This article introduces the following points;

・A list of XM Group companies, their coverage area and the regulations to which companies are subject.

・Features of each group company

XM ( Trading Point of Financial Instruments Ltd ) Official Site

XM has different group companies depending on the customer's country of residence, and the services offered by each company also differs. The reason why there are multiple companies and different services is that they have to comply with the regulations of financial licenses in different countries. These aspects also enable XM to provide services which take advantage of the features (strengths) of each regulation.

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments Ltd was established in 2009 and it is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), Trading Point of Financial Instruments Pty Ltd was established in 2015 and it is regulated by the Australian Securities and Investments Commission (ASIC 443670) and XM Global Limited was established in 2017 and is regulated by the International Financial Services Commission (000261/158).

For example, XM offers a bonus service, which allows account holders to increase their margin. But it is not available in Europe because financial licenses covering the region including CySec (Cyprus Securities and Exchange Commission) prohibit its offering at all. Meanwhile, traders in Asia can enjoy it because the regulation body covering the Asian region, IFSC (International Financial Services Commission), allows it.

XM has various features in each group company. However, some people who are interested in XM now may be unsure about which group company my country belongs to. Therefore, this article is intended to help readers visualize where each group company are covering and what features each company has.

Contents

- 1 【XM】 How to Distinguish XM Group’s Website

- 2 List of XM Group Companies, Covering Areas and Regulations

- 3 Features of Each Group Company

【XM】 How to Distinguish XM Group’s Website

As mentioned above, XM is composed of the below three affiliates.

・Trading Point of Financial Instruments Ltd(CySec)

・Trading Point of Financial Instruments Pty Ltd(ASIC)

・XM Global Limited(IFSC)

As I provide information about brokers, I want readers who have an intention to open an account to understand which XM group’s website you are watching. So, this article introduces how to distinguish XM group’s websites at glance.

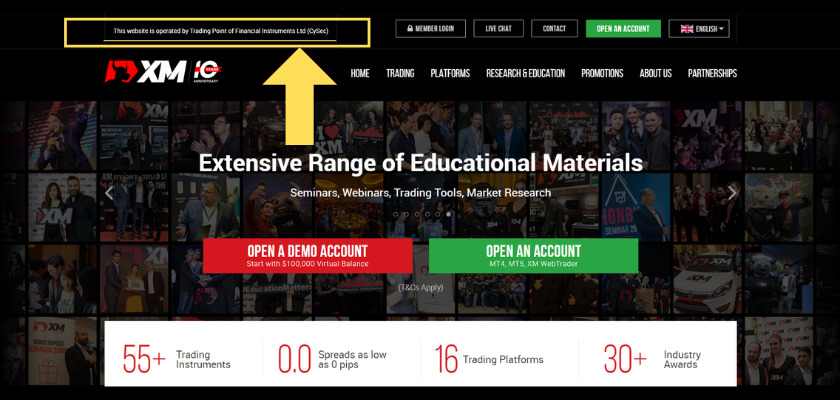

The above images show the upper and lower parts of XM's official website.

XM ( Trading Point of Financial Instruments Ltd ) Official Site →

XM ( XM Global Limited ) Official Site →

<Upper>

This website is operated by Trading Point of Financial Instruments Ltd (CySec)

<Lower>

Legal: This website is operated by Trading Point of Financial Instruments Limited, registration number HE251334, with registered address at 12 Richard & Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042 Limassol, Cyprus.

These images say that the site is operated by Trading Point of Financial Instruments Ltd, which is registered at CySec. Since XM displays the site in accordance with the customer's country of residence, you can see the group company you should sign up with by checking these descriptions. In this case, this company is regulated by CySec.

List of XM Group Companies, Covering Areas and Regulations

Here, we take a look at the companies XM Group operates, the financial licenses they belong to, and the regulations they should abide by. The country or countries each company is covering are also listed, so it will be helpful for you to know which company you should open an account with and what kind of regulations it has.

Trading Point Holdings Ltd

Country of Headquarter: Cyprus

License: IFSC, CySec, ASIC

Trading Point of Financial Instruments Ltd

XM ( Trading Point of Financial Instruments Ltd ) Official Site →

Country: Cyprus

License: Cyprus Securities Commission (CySec)

Regulations

・Negative Balance Protection

・Segregated Client Funds

・Maximum Leverage: 1:30 * (depending on the instrument)

・No deposit bonus or any other special offers are allowed.

・ICF (Investor Compensation Fund)

ICF: Trades are eligible for compensation of up to €20,000 in the event of the failure of an ICF member institution.

Key Point

・CySec is one of the most rigorous financial licensers in the world as it grants license exclusively to the forex brokers which have passed a strict screening process. Since audits are conducted annually, traders can deposit their funds to them with confidence.

・Companies with this license are suitable for those who want to trade under the strict licensing regulations and to ensure the safety of their account funds.

・If you want to manage a large amount of investment funds, you should select the broker with the CySec license.

Covering Countries

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom

People living in the country listed above will open an account with Trading Point of Financial Instruments Ltd.

XM Global Limited

XM ( XM Global Limited ) Official Site →

Country: Belize

License: International Financial Services Commission (IFSC)

Regulations

・Negative Balance Protection

・Segregated Client Funds

・Maximum Leverage: 1:888 * (depending on the instrument)

・Deposit bonus and other bonus offers are allowed.

XM (XM Global Limited) bonus program [Official Site]

Key Point

・The broker offers the bonus for traders who deposit money and have an excellent range of leverage (1:888).

・The IFSC license is not as rigorous as the CySec one. Therefore, it is better to diversify your funds with other accounts to reduce risk in case XM goes bankrupt.

Covering Countries/Regions

China, Hong Kong SAR, India, Indonesia, Malaysia, Philippines, Russia, Singapore, Taiwan,

Algeria, Andorra, Angola, Antarctica, Armenia, Aruba, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Benin, Bermuda, Bhutan, Bolivia, Botswana, Brazil, Brunei, Burkina Faso, Burundi, Cape Verde, Cambodia, Cameroon, Chile, Christmas Island, Cocos (keeling) Islands, Colombia, Comoros, Cook Islands, Costa Rica, Curacao, Djibouti, Dominica, Dominican Republic, East Timor, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Ethiopia, Falkland Islands, Fiji French Guiana, French Polynesia, Gabon, Gambia, Georgia, Ghana, Gibraltar, Greenland, Grenada, Guadeloupe, Guatemala, Guinea, Guyana, Haiti, Honduras, Iraq, Ivory Coast, Jamaica, Jordan, Kazakhstan, Kenya, Kiribati, Kuwait, Kyrgyzstan, Laos, Lebanon, Lesotho, Libya, Macau, China Madagascar, Malawi, Maldives, Mali, Marshall Islands, Martinique, Mauritius, Mexico, Micronesia, Moldova, Monaco, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Namibia, Nauru, Nepal, New Caledonia, Niger, Nigeria, Niue, Oman, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, Qatar, Reunion, Rwanda, Saint Helena, Saint Kitts and Nevis, Samoa, San Marino, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Solomon Islands, Somalia, South Africa, Sri Lanka, Suriname, Swaziland, Switzerland, Tajikistan, Thailand, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Tuvalu, Uganda, Ukraine, United Arab Emirates, Uruguay, Uzbekistan, Vatican City, Venezuela, Vietnam, Zambia, Zimbabwe,

People living in the country listed above will open an account with XM Global Limited.

Difference between CySec and IFSC

CySec

・Brokers under the CySec license are suitable for those who want to trade under the strict regulations and ensure the safety of large amounts of investment funds.

・CySec does not allow brokers to offer bonuses to clients but requires a better guarantee of funds.

IFSC

・Brokers under the IFSC license can offer bonuses to account holders which can increase their margin in exchange for deposits, and have an excellent range of leverage (1:888).

・The IFSC license is not as rigorous as the CySec one. Therefore, it is better to diversify your funds with other accounts to reduce risk in the event of insolvency.

Trading Point of Financial Instruments Pty Ltd

Country: Australia

License: Australian Securities and Investments Commission (ASIC)

Regulations

・Negative Balance Protection

・Segregated Client Funds

・Maximum Leverage: 1:30 * (depending on the instrument)

・No deposit bonus or any other special offers is allowed.

Covering country

Australia

If you are living in Australia, you will automatically sign up with Trading Point of Financial Instruments Pty Ltd, an ASIC licensed company, to open an account.

Features of Each Group Company

[Trading Point of Financial Instruments Ltd] Financial License: CySec

XM ( Trading Point of Financial Instruments Ltd ) Official Site

In general, CySec-licensed brokers are suitable for traders who put emphasis on the safety of fund management.

Traders can manage a large amount of money in the stable trading environment and under the strict license control.

Details of regulations

・Negative Balance Protection (CySec)

・Segregated Client Funds (CySec)

・ICF (Investor Compensation Fund) (CySec)

・Maximum Leverage: 1:30 * (depending on the instrument)

・No deposit bonus or any other special offers is allowed.

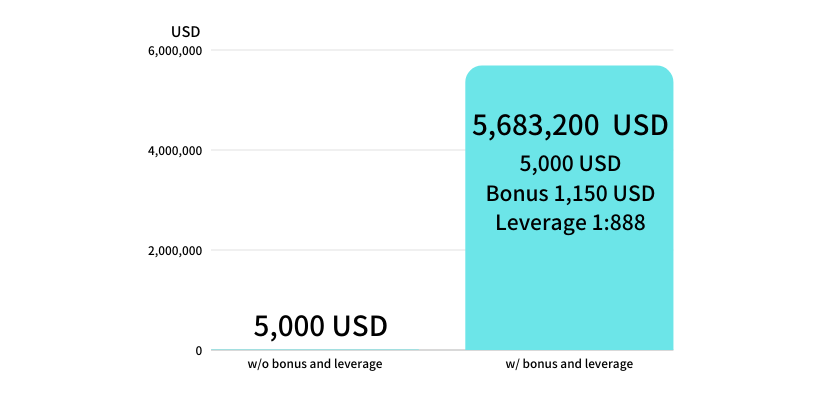

This figure shows the difference in investment funds with and without leverage. If you think that those who have more money have an edge in the world of trading, then you are correct. The larger the number of lots you trade, the greater the possibility of earning large profits. Needless to say, it does not mean that you can easily make money. Continuous study and accumulation of experiences matter.

In FX trading, it is necessary to deposit “margin” as an operational fund with a broker. Therefore, brokers are required to have sufficient safety and security systems. The above company meet the criteria required by CySec

The 1:30 leverage as the maximum allowable leverage may seem inferior. However, it favors traders who utilize huge money and transact huge amounts of lots as the environment for safekeeping the funds are secured.

(The currency used to open an account can be selected from USD and others.)

Covering Countries 【Trading Point of Financial Instruments Ltd】

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom

People living in the country listed above will open an account with Trading Point of Financial Instruments Ltd.

XM ( Trading Point of Financial Instruments Ltd ) Official Site →

[XM Global Limited] Financial license: Belize IFSC

XM ( XM Global Limited ) Official Site

Regulations

・Negative Balance Protection

・Segregated Client Funds

・Maximum Leverage: 1:888 * (depending on the instrument)

・Deposit bonus and other bonus offers are allowed.

XM (XM Global Limited) bonus program [Official Site]

Bonus

・Bonus for opening an account (USD 30.00 or its equivalence in other currencies) after the account opening and deposit are confirmed)

・Deposit bonus

・Loyalty program, in which a trader can earn some points in accordance with trading volume and can convert the accumulated points into rewards.

Here, we take a closer look at the deposit bonus.

In this program, traders can increase the investment fund in accordance with the amount of the deposit. 50% of the bonus is offered when depositing up to USD 500.00 (a), and for the portion of deposit amount between USD 500.00 and USD 5,000.00, 20% of the amount is offered (b).

This bonus is automatically available for all clients who deposit funds into their trading accounts until the maximum bonus amount of $5,000 has been received.

This chart shows the difference in investment capital with and without bonus and leverage when deposition USD 5,000.00. In the right case, the bonus expands the fund to USD 6,150.00 and the 1:888 leverage further expands it to USD 5,683,200.00

NOTE: Applicable maximum leverage and other restrictions.

・Bonuses are applicable to Standard and Micro accounts.

・Deposit bonus is NOT applicable to XM Ultra Low account.

Covering Countries/Regions 【XM Global Limited】

China, Hong Kong SAR, India, Indonesia, Malaysia, Philippines, Russia, Singapore, Taiwan,

Algeria, Andorra, Angola, Antarctica, Armenia, Aruba, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Benin, Bermuda, Bhutan, Bolivia, Botswana, Brazil, Brunei, Burkina Faso, Burundi, Cape Verde, Cambodia, Cameroon, Chile, Christmas Island, Cocos (keeling) Islands, Colombia, Comoros, Cook Islands, Costa Rica, Curacao, Djibouti, Dominica, Dominican Republic, East Timor, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Ethiopia, Falkland Islands, Fiji French Guiana, French Polynesia, Gabon, Gambia, Georgia, Ghana, Gibraltar, Greenland, Grenada, Guadeloupe, Guatemala, Guinea, Guyana, Haiti, Honduras, Iraq, Ivory Coast, Jamaica, Jordan, Kazakhstan, Kenya, Kiribati, Kuwait, Kyrgyzstan, Laos, Lebanon, Lesotho, Libya, Macau, China Madagascar, Malawi, Maldives, Mali, Marshall Islands, Martinique, Mauritius, Mexico, Micronesia, Moldova, Monaco, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Namibia, Nauru, Nepal, New Caledonia, Niger, Nigeria, Niue, Oman, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, Qatar, Reunion, Rwanda, Saint Helena, Saint Kitts and Nevis, Samoa, San Marino, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Solomon Islands, Somalia, South Africa, Sri Lanka, Suriname, Swaziland, Switzerland, Tajikistan, Thailand, Togo, Tokelau, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Tuvalu, Uganda, Ukraine, United Arab Emirates, Uruguay, Uzbekistan, Vatican City, Venezuela, Vietnam, Zambia, Zimbabwe,

People living in the country listed above will open an account with XM Global Limited.

XM ( XM Global Limited ) Official Site →

People living in the country not listed above are ineligible for any bonus programs.

Conditions of the bonus program differ from the country of residence.

Summary of Features of XM Global Limited

・Various bonuses and the leverage up to 1:888 help new and existing clients to hold their positions open for a longer period, even if they want to use small amounts for investment.

・Various bonuses and high leverage are not available under the CySec licenses. Therefore, these services are unique to XM Global Limited as it is administered by IFSC.

・As the IFSC license has laxer stipulations than CySec when it comes to the compensation in the event of insolvency, it is better to avoid depositing large amounts of money as margin. Instead, trading with a small amount of margin is recommended.

・There are many traders who earn money by enjoying these advantages. If you are a resident of the country where IFSC covers, you should take advantage of it.

Thank you very much for sparing your time reading this article. I hope this helps you choose a broker.