[Summary of This Article]

- CySec-licensed brokers offer compensation of up to EUR 20,000 to clients.

- This compensation is made when the broker fraudulently uses the fund of clients.

- In the case where a broker goes bankrupt, clients can receive a full refund.

This article introduces the compensation system offered by CySec-licensed brokers. The CySec license governs the brokers in Europe. Most of the major European brokers have acquired the license because it complies with the legal requirements for brokers operating in Europe (the rating of the license is among the highest in the world).

This article summarizes information about the compensation system for European traders under the regulation of the CySec license so that you can learn how the system works. I would be happy if this article could help you to grasp CySec's compensation system.

Which finance license is applied is determined by the trader's country of residence.

The CySec license applies mainly to the European zone. Therefore, this article is intended for those residing in Europe and having an intention to do FX trading through a CySec-licensed broker. This article is not directly relevant for traders living in a country or region where CySec does not govern such as Asia. But it would be good if you can read this article to learn more about the regulatory situation in Europe.

Contents

ICF (Investor Compensation Fund) and Segregated Custody

CySec-licensed brokers are obliged to join ICF (Investor Compensation Fund). Under ICF, traders who conduct FX trading through a member broker can receive compensation of up to EUR 20,000 as one sphere of investor protection (EUR 20,000 ≒ USD 23,200, EUR/USD=1.16000).

Can Clients Receive Compensation Only When Broker Goes Bankrupt?

This is wrong. It is a given fact that, in the event of a broker's bankruptcy, the full amount of the margin shall be refunded.

If you hear that you can receive compensation of EUR 20,000 at the maximum, it is no wonder that you think that we should deposit the money of less than EUR 20,000. This perception itself is good, but it is wrong if you think you will only get EUR 20,000 back.

The CySec license requires brokers to segregate client assets (segregated custody). Therefore, if a licensed broker went bankrupt, the segregated assets would be used to give an immediate refund to clients.

ICF's "compensation of up to EUR 20,000" system is triggered only when the segregated assets are not returned for some reason.

What Is “Segregated Custody”?

Segregated custody means that FX brokers segregate clients’ assets from the company's operating expenses. It ensures that their assets shall not be used for the sake of the broker. In the event of broker's bankruptcy, clients’ assets held in segregation will be returned to clients.

The Case Where Clients’ Assets Are Fully Returned Even after Broker’s Bankrupt

Various factors cause a company to go bankrupt. However, when it comes to FX brokers, it is a violent fluctuation of the market. This section explains why brokers are damaged by price volatility and how client assets are handled in this case.

How Brokers Conduct Trading

FX brokers employ two trading methods: Dealing Desk (DD) and No Dealing Desk (NDD).

Brokers employing NDD are recommended because they do not intervene in their clients’ trades, and therefore the relationship between the broker and the client is not a conflict of interest.

Details of DD and NDD can be found in another article.

The below focuses on NDD brokers' role in FX trading and why bankruptcy-level loads occur in some cases.

Role of NDD Brokers

The role of brokers employing NDD is to mediate transactions.

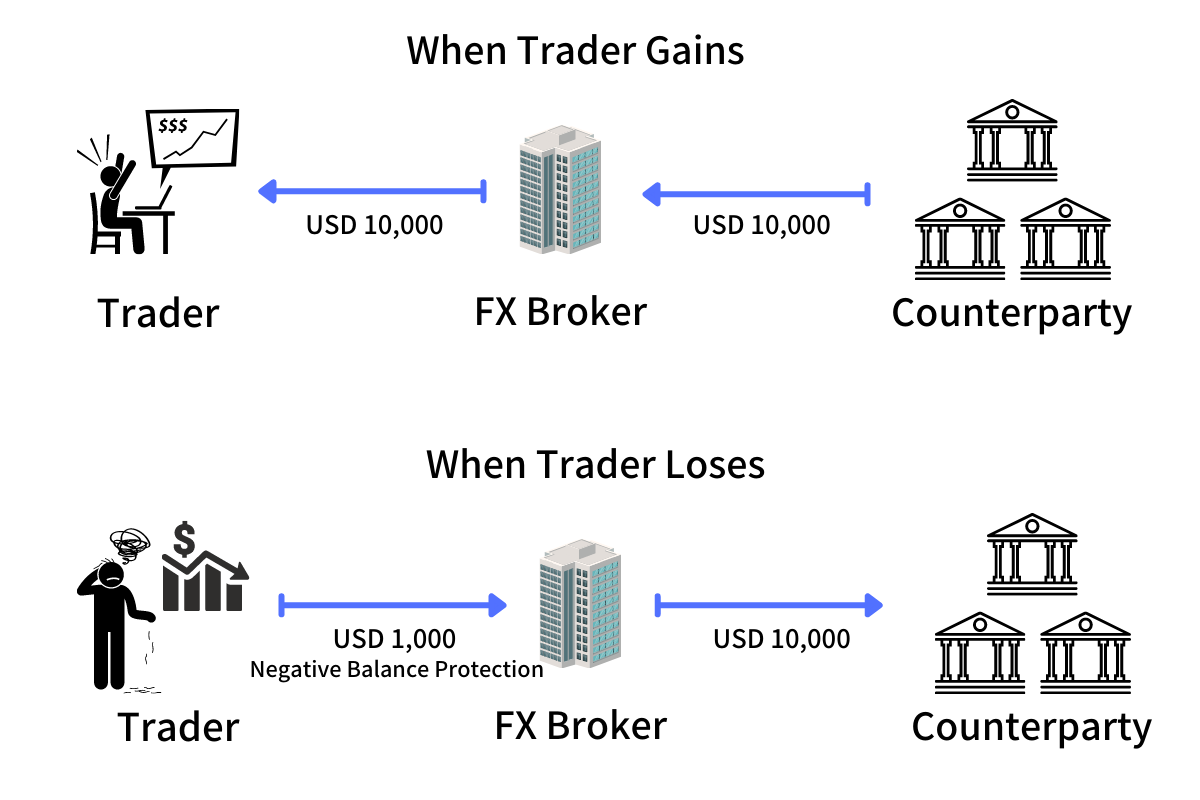

NDD brokers forward traders' orders to the interbank and take cover transactions. If a client makes a profit of USD 10,000, the counterparty (a broker or a financial institution of the opposite side of the client) loses USD 10,000, and the broker receives USD 10,000 to add it to the client’s asset.

On the other hand, if a client loses USD 10,000, the broker uses USD 10,000 of the client’s asset to pay it to the counterparty. The broker's revenue is nothing but commission. There is no relationship between the trader's results and the broker's revenue.

But with this explanation, some may think there is no case where brokers are heavily loaded in any market environment.

When Does Load fall on Brokers?

The case where the NDD brokers are heavily loaded is when the market suddenly turns volatile, which causes a large number of traders to have huge losses. Then, the amount of payment to the counterparties may exceed the clients’ assets.

When a trader's negative balance is reset by Negative Balance Protection, the broker will eventually be responsible for any shortfall payments to the counterparties. Failure to make such payments may result in bankruptcy.

For example, in the wake of the sudden volatility called “Swiss Franc Shock,” which occurred on January 15, 2015, a major Australian broker Alpari UK went bankrupt.

In the event of a broker's failure due to such a sudden and short-term price change, clients’ assets in segregated custody will be returned.

The Case Where Clients’ Assets Are NOT Fully Returned after Broker’s Bankrupt

When a broker fraudulently used clients’ assets, clients will not receive a full refund.

Such a case has rarely happened recently, thanks to the stricter supervision from CySec. Financial regulators such as FCA, CySec, and CIMA require the licensed brokers to segregate clients’ funds from brokers’ and strictly monitor their segregated custody status. Therefore, when it comes to investor protection, it is recommended to do the transactions through the brokers licensed by either of the above regulators, especially when you invest a lot of money.

Conclusion

This article introduced CySec brokers’ compensation system. It would be good if you could grasp what ICF's "compensation of up to EUR 20,000” means from this article. You should keep the following points in mind.

- ICF’s compensation system is triggered only when the broker fraudulently uses clients’ funds.

- If a broker goes bankrupt, its clients can receive a full refund not limited to EUR 20,000 in principle.

For your information, below are the brokers who hold CySec licenses.

| Broker | Operation Area | Operating Company | Official Website |

| XM | Europe | Trading Point of Financial Instruments Ltd | Official Website |

| HotForex | Europe | HF Markets (Europe) Ltd | Official Website |