This article gives answers to questions regarding “what is FX trading?” and “how to generate a profit, or currency-exchange gain” to those who want to start FX trading.

FX trading is a method of investment which aims at currency-exchange gain by trading the fluctuating currencies such as the US dollar (USD), Euro (EUR) and Japanese Yen. To earn a profit, traders buy a currency at a low price and sell it at a high price, or sell a currency at a high price and cover it at a low price.

What distinguishes FX trading from other investment products is that traders can leverage their own margin (deposit). It can multiply the amount of assets and accordingly efficiently drive earnings growth, creating an opportunity to make much more money than other investment products and side businesses. In contrast, the ability of risk management is also required as there is the same equivalence of risk as expectation.

This article first compares “margin trading” to “share trading” in order to well understand FX trading and then introduces “currency-exchange gain” of FX trading.

<What you can learn>

・What is FX trading?

・What is margin trading?

・What is the difference between share trading and margin trading?

・What is currency-exchange gain?

Contents

1. What is margin trading?

FX is an abbreviation of “foreign exchange”, and the official name of FX trading is “foreign exchange margin trading”. Margin trading is a method of transaction in which traders leverage their own margin (deposit) to conduct trading and balance profits and losses at the time of settlement.

You may not understand what “balance profits and losses at the time of settlement” means. So to begin with, I summarize the settlement method on FX trading.

Contract for differences (CFD)

First, the transaction method in the world of FX trading is called “contract for differences (CFD)”. As the name suggests, traders have to make settlement only on the differences.

In a normal transaction, a buyer makes a payment in exchange for the goods. If you want to obtain the goods at the price of USD 500.00, you have to give the seller the equivalent amount of money.

On the other hand, FX traders do not need to make payment, or make settlement, at the time of entry, or purchase. Instead, they need to make settlement when they release their positions. For example, a trader wants to buy EUR 10,000 with USD. But how much the trader has to pay is the difference between the amount of USD equivalent to EUR 10,000 at the time of entry and that at the time of settlement.

What is margin?

The theory of aforementioned CFD is “Once I purchase a currency, I will definitely resell it in the future. So it will be simple to pay only for the portion of difference at the time of reselling”. It is based on the premise that the currency a trader placed a buy order for has to be resold later, and conversely the currency a trader placed a sell order for has to be covered later. Therefore, before holding a position, the trader must have proof, or “margin”, that the trader can make settlement even if the loss arises from the position. If the amount of arisen loss exceeds the amount of margin, the trader is forced to make a loss-cut.

First, we take a look at share trading.

A trader selects a company and purchases and holds its share. Share price varies in accordance with various factors such as the performance of the company. A shareholder can utilize it to earn profit (strictly speaking, becoming a shareholder to acquire some rights is another attractive aspect of share trading).

For example, if a trader wants to hold 500 shares in a company whose price per share is USD 20.00, the trader needs to pay at least USD 10,000 (USD 20.00 × 500 shares). Unsurprisingly, the trader prepares the same amount of money for the investment. In share trading, traders need to provide the money every time a transaction occurs. And the assets increase or decrease in accordance with the change of share price.

Margin trading

Next, we take a look at margin trading.

As mentioned above, margin trading is based on CFD. Traders can leverage their own margin and adjust the amount of funds. In the case of share trading, a trader needs to provide USD 10,000 to invest the same amount of money. However, FX traders do not actually need to pay such an amount.

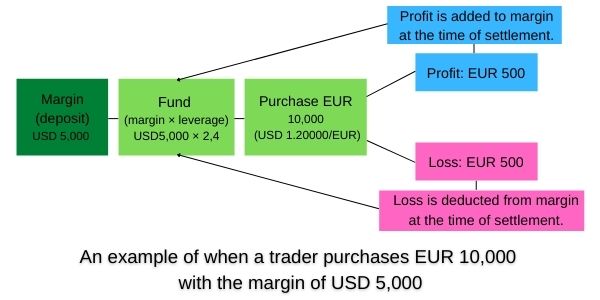

The following figure shows FX trading with the margin of USD 5,000. By right, the trader who has USD 5,000 cannot buy in excess of EUR 4,166 (at the rate of USD 1.20000 to EUR). But leverage enables the trader to buy up to EUR 10,000, as the following calculation states.

USD 5,000 × Leverage rate 2.4 / USD 1.20000 (EUR/USD) = EUR 10,000

* Leverage rate is adjustable in accordance with purchase volume.

In margin trading, leverage enables the traders to invest more money than the amount of margin.

In addition, if a trader conducts trading with a 1:1 leverage ratio, the amount of margin is equal to the one of funds for investment, and it results in being similar, in a sense, to foreign currency deposits, although there are some differences in the method of fee payment and others.

3 What is currency-exchange gain?

Currency-exchange gain is a profit earned by selling the holding currency or covering the sold currency. In the fluctuating foreign exchange market, when a certain currency becomes much in demand, its price goes up, and vice versa. FX traders utilize this kind of price movement to repeatedly “buy low to sell high” and “sell high to cover low”, and earn a profit from the market.

The strategies of “buy low, sell high” and “sell high, cover low” are common not only in FX trading but also in other investments and businesses. Like share trading and cryptocurrency trading, if a person buys clothes at a price of USD 100 and then sells it at a price of USD 120, the person earns a profit of USD 20.

You may see on the news traders watching multiple screens showing charts in a trading room. They are checking the charts around the clock to repeatedly conduct transactions of “buy low, sell high” or “sell high, cover low”. It seems difficult as they make full use of multiple screens and sophisticated indicators, but what they are doing is quite simple.

One of the traits of trades to aim at currency-exchange gain is its variety of styles. Some traders purchase and settle the position within a few seconds or minutes. Others spend a few days or weeks to earn a gain. Trading style can be adjusted in accordance with the lifestyle of each trader. That is why FX trading is suitable for side business.

Example of “Buy low, sell high”

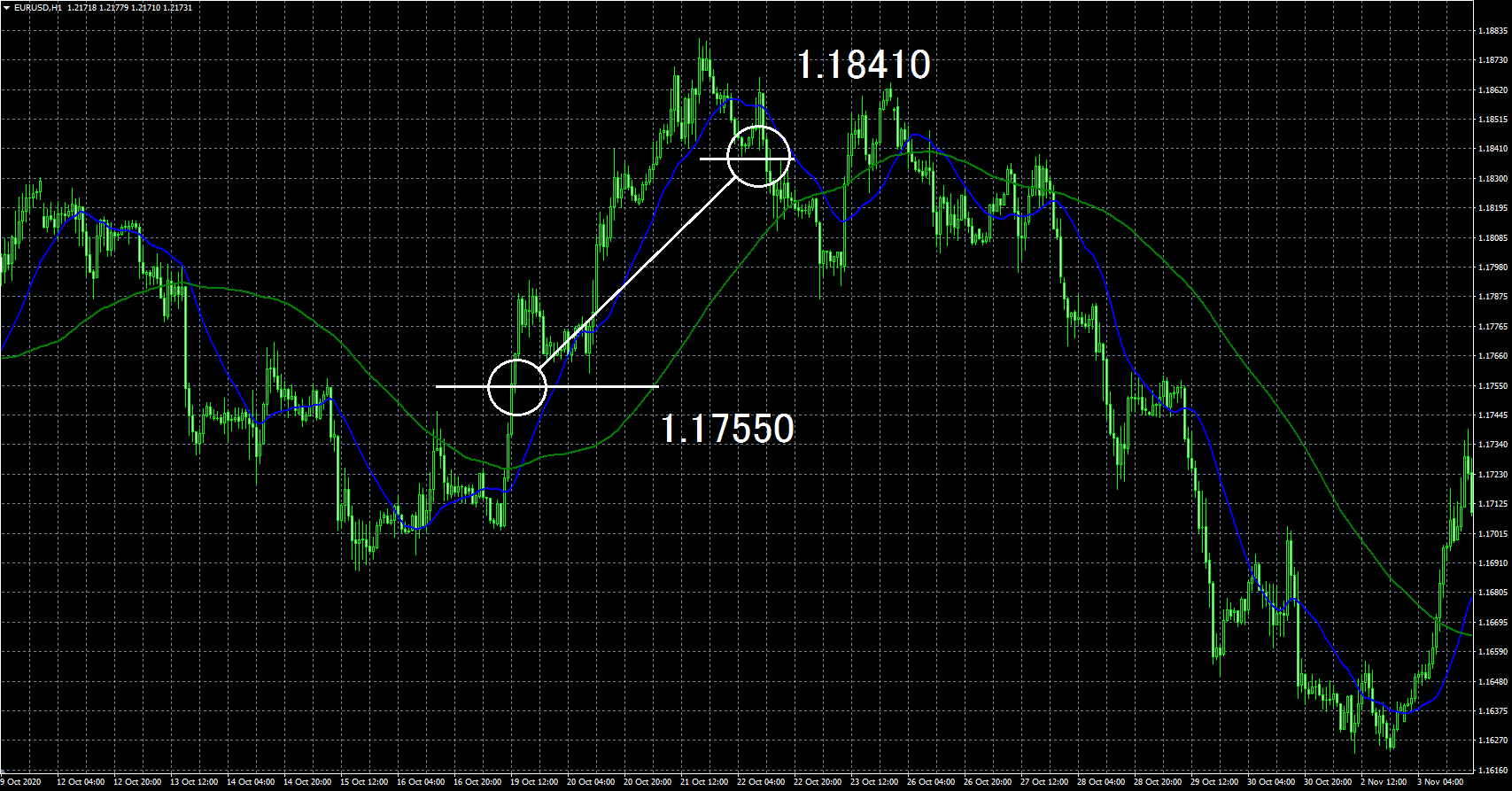

Chart

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

This is an hourly basis chart of EUR/USD. If you bought EUR 100,000 at the price of USD 1.17550 to EUR and sold it at USD 1.18410 to EUR, the trader can earn a profit of USD 860.00 as stated in the follows calculation;

(USD 1.18410/EUR × EUR 100,000) - (USD 1.17550/EUR × EUR 100,000) = USD 860.00

* Fees and other expenses are excluded to simplify the explanation.

The above well exemplifies “buy low, sell high” strategy. For long position traders to earn a profit, they should enter the market at the time of uptrend. To predict such a timing, they need to analyze the chart. FX traders mainly use the approaches of utilizing either technical analysis or economic data. Both are effective but which approach fits you varies from the trading style. So you need to establish your own style through a lot of experiences.

Example of “Sell high, cover low”

Chart

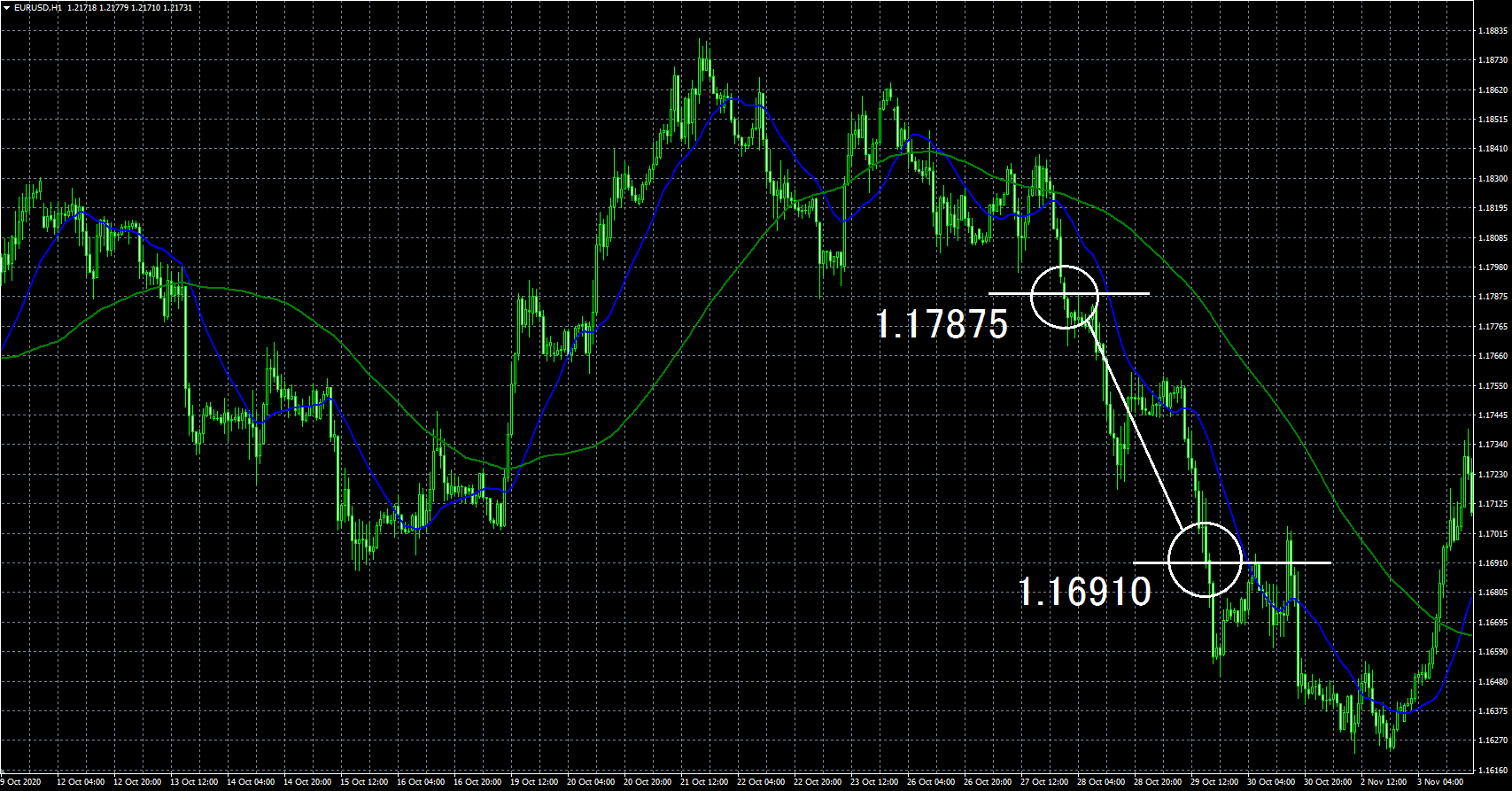

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

Like the previous example, the above shows an hourly basis chart of EUR/USD. If you sold EUR 100,000 at the price of USD 1.17875 to EUR and covered it at USD 1.16910 to EUR, you can earn a profit of USD 965.00.

However, someone may wonder how to sell it high and cover it low, although the trader has not had EUR before selling it. It is quite natural that many do not understand why the trader can sell EUR without having it.

To summarize the answer to this question, it is because FX trading is based on margin trading, where traders make settlement by adding the amount of profit to the margin or deducting the amount of loss from it. Therefore, it is safe to understand that even the trader who does not have EUR can conduct trades by presuming that he or she has it in theory.

Also, buy orders and sell orders are inextricably linked together. While you place a buy order, another trader somewhere in the world places a sell order. You may wonder why a trader can place an order for USD even without having it. To answer this question, I would say that “At the exact time when your sell order is settled, someone’s buy order is also settled”.

Conclusion

・FX is an abbreviation of “foreign exchange”, and the official name of FX trading is “foreign exchange margin trading”.

・In margin trading, traders leverage their own margin (deposit) to conduct transactions and balance profits and losses at the time of settlement.

・The transaction method in the world of FX trading is called “contract for differences (CFD)”. In a normal transaction, a buyer makes a payment in exchange for the goods. If you want to obtain the goods at the price of USD 500.00, you have to pay it. On the other hand, FX traders do not need to make payment, or make settlement, at the time of entry, or purchase. Instead, traders need to make settlement when they release their positions.

・In the trade for currency-exchange gain, traders can earn profit through both buy and sell orders.

・Traders can establish their own trading style on the short-term, middle-term or long-term basis at their discretion.

Thank you for sparing your precious time to read this article. I hope this will be helpful to those who want to start FX trading.