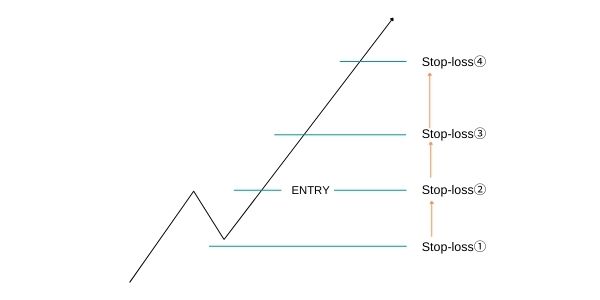

【Portfolio Management】 Other Methods of Portfolio Management

In addition to the above-mentioned methods, there are other methods of portfolio management. For example, if the rate goes up as expected after the entry, you can raise the stop-loss line in parallel with the uptrend. When you enter the market, you should set the line at “Stop-loss 1” level in order to limit the loss. On the other hand, profit-taking line should be determined in reference to the growth of rate. Like the above methods, it is important for the traders to assume the maximum drawdown.

Conclusion

Thank you for sparing your precious time to read this article.

When you ask what is required in order to steadily succeed in FX trading, many traders will emphasize the importance of trading methods. I agree with it. However, I also believe that portfolio management is as important as trading methods. In reality, I am taking them into account in combination, and I recommend you to do so. I hope this article will be of help to you.