Closer look at how to utilize the all-in-one calculator and what information it provides.

XM provides six calculation tools for FX trading on its official website. They are available for free even if you do not have an account with XM.

XM Calculator ( Official Site ) →

Contents

What information does XM Calculation Tool provide?

(1) Pip Value: Calculate the amount of currency (price) moved by the change of 1 pip

(2) Currency: Use XM rate to calculate the amount of money at the time of conversion

(3) Margin: Calculate the margin required to open a position in accordance with the entered currency amount.

(4) Swaps: Calculate the cost when holding the specified currency pair for one day.

(5) Profit And Loss: Calculate the price and the width of pips from the entry line at the time when the rate reaches the specified stop-loss or profit-taking line.

(6) All In One: Calculate the amount of margin required, pip value (profit and loss per pip), and daily holding cost (swap).

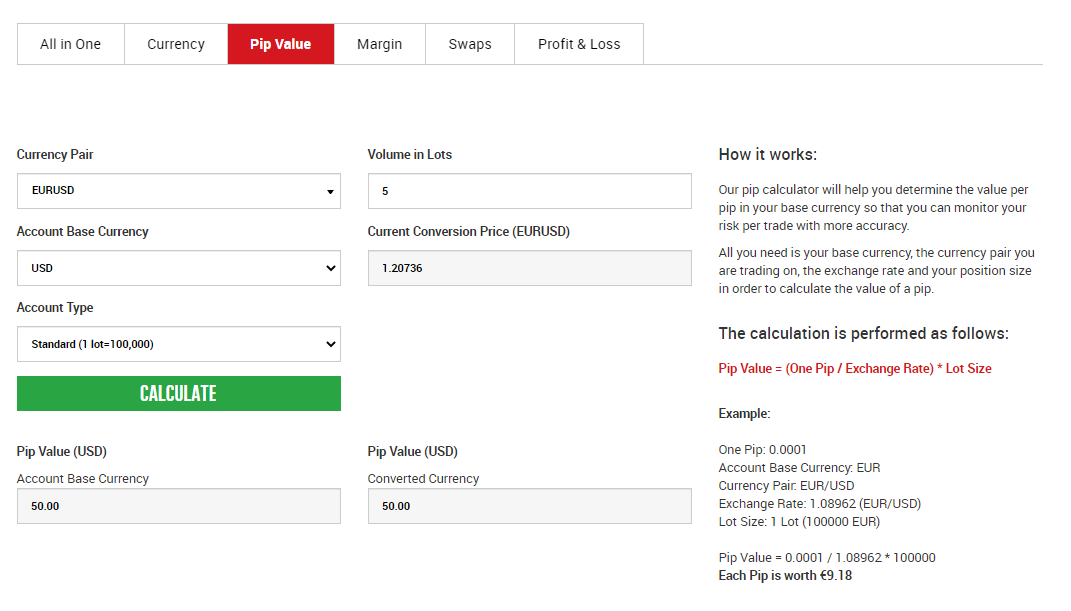

①Pip Value

<What information is required for calculation>

Currency Pair: Specify currency pair you are trading or will trade

Account Base Currency: Specify your account currency.

Account Type: Specify your account type.

Volume in Lots: Specify the amount of currency to trade.

※ Current Conversion Price is automatically calculated.

<What this tool calculates>

This tool calculates the amount of currency (price) moved by the change of 1 pip. It displays the calculated value on the basis of both account currency and the trading currency. The latter means the one shown on the right side of the currency pair. For example, when you specify “EURUSD” as a currency pair, the trading currency is USD.

This tool is useful for figuring out the optimal lot size and the number of loss-cut pips.

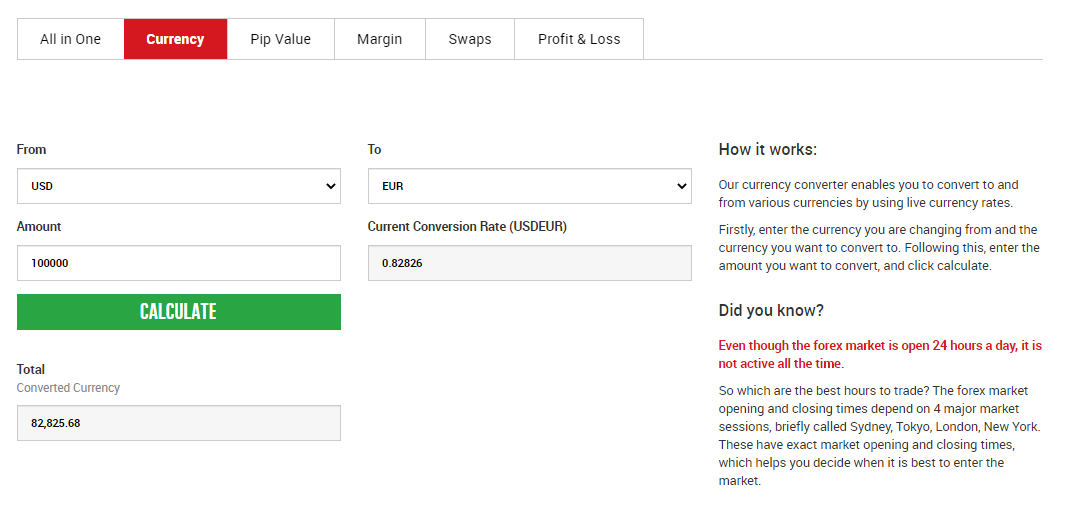

②Currency

<What information is required for calculation>

From: The currency you are changing from

To: The currency you want to convert to

Amount: The amount you want to convert

※ Current Conversion Rate is automatically calculated.

<What this tool calculates>

This tool uses the live currency rate of XM to calculate the amount of money when converting a currency into another. This tool is useful when you open an account with the currency different from your home currency, for example, when a Japanese trader uses the US dollar as his account currency.

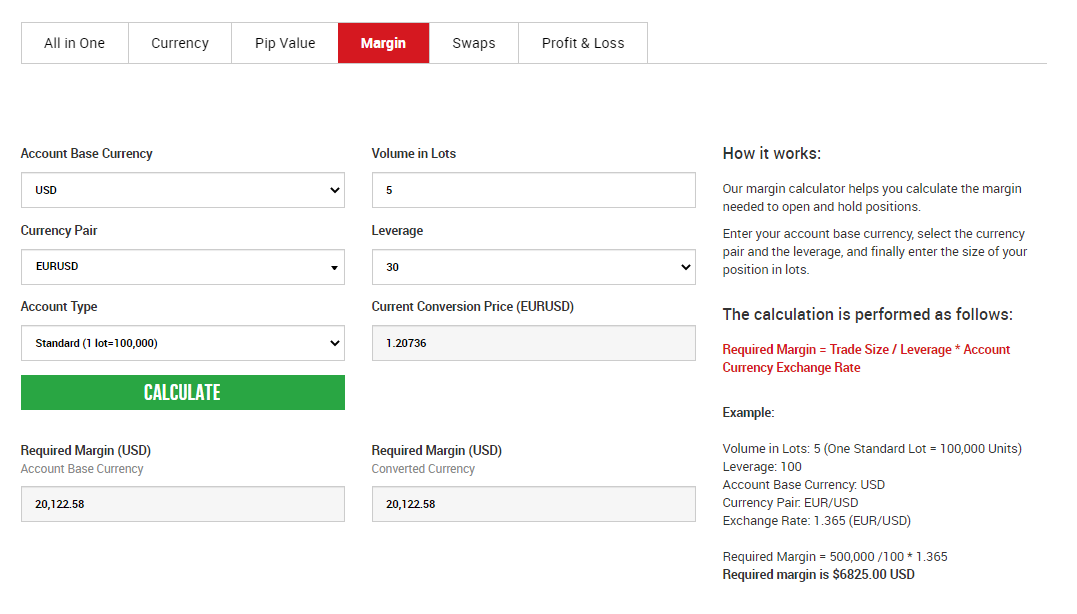

③MARGIN

<What information is required for calculation>

Account Base Currency: Specify your account currency.

Currency Pair: Specify currency pair you are trading or will trade

Account Type: Specify your account type.

Volume in Lots: Specify the amount of currency for trading.

Leverage: Specify the maximum leverage of the using account.

※ Current Conversion Price is automatically calculated.

<What this tool calculates>

This tool uses the margin required to open a position for the specified amount of currency for trading. Similar to the above Pip Value tool, it displays the amount of required margin on the basis of both account currency and the trading currency.

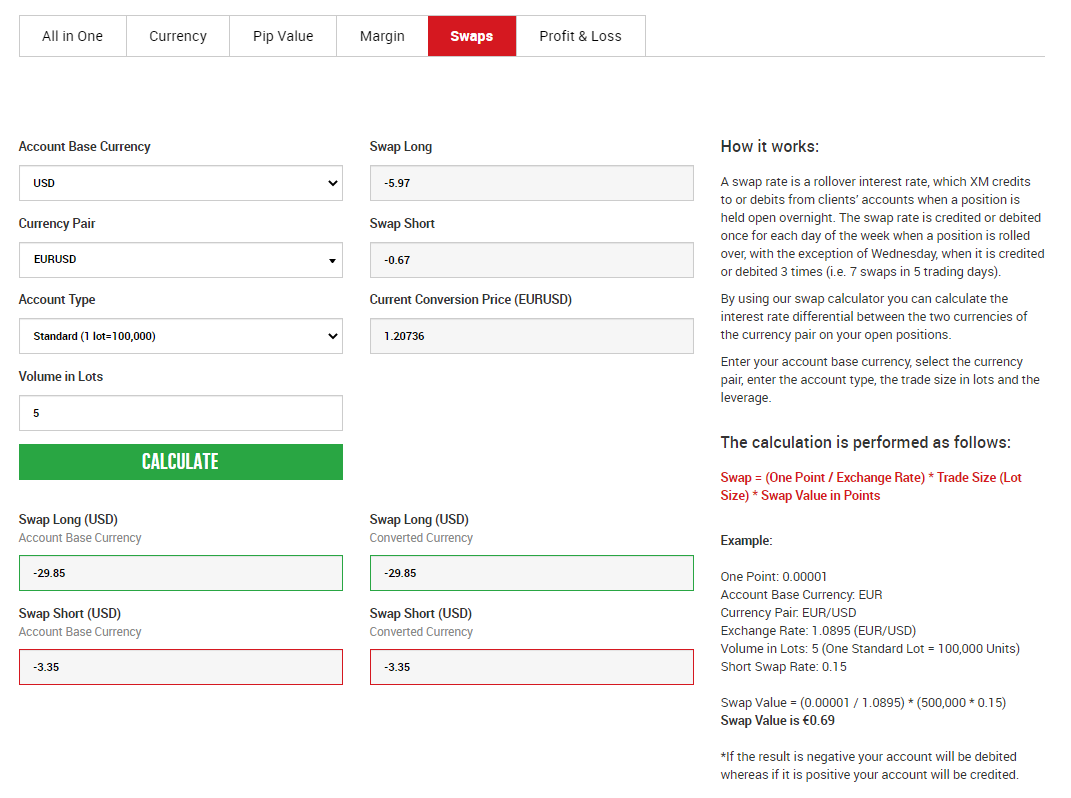

④SWAPS

<What information is required for calculation>

Account Base Currency: Specify your account currency.

Currency Pair: Specify currency pair you are trading or will trade

Account Type: Specify your account type.

Volume in Lots: Specify the amount of currency for trading.

※ Swap Long, Swap Short and Current Conversion Price are automatically calculated.

<What this tool calculates>

It calculates the cost when holding the specified currency pair for one day. Values of Swap Long and Swap Short are displayed on the basis of both account currency and the trading currency. A swap rate is a rollover interest rate, which XM credits to or debits from the trader’s accounts when a position is held open overnight.

If a position is held for a few days or weeks, the cost can be roughly calculated by using the swap rate and number of such days. This is especially useful for swing traders.

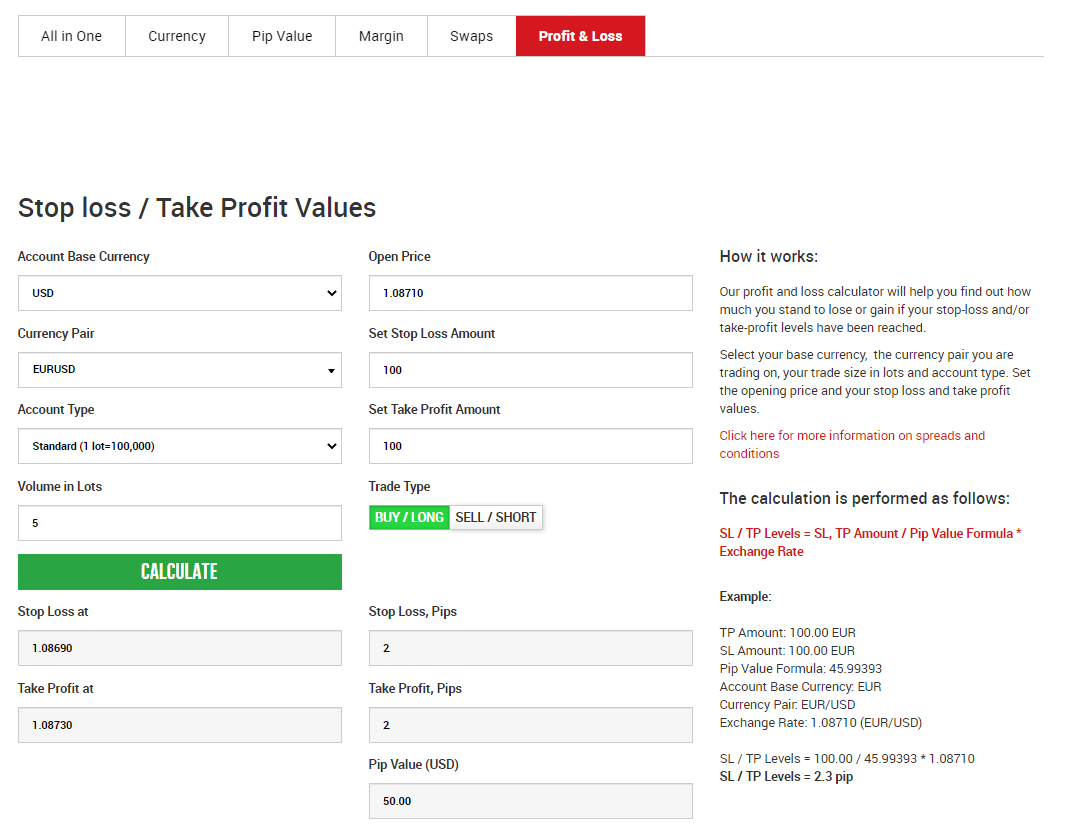

⑤PROFIT AND LOSS

Stop loss / Take Profit Values

<What information is required for calculation>

Account Base Currency: Specify your account currency.

Currency Pair: Specify currency pair you are trading or will trade

Account Type: Specify your account type.

Volume in Lots: Specify the amount of currency for trading.

Open Price: Specify the price at which you plan to enter the market.

Set Stop Loss Amount: Specify the stop loss price in the account currency.

Set Take Profit Amount: Specify the profit amount price in the account currency.

Trade Type: Select buy entry (long) or sell entry (short).

<What this tool calculates>

This tool calculates at which level the rate reaches to make a loss-cut or profit-taking and the range of pips at that time. It also calculates the pip value mentioned in ①. It is useful to understand the rate which reaches the level of the allowable amount of loss or target for taking profit.

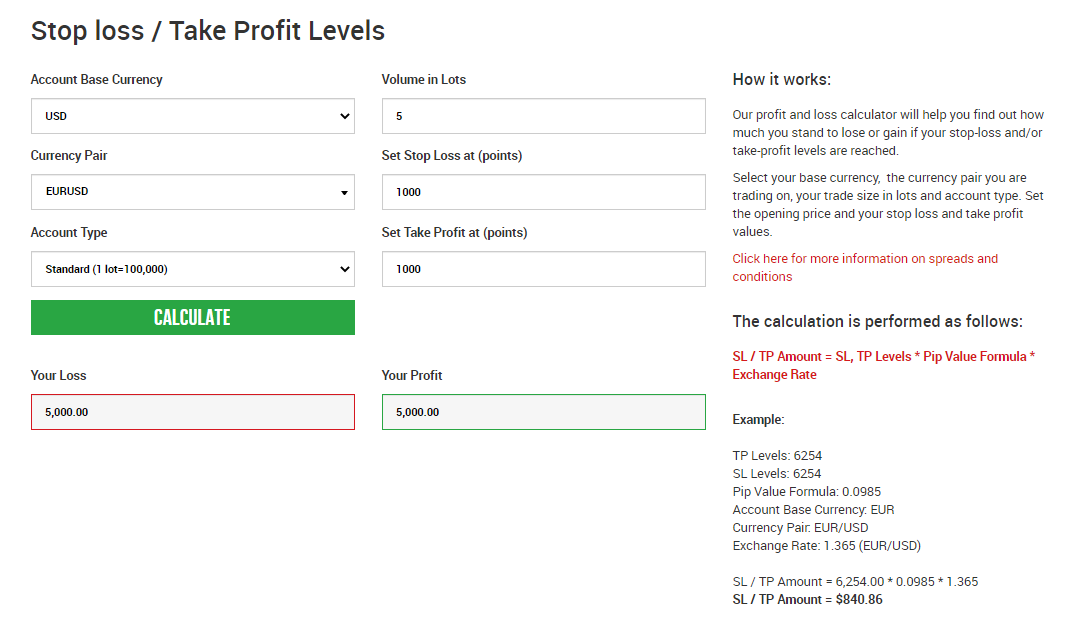

Stop Loss / Take Profit Levels

<What information is required for calculation>

Account Base Currency: Specify your account currency.

Currency Pair: Specify currency pair you are trading or will trade.

Account Type: Specify your account type.

Volume in Lots: Specify the amount of currency for trading.

Open Price: Specify the price at which you plan to enter the market.

Set Stop Loss at (points): Specify the point to make a loss cut.

Set Take Profit at (points): Specify the point to take profit.

Trade Type: Select buy entry (long) or sell entry (short).

(*) What is a point?

“1 point” means the minimum value of the decimal point displayed in the rate. XM displays the USD/JPY rate like 106.507 and the EUR/USD rate like 1.20726. Therefore, 1 point in XM is equivalent to 0.1 pips. In other words, if you want to calculate with "100 pips", you should enter "1,000 points".

Related article (Explaining the difference between pips and points)

【What Is Pip?】Understand what pip is in FX and learn how to calculate profit and loss.

<What this tool calculates>

It calculates the amount of loss and profit at the specified stop-loss and profit-taking points. It is useful for trades who use the width of pips to determine their settlement target as this tool shows the amount of loss and profit per trade at once.

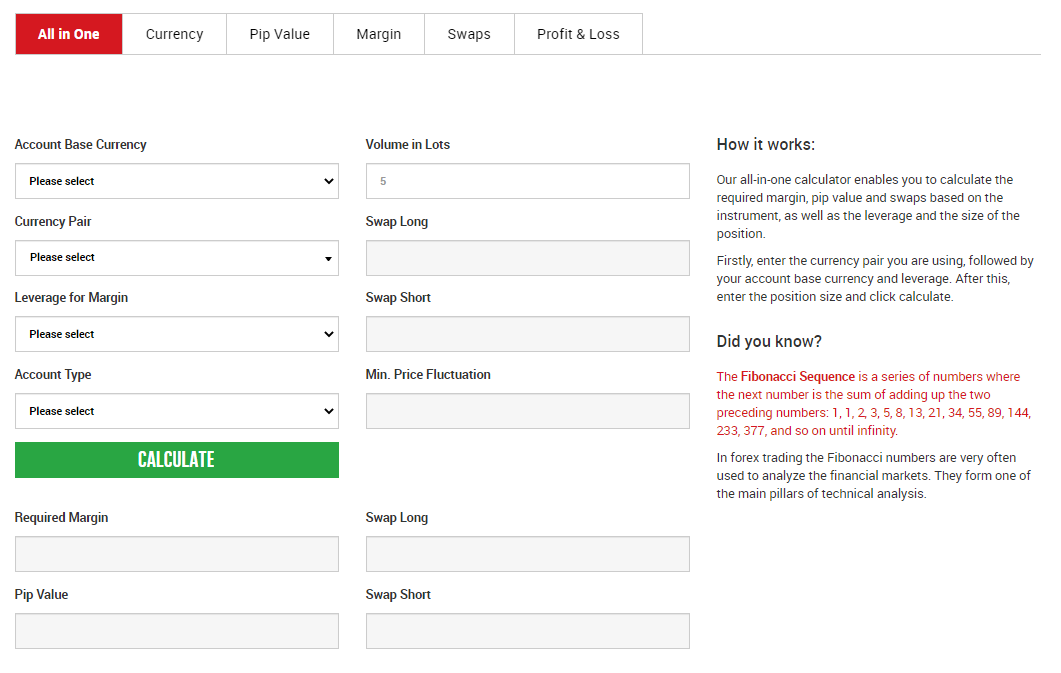

⑥ALL IN ONE

<What information is required for calculation>

Account Base Currency: Specify your account currency.

Currency Pair: Specify currency pair you are trading or will trade

Leverage for Margin: Specify the maximum leverage of the using account.

Account Type: Specify your account type.

Volume in Lots: Specify the amount of currency for trading.

※ Swap Long, Swap Short, Min. Price Fluctuation will be calculated automatically.

<What this tool calculates>

This tool calculates the required amount of margin, pip value (amount of profit or loss per pip), and daily holding cost, i.e. swap. It is useful for traders who want to know the required amount of margin and swap at the same time.