Many beginners of FX trading would have no idea of what to do first. So, this article introduces what they should do in order to steadily earn money. It summarizes what I have experienced at the beginning to stably make a success and the experiences of successful traders around me. This article, which is written from the standpoint that “I would do so if I were today”, will give beginners the steps for success with as little waste as possible. I hope this article will be helpful to you.

Contents

- 1 1. Understand how difficult and brutal the world of FX trading is.

- 2 2.Open (demonstration) FX account and try transactions.

- 3 3.Learn the methods of analyses.

- 4 4.Establish your own trading style.

- 5 5.Proceed to conduct transactions on your real account.

- 6 6.Analyze the result of the transaction and keep improving.

- 7 Conclusion

1. Understand how difficult and brutal the world of FX trading is.

Many beginners light-heartedly enter the market but then blindly lose a great deal of money. I was one of them.

Here are the mistakes I have made as a beginner.

・I started real trading at any rate.

・I did everything I had just learned right away.

・I repeated groundless trading.

・I had no idea of fund management.

・I didn’t cut my losses.

I entered the market with USD 1,000, and lost it in a moment.

It is said that the world of FX is where 90% of traders lose money and leave meanwhile only 10% of them can continue to succeed.

FX market has a total daily turnover of JPY 600 trillion. Where, many market players, including hedge funds, top traders around the world, institutional investors and professional dealers, conduct multiple transactions in order to increase their own assets.

FX is a zero-sum game, meaning that someone’s profit is generated by another trader’s loss. If you want to continue to succeed, you have to be equipped with the trading skills superior to the ones of other players.

Your opponent is not the chart on the screen but other market players behind the chart. As the traders who have expected the direction opposite to you cut their losses, the rate goes into the direction of your expectation, generating huge profits. The world of trading is so difficult and brutal that someone’s losses bring profits to you, and vice versa.

2.Open (demonstration) FX account and try transactions.

When you open an FX account, you will be able to use the platform for transactions. Instead of learning the basics of FX trading with some materials, it will be more efficient to learn it by watching the actual charts to check the price movements.

Some securities companies provide their original platform. But I recommend you to choose the company which provides the platform MT4.

As MT4 is a world-standard chart analysis software, you can use the same charts as the traders around the world use. Aligning the chart you use with the widely-used one is important when it comes to starting FX trading. (Availability of MT4 differs between securities companies).

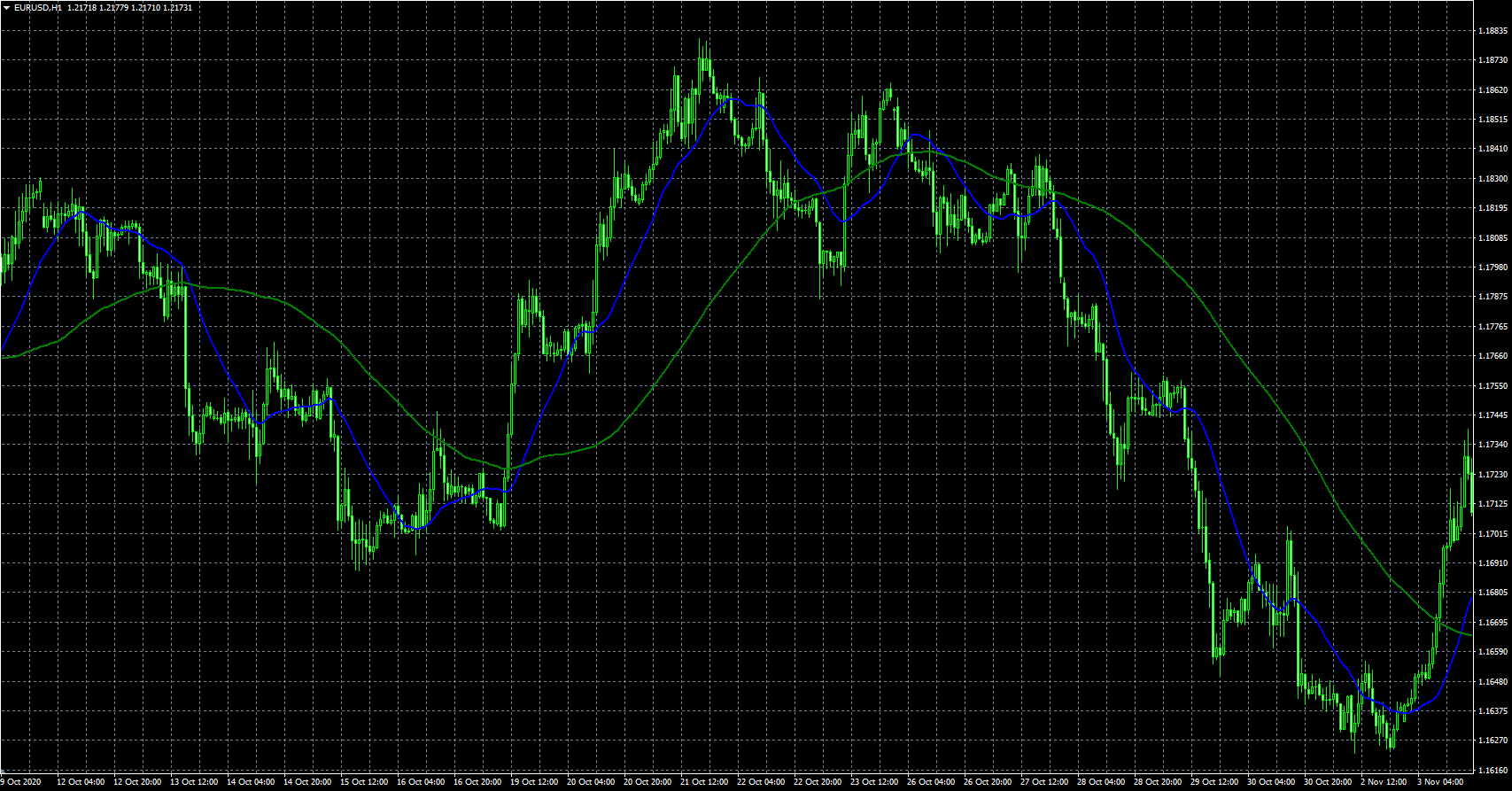

Chart

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

If you open an account for the first time, I recommend you to open a demonstration account, not a real one. It enables you to experience the transactions without using the actual money. It is not too late to start to conduct the transaction with a real account until you can continuously succeed with a demonstration account.

You should learn the following basics of FX trading through demonstration trading.

・Learn how to place an order and operate the platform.

・Learn the jargon of FX.

・Learn various indicators.

3.Learn the methods of analyses.

There are two methods of analyses for trading; technical analysis and fundamental analysis.

Technical analysis uses various indicators and analysis theories to make a prediction on the basis of past price movement. As what logic is used varies between traders, it shows the characteristics of each trader.

On the other hand, fundamental analysis is similar to the market analysis used for share trading. It is based on the analysis of economic climate.

This article refers to technical analysis as I mainly utilize it.

4.Establish your own trading style.

Here are the important points to steadily succeed as a trader.

・The ability to establish the logic of steadily earning profit.

・The mental to repeat the established logic.

I have repeated the transactions while learning the above methods of analyses. Then, if my logic worked well, I checked why it worked. If it failed to be viable, I found fault and repeatedly corrected it. Successful traders around me also have established their own logics through the cycle of hypothesis, validation, consideration and correction.

In addition to a repeat of the above 3 and 4, the ability of fund management (position sizing) is required. This fund management should be accompanied by trade logics.

I summarize what I have taken into consideration to establish trading logics as below.

・Which time frame should be specified; swing trading, day trading or scalping trading.

・Which trading style should be selected; trend following, contrarian or indicator responsive

・How to manage your investment fund, i.e. the allowance of loss against the total amount of assets per transaction

・What indicator should be utilized.

・What currency pair should be utilized.

・What time frame should be utilized.

・What time frame should be referred to recognize the environment.

・Whether the window for trading should be specified.

If you applied your logic to the past chart and then made sure that it could bring you profits, it is good to start real trades with a small amount of money.

5.Proceed to conduct transactions on your real account.

After establishing the logic, take a step to conduct real trades.

When I was a beginner, I started the trades with a small amount of money. Then, I learned the importance of mental toughness.

It was more difficult than imagined to repeat my established logic on my real account in an automatic manner. Through the early-time experiences, I have trained myself to get the ups and downs of my feelings, i.e. the greed for more profits or the fear for losing money, under control.

It is not too late to start to increase the money on your real account until you have felt a good response through transactions with a small amount of money. After you can steadily drive earnings growth, increase your assets step by step.

6.Analyze the result of the transaction and keep improving.

As you have experienced many transactions, you will be able to see “avoidable losing trade” and “successful trade to capitalize”. For example, I added the filter of MA (moving average line) to my indicator-responsive logic. This boosted my winning percentage by 5%.

In my opinion, successful traders never neglect the validation, consideration and correction. Although no one is sure whether these efforts will do bear fruit, successful persons definitely make an effort. It holds true for everything.

I hope you can establish your own logic and succeed in the world of FX.

Conclusion

Simply put, it is important to face FX with sincerity and keep learning.

1. Understand how difficult and brutal the world of FX trading is.

2. Open (demonstration) FX account and try transactions.

3. Learn the methods of analyses.

4. Establish your own trading style.

5. Proceed to conduct transactions on your real account.

6. Analyze the result of the transaction and keep improving.

Thank you for sparing your precious time to read this article. I hope this will be helpful to you.