This article introduces my forex scalping style.

This style focuses on a clear line to take profit of a few pips. When the rate touches a line that many traders are interested in, some traders open a position while others close it. It often makes the price fluctuate up and down at a small scale. My scalping style utilizes this feature.

I have frequently received questions via Instagram (@takalife_eng) about my trading method. This article is my answer to them. My scalping style works better than other methods because it repeatedly utilizes leverage. It would be good if this article is helpful to you.

[Caution]

The information hereinafter includes my subjectivity whose credibility is not guaranteed.

Final decisions on the transaction should be made at your own discretion.

Contents

- 1 Forex Scalping Utilizing Leverage

- 2 Advantage and Disadvantage of Scalping Utilizing Leverage

- 3 Conclusion

Forex Scalping Utilizing Leverage

There are five keys of utilizing leverage for forex scalping.

- Invest in the currency pair with a narrow spread

- Invest in the currency pair resistant to the market disturbance

- Use the 5-minute chart (or the 15-minute chart at longest)

- Focus on the line that other traders are interested in

- For advanced investors, do not fix the points of loss cut and profit-taking

Invest in the currency pair with a narrow spread

EUR/USD or USD/JPY is the best option.

Since scalping involves a number of transactions, choosing a pair with a narrow spread is a must. When it comes to the narrow spread, you should choose Tradeview.

Click here for Tradeview official website

Tradeview holds the world's highest financial license (CIMA) and offers industry-leading low spreads.

Invest in the currency pair resistant to the market disturbance

Again, EUR/USD or USD/JPY is the best option.

The market of a minor currency pair is subject to instability due to its low liquidity, posing a risk of drastic price movement. To avoid this risk, it is better to choose a major currency pair. It is also necessary to refrain from trading before the release of important economic indicators and amid major events.

Use the 5-minute chart (or the 15-minute chart at longest)

Forex scalping involves buying or selling currency pairs with only a brief holding time.

The average profit per trade should be between 5 and 10 pips. Using the one-minute chart is too short to track the price movement while the chart of more than a 30-minute timeframe is too redundant.

Focus on the line that many traders are interested in

When doing the scalping, you should pay attention to (1) clear support and resistance lines and (2) leading indicators to identify the entry point.

(1) Utilizing Support or Resistance Line

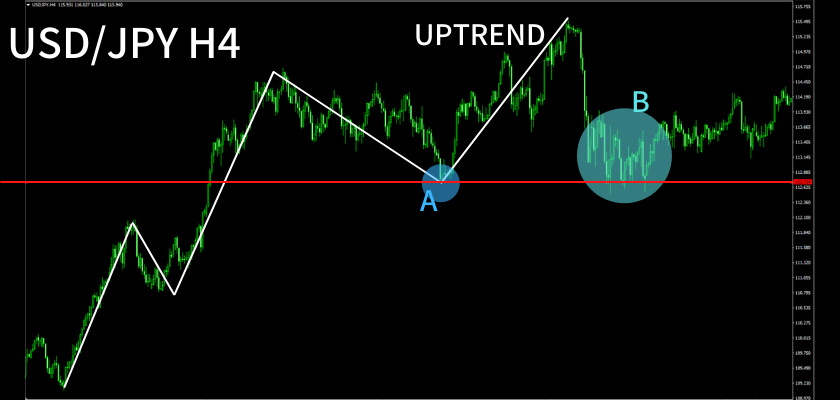

The support line you should pay attention to in forex scalping is the one that can be seen even on the chart with a longer timeframe such as the four-hour chart (H4). After checking with the H4 chart whether the support line is reliable, check the five-minute or the 15-minute chart to adjust the position.

After the rate touches the support line at the point of A, the uptrend starts to reach the latest high, where long-position traders take profit.

Meanwhile, the area of B shows the mixture of opposing positions. Some traders decide to open the position in anticipation of the continuance of the uptrend while others decide to close it, expecting otherwise.

The chart pattern shown in B occurs when the rate touches the same support line as the one that many traders focused on at the point of A. As more traders notice that the rate hits the support line, a chart pattern like B is more likely to occur. Scalping traders should utilize it.

Next, check the price movement of area B on the 15-minute chart. The support line drawn on the H4 chart also plays the same role on this chart as the chart shows a series of rebounds after touching the line (it is no problem to adjust the position after confirming the reliability as a support line at points 1 and 2).

The speculation of the long-term uptrend or downtrend makes no sense in forex scalping. Rather, you should pay attention to whether the support line functions. When the price movement lacks the direction around the line, you should utilize the slight rebound to take profit. In this case, you should take a long position at points 1-7.

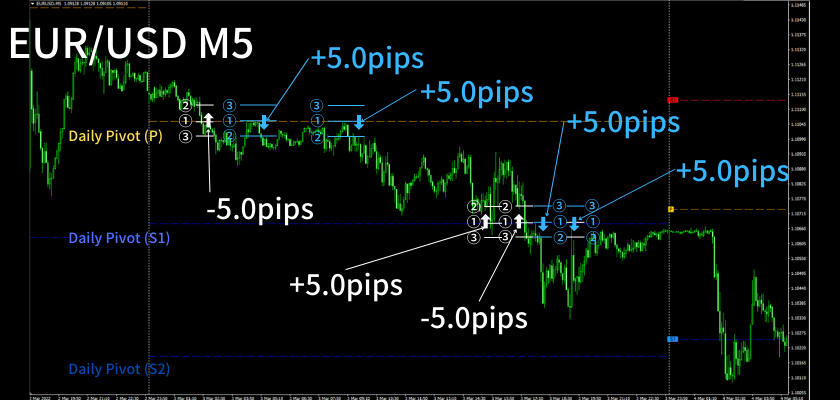

(2) Utilizing Pivot and Other Leading Indicators

Personally, this style works better than the previous style.

What Is Pivot?

- A pivot point can be calculated from the data of the previous day, week or month by using a specific calculating formula.

- A pivot line can be drawn by connecting previous data with current data on the chart, and be extended to the right side of the chart, i.e., future dates, weeks or months.

Why Utilizing Pivot Works

Most indicators, including moving averages, analyze and visualize past price movements. So they can make an analysis only on the basis of past prices. Meanwhile, the pivot line can be drawn from past to future on the same chart as other traders watch. Therefore, pivot can be useful to identify the entry point.

The speculation of the possible higher quotation after the rebound makes no sense. Rather, you should utilize the characteristic of pivot that the rate slightly or strongly bounces back after hitting the pivot line in which many traders are interested. When a slight rebound can be confirmed, you should utilize it to take a small profit. This is the best part of forex scalping.

FYI, if you utilize the strong rebound on the pivot to make a profit of 15 pips or more, it can be defined as “day trading.” Day traders utilize the pre-engaged trades for opening the position.

While pivot is very useful and helpful to traders, many brokers do not implement it on their trading platform MetaTrader 4 (MT4) by default. However, HotForex provides account holders with this indicator without charge.

Click here for HotForex official website

HotForex offers an extensive bonus program and advanced indicators free of charge.

(Click here for more information on HotForex's bonus program)

If you are interested in day trading utilizing pivot, please visit the following article, which includes an explanation of HotForex's custom indicator.

Related Article: [HotForex Custom Indicator] Introducing How to Utilize Pivot Points

Loss-cut and Profit-taking

How to Determine Profit and Loss Rates

In forex scalping, it is important to make a balance between the percentages of loss and profits against the invested amount. The allowance of this balance varies between traders.

Pattern (1): Loss-cut width < Profit width

Pattern (2): Loss-cut width = Profit width

Pattern (3): Loss-cut width > Profit width

Patterns (1) and (2) are recommended if you want to prevent large losses. Meanwhile, an experienced trader who has an ability to stably make a profit can use the pattern (3).

Here is the case of pattern (2).

① Entry Point

② SL (stop loss) point

③ TP (take profit) point

Day traders should set the lines to carry out the loss cut and profit-taking at the time of entry. It enables to incorporate the performance into future transactions through backtesting.

However, this theory cannot always hold true for scalping. In this case, you should adjust the timing of closing the position to take a small profit or accept the small loss in accordance with the market environment. For example, you should check the momentum of price movement, such as how the rate touched the entry line. Many successful scalping traders have a knack for determining the timing.

Lot Size

Generally, to determine the lot size, you should assume the possible losing streak and the acceptable rate of loss against the invested amount when experiencing the maximum drawdown. I personally use this method to set the percentage of loss cut as 1% of the investment.

Example:

Acceptable maximum drawdown: - 30% (= 15 losing streaks)

Given that you lose 2 % of the investment per loss cut, you are allowed to have up to 15 losing streaks to reach the maximum drawdown. Therefore, you should invest a currency amount smaller than 2% of the investment.

If you have difficulty making the calculation to adjust the amount of investment, you can use HotForex’s "Risk Percentage Calculator".

This free-of-charge calculator is quite convenient. For details, please refer to the following article;

【Loss Cut】 Overview of Loss Cut and How to Hedge It

Also, please read this article on how to manage your fund.

Advantage and Disadvantage of Scalping Utilizing Leverage

Advantage

Scalping Traders Can Make the Most of Leverage

The benefit of leverage improves as the number of transactions increases. Leverage enables traders to do the transactions with a large amount of money and at the same time have multiple positions simultaneously.

As scalping involves more transactions, traders can benefit from the leverage.

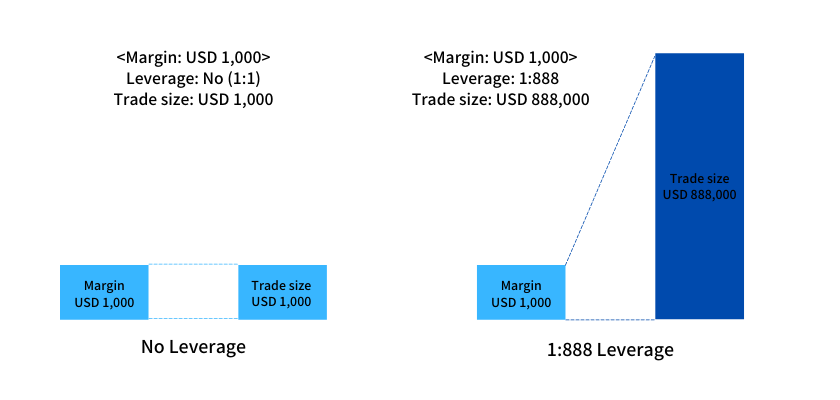

Trade size: The assumed amount of money available for investment

Originally, when USD 1,000 is deposited as a margin (funds for investment), the trader can hold the position within USD 1,000. When the leverage ratio is 1:888, the trader can hold the position of as much as USD 888,000.

Click here for an explanation of leverage.

Related Article:【What Is Leverage?】Why FX trading is the best way to build the asset

XM Group is a leading broker worldwide with high popularity among traders thanks to its high leverage and secured trading environment.

XM Official Website (Outside Europe)

XM Official Website (Outside Europe)

Disadvantages

(1) Hefty Fees Are Charged

Due to the number of transactions, traders should pay a lot of fees. The disadvantage requires traders to choose the broker which offers as low a spread as possible.

Account Currency: USD

Currency Pair: EUR/USD

Lot Size: EUR 100,000

[Broker A] Spread: 0.8 pip (USD 8.00)

[Broker B] Spread: 1.2 pips (USD 12.00)

When 100 transactions are made via each broker, the difference of fee reaches USD 400.00.

Click here for an explanation of pips.

As mentioned above, when it comes to the low spread, you cannot help being surprised at Tradeview’s super-low spread.

(2) Scalping Is Vulnerable to Fundamentals.

It is no exaggeration to say that how advantageous it is to utilize the horizontal line and pivot line for trading depends on how many traders pay attention to them altogether. However, high-profile economic indicators and news may drown out such an advantage. Therefore, the ability to identify the "right time to trade" will be tested.

(2) Scalping Is Vulnerable to Fundamentals.

It is no exaggeration to say that how advantageous it is to utilize the horizontal line and pivot line for trading depends on how many traders pay attention to them altogether. However, high-profile economic indicators and news may drown out such an advantage. Therefore, the ability to identify the "right time to trade" will be tested.

Conclusion

Again, there are five keys of utilizing leverage for forex scalping.

- Invest in the currency pair with a narrow spread

- Invest in the currency pair resistant to the market disturbance

- Use the 5-minute chart (or the 15-minute chart at longest)

- Focus on the line that other traders are interested in

- For advanced investors, do not fix the points of loss cut and profit-taking

Also, there are the following advantage and disadvantages in forex scalping.

Advantage

Scalping traders can make the most of leverage.

Disadvantages

- Hefty fees are charged.

- Scalping is vulnerable to fundamentals.

It is great if you can understand the trading method like the above exist how pivot can be utilized through this article.

Thank you for sparing your time for reading this article.

[For Your Information]

Brokers mentioned on this site are highly reliable since they are authorized by strict financial licenses.

The below site introduces the best brokers country-by-country which offer high reliability, a good trading environment and other excellent options.