This article introduces an overview of stop level and brokers which offer the zero stop level.

Stop level is the minimum distance from the current rate at which traders can place a pending order (both entry and closure of position) for taking profit or cutting a loss.

The wider the stop level is, the greater the disadvantage for traders. Although many traders prefer small spreads, they care less about the stop level. In fact, it significantly affects profitability, especially for traders who repeatedly place tight orders, such as scalpers. Also, some brokers like XM and Tradeview offer a trading environment with zero stop level.

It would be nice if you can grasp an overview of stop level with this article.

[Summary]

- Stop level is the minimum distance from the current rate at which traders can place a pending order for taking profit or cutting a loss.

- A wide stop level gives nothing but a disadvantage to traders due to the following factors:

- The available rate for limit and stop limit orders is restricted.

- Traders have difficulty earning profit but are likely to incur a heavy loss.

- Automatic transaction systems do not perform as verified in back testing.

- Some brokers like XM and Tradeview offer a trading environment which offer the zero stop level.

Contents

- 1 What Is Stop Level?

- 2 Why Wider Stop Level Is Disadvantageous

- 3 How to Check Stop Level

- 4 (F2) Broker with Zero Stop Level

- 5 Summary

What Is Stop Level?

Stop level means the minimum distance from the current rate that traders can place a pending order for taking profit or cutting a loss.

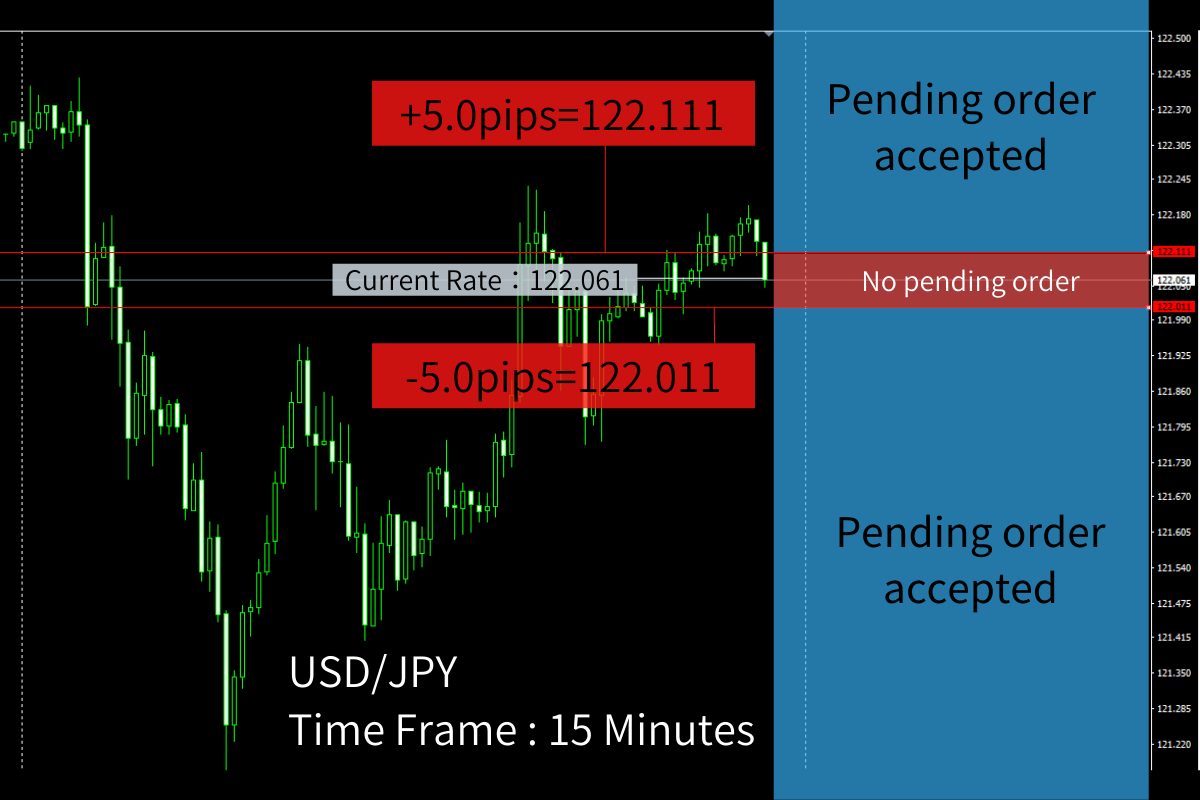

In the below example, when a broker offers the 5-pip stop level and the current rate of USD/JPY is 122.061, pending orders can be placed and accepted when a trader gives a limit at a rate more than 5 pips away from the current rate.

Why Wider Stop Level Is Disadvantageous

A wider stop level gives nothing but a disadvantage to traders due to the following factors.

- The available rate for limit and stop limit orders is restricted.

- Traders have difficulty earning profit but are likely to incur a heavy loss.

- Automatic transaction systems like EA do not perform as verified in back testing.

1. Available rate for limit and stop limit orders is restricted

If a broker offers a wider stop level, it is inevitable for traders to set a certain margin from the current rate to place a pending order.

Example of 5-pip stop level

When placing a pending order for taking profit or cutting a loss, any pending orders whose designated price is within 5 pips from the current rate will not be accepted and executed. So a trader should have the margin of more than 5 pips to give a limit and place pending orders.

2. Traders have difficulty earning profit but are likely to incur a heavy loss

Supposing that the current rate of EUR/USD is 1.0900 and a broker offers the 5-pip stop level, traders who want to place a pending order to cut a loss through this broker should give a limit at the rate lower than 1.0895. Conversely, it should be 1.0905 or higher for profit-taking.

Why traders have difficulty earning profit

When a trader holding a long position now tries to place a pending order to take profit at 1.0902, such a pending order is not accepted. So, the trader must place it by giving a limit at 1.0905 or higher. Then, if the rate hits 1.0940 and starts to fall back, the trader misses the chance to take profit since the pending order is not executed.

Why traders are likely to incur a heavy loss

Even if a trader wants to place a pending order to cut a loss at the rate 3 pips below, the trader is forced to give a limit at the rate at least 5 pips below. The pending order is executed when the rate falls as far as 5 pips. As a result, the trader incurs a heavier loss against the will.

3. Automatic transaction systems do not perform as verified in back testing

Stop level decreases the capability of the back-tested automatic transaction systems like Expert Advisor (EA) of MetaTrader (MT) 4 and MT5. Especially, a wider stop level gives a profound effect to a system that focuses on scalping as the trading method requires multiple transactions within a narrow price range.

How to Check Stop Level

This section focuses on how to check the stop level with MT4 and MT5.

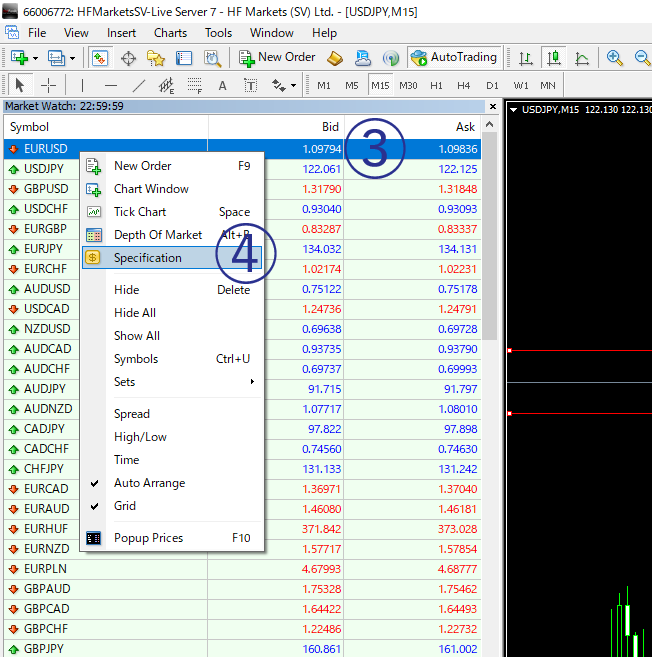

①Click [View]

②Click [Market Watch]

③Right-click on the currency pair

④Click [Specification]

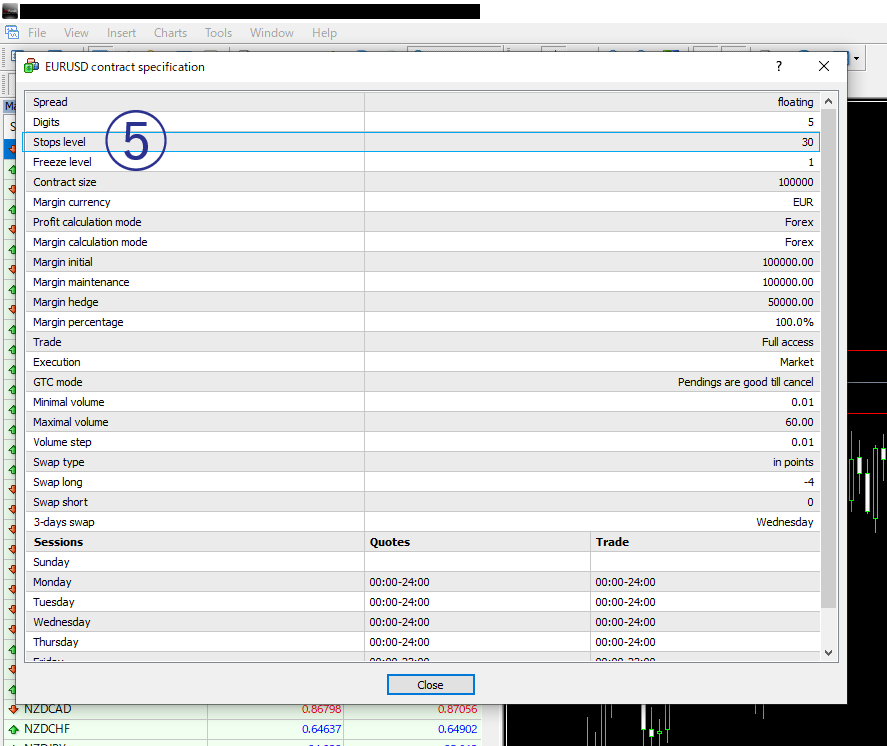

⑤Check the value of [Stops level]

Note that the value shown on the line is represented by unit of point, not pip. When this value is shown as 30, it means 0.3 pip.

For details on the difference between pip and point, please refer to the below article.

(F2) Broker with Zero Stop Level

As of April 2022, XM and Tradeview offer zero stop level for all currency pairs.

| Currency Pairs | XM | Tradeview |

| USD/JPY | 0.0 pips | 0.0 pips |

| EUR/USD | 0.0 pips | 0.0 pips |

| GBP/USD | 0.0 pips | 0.0 pips |

| AUD/JPY | 0.0 pips | 0.0 pips |

| AUD/USD | 0.0 pips | 0.0 pips |

| USD/CAD | 0.0 pips | 0.0 pips |

| USD/CHF | 0.0 pips | 0.0 pips |

| EUR/JPY | 0.0 pips | 0.0 pips |

| AUD/JPY | 0.0 pips | 0.0 pips |

The zero stop level allows traders to give a limit at their discretionary rate for pending orders. For example, a trader can place a pending order for stop loss at the rate as tight as 3 pips below.

Basically, day traders using a chart on an hourly basis or traders in reference to a longer time-frame chart do not have to worry about the width of the stop level. However, scalping traders using the 1-minute or the 5-minute chart should choose a broker with zero stop level.

XM

XM Official website (Outside Europe)

As finance license differs depending on the country of the trader's residence, XM has multiple official sites.

[Features of XM (Europe)]

- Providing great client protection under a strict finance license, CySec.

- The CySec license is one of the most highly trusted and the strictest licenses in the world.

- As a member of Investor Compensation Fund (ICF), XM compensates the clients' account money of up to EUR 20,000 in the case of bankruptcy.

- Providing a special trading environment such as the top-class execution ability

- All orders can be surely executed without rejection.

- 35% of all orders can be completed within one second.

- Negative Balance Protection is applied.

[Features of XM (Outside Europe)]

- Extensive Bonus Program (click here for details of the program)

- Trading Bonus

- Deposit Bonus

- Loyalty Program

- Providing a special trading environment such as the top-class execution ability

- All orders can be surely executed without rejection.

- 35% of all orders can be completed within one second.

- Negative Balance Protection is applied.

Tradeview

[Features of Tradeview]

- Lowest transaction cost (spread) among all FX brokers

- The spread offered by Innovative Liquidity Connector (ILC) Account is 0.2 pips in EUR/USD and USD/JPY.

- Although markup is incurred as an administrative fee of Electronic Communications Network (ECN), the total transaction cost is still lower than others.

- High-security environment

- Tradeview is authorized by the highly reliable CIMA license.

- The account holder is protected at a maximum of USD 35,000 in the event of bankruptcy.

This website introduces the best brokers for each country. Select your country, and you will be able to see a list of the best brokers operating in that country.

It would help you choose a broker (XM and Tradeview are listed as one of the best brokers in various countries).

[Popular Broker] Well-reputed FX Broker by Country

Summary

- Stop level is the minimum distance from the current rate at which traders can place a pending order for taking profit or cutting a loss.

- A wide stop level gives nothing but a disadvantage to traders due to the following factors:

- The available rate for limit and stop limit orders is restricted.

- Traders have difficulty earning profit but are likely to incur a heavy loss.

- Automatic transaction systems do not perform as verified in back testing.

- Some brokers like XM and Tradeview offer a trading environment which offer the zero stop level.

Thank you for sparing your time to read this article.