This article introduces the overview of Tradeview, including its strengths, weaknesses, and recommended trader types. It would be good if you took an interest in Tradeview.

First, Tradeview provides a fully equipped investor protection system and a high-class trading environment. But the support for beginners is not as good as other major brokers. For this reason, Tradeview can be recommended to intermediate or advanced FX traders. If you fit into this category of traders, it is worth trying.

Established in 2004, Tradeview has been praised for its investor protection system and trading environment. Tradeview is not so famous as it does not focus on promotion so much. But the legitimate broker is preferred by advanced traders who have been trading for a long time. It is highly likely that it will gain popularity as it gets a lot of visibility.

The below summarizes Tradeview's strengths and weaknesses and who should choose this broker. Their details will be explained later.

①Strength

- ILC account’s spread is quite

- As licensed by CIMA, there has been no trouble in relation to withdrawal.

- It provides a fully equipped investor protection system to secure up to USD 35,000.

- It offers 36 currency pairs.

- It employs Negative Balance Protection, which does not require additional margin.

- It employs highly transparent NDD.

- MT4, MT5 and cTrader are available for trad

②Weakness

- Maximum leverage is 1:200 (1:30 in some regions), and the loss cut level is 100%.

- Clients are required to deposit USD 1,000 at the minimum and conduct trading with at least 10,000 currenc

- The official site provides only a little information that is not customer-friendly.

- No bonus program is offered.

③Who Should Select Tradeview

- Traders who want to reduce the trading costs to the limit by using a low spread account

- Traders who want to trade with a highly secure broker

Contents

- 1 Strength

- 1.1 (1) ILC account’s spread is quite narrow.

- 1.2 (2) As licensed by CIMA, there has been no trouble in relation to withdrawal

- 1.3 (3) It offers a fully equipped investor protection system to secure up to USD 35,000.

- 1.4 (4) It offers 36 currency pairs

- 1.5 (5) It employs Negative Balance Protection, which does not require additional margin.

- 1.6 (6) It employs highly transparent NDD.

- 2 (7) MT4, MT5 and cTrader are available for trading.

- 3 Weakness

- 3.1 (1) Maximum leverage is 1:200 (1:30 in some regions), and the loss cut level is 100%.

- 3.2 (2) Clients are required to deposit USD 1,000 at the minimum and conduct trading with at least 10,000 currencies.

- 3.3 (3) The official site provides only a little information, which is not customer-friendly.

- 3.4 (4) No Bonus Program Is Offered.

- 4 Conclusion: Who Should Select Tradeview?

Strength

(1) ILC account’s spread is quite narrow.

Tradeview’s ILC (Innovative Liquidity Connector) account and cTrader account give traders the chance to do FX trading at low costs (the account type can be specified when opening an account).

Tradeview offers three types of accounts; Standard, ILC Account, and cTrader. Standard Account and ILC Account support the famous trading platforms MT4 (MetaTrader4) and MT5 (MetaTrader5). Although both are excellent, many traders prefer MT4. Therefore, it is recommended to select ILC Account with MT4 to align the trading environment with other traders.

| Account Type | Standard Account | ILC Account | |

| Account Currency | USD, JPY, EUR, GBP, AUD, CAD, MXN | USD, JPY, EUR, GBP, AUD, CAD, MXN | USD, JPY, EUR, GBP, AUD, CAD, MXN |

| Transaction Type | NDD STP | NDD ECN | NDD ECN |

| Trading Platform | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Commission (EUR/USD) | No Charge | USD 5.00, round trip (per 100,000 currencies) | USD 5.00, round trip (per 100,000 currencies) |

| One Lot Size | 100,000 currencies | 100,000 currencies | 100,000 currencies |

| Minimum Trading Volume | 1,000 currencies | 10,000 currencies | 10,000 currencies |

| Maximum Trading volume | N/A | N/A | N/A |

| Minimum Deposit (USD) | USD 100.00 | USD 1,000.00 | USD 1,000.00 |

| Maximum Leverage | 1:500 | 1:200 | 1:400 |

For details of the ILC Account, please visit Tradeview’s official website. → official website

The upper limit of leverage depends on the finance license governing the trader's country of residence.

Next, we take a look at how low Tradeview’s spread cost is compared to other major brokers from around the world. If commissions are incurred, they are included in the spread. The following spread cost ranking can be compared as a pure trading cost, so please use it as a reference when choosing a broker.

As you look at the following rankings of transaction costs for the major currency pairs (EUR/USD, USD/JPY, GBP/USD, AUD/USD), Tradeview's ILC Account is highly ranked, meaning that it offers a low spread for all currency pairs (of course, the top contenders such as Exness, OANDA, and easyMarkets are also excellent brokers).

Spread Ranking

[Conditions]

Trading Tools: MT4

Trading Commission: 100,000 currencies per lot (round trip)

Average Spread: For Account types that incur a trading fee, the fee is included in the spread.

※ The following data is as of November 2021. The number is subject to change.

EUR/USD Spread Ranking

| Rank | Broker | Account Type | Average Spread | Commission | Official Site |

| T-1 | Tradeview | ILC | 0.8 pips | USD 5.00 | → (Whole world) |

| T-1 | Exness | Pro | 0.8 pips | – | |

| T-1 | OANDA | Tokyo srv. | 0.8 pips | – | |

| T-4 | easyMarkets | VIP | 0.9 pips | – | |

| T-4 | Exness | Raw Spread | 0.9 pips | USD 7.00 | |

| T-4 | Exness | Zero | 0.9 pips | USD 7.00 | |

| T-4 | FBS | Cent | 0.9 pips | – | |

| T-4 | FBS | Standard | 0.9 pips | – | |

| T-4 | FBS | ECN | 0.9 pips | USD 6.00 | |

| T-4 | FXDD | Premium | 0.9 pips | USD 5.98 | |

| T-4 | HotForex | Zero Spread | 0.9 pips | USD 6.00 | → (Asia) |

| T-4 | Milton Markets | Elite | 0.9 pips | – | |

| T-4 | OANDA | Pro | 0.9 pips | – | |

| T-4 | Traders Trust | Pro | 0.9 pips | USD 6.00 | |

| T-15 | Ava Trade | MT4 | 1.0 pips | – | |

| T-15 | Exclusive Markets | Professional | 1.0 pips | USD 6.00 | |

| T-15 | MYFX Markets | Pro | 1.0 pips | USD 7.00 | |

| T-15 | Titan FX | Blade | 1.0 pips | USD 7.00 | |

| 19 | Land-FX | ECN | 1.1 pips | USD 7.00 | |

| 20 | Dukascopy | MT4 | 1.2 pips | USD 7.00 |

USD/JPY Spread Ranking

| Rank | Broker | Account Type | Average Spread | Commission | Official Site (Cover Areas) |

| 1 | OANDA | basic | 0.5 pips | – | |

| T-2 | FOREX EXCHANGE | MT4 | 0.6 pips | – | |

| T-2 | GEMFOREX | No spread | 0.6 pips | – | |

| T-4 | Tradeview | ILC | 0.7 pips | USD 5.00 | → (Whole world) |

| T-4 | Exclusive Markets | Exclusive | 0.7 pips | USD 3.00 | |

| T-4 | OANDA | Tokyo srv. | 0.7 pips | USD 3.00 | |

| 7 | Traders Trust | VIP | 0.8 pips | – | |

| T-8 | Exness | Pro | 0.9 pips | – | |

| T-8 | Milton Markets | Elite+ | 0.9 pips | – | |

| T-8 | OANDA | Pro | 0.9 pips | – | |

| T-12 | easyMarkets | VIP | 1.0 pips | – | |

| T-12 | Exclusive Markets | professional | 1.0 pips | USD 6.00 | |

| T-12 | Exness | Raw Spread | 1.0 pips | USD 7.00 | |

| T-12 | Exness | Zero | 1.0 pips | USD 7.00 | |

| T-12 | FXDD | Premium | 1.0 pips | USD 5.98 | |

| T-17 | HotForex | Zero Spread | 1.1 pips | USD 6.00 | → (Asia) |

| T-17 | Land-FX | ECN | 1.1 pips | USD 7.00 | |

| T-17 | Traders Trust | Pro | 1.1 pips | USD 6.00 | |

| T-17 | Titan FX | Blade | 1.1 pips | USD 7.00 | |

| 20 | Dukascopy | MT4 | 1.2 pips | USD 7.00 |

GBP/USD Spread Ranking

| Rank | Broker | Account Type | Average Spread | Commission | Official Site |

| 1 | Exness | Pro | 1.0 pips | – | |

| T-2 | Tradeview | ILC | 1.1 pips | USD 5.00 | → (Whole world) |

| T-2 | Exness | Raw Spread | 1.1 pips | USD 7.00 | |

| T-3 | Exness | Zero | 1.2 pips | USD 9.00 | |

| T-3 | OANDA | Basic | 1.2 pips | – | |

| T-3 | Traders Trust | VIP | 1.2 pips | USD 3.00 | |

| T-7 | easyMarkets | VIP | 1.3 pips | – | |

| T-7 | FXDD | Premium | 1.3 pips | USD 5.98 | |

| T-7 | HotForex | Zero Spread | 1.3 pips | USD 6.00 | → (Asia) |

| T-7 | Milton Markets | Elite+ | 1.3 pips | – | |

| T-7 | OANDA | Tokyo srv. | 1.3 pips | – | |

| T-12 | FOREX EXCHANGE | MT4 | 1.4 pips | – | |

| T-12 | Land-FX | Standard | 1.4 pips | – | |

| T-12 | OANDA | Pro | 1.4 pips | – | |

| 15 | Traders Trust | Pro | 1.5 pips | USD 6.00 | |

| T-16 | Exness | Standard | 1.6 pips | – | |

| T-16 | FBS | ECN | 1.6 pips | USD 6.00 | |

| T-16 | Milton Markets | Elite | 1.6 pips | – | |

| T-19 | FBS | Cent | 1.7 pips | – | |

| T-19 | FBS | Standard | 1.7 pips | – |

AUD/USD Spread Ranking

| Rank | Broker | Account Type | Average Spread | Commission | Official Site |

| T-1 | GEMFOREX | No spread | 0.8 pips | – | |

| T-1 | Traders Trust | VIP | 0.8 pips | USD 3.00 | |

| T-3 | Tradeview | ILC | 0.9 pips | USD 5.00 | → (Whole world) |

| T-3 | Exness | Pro | 0.9 pips | – | |

| T-3 | Exness | Raw Spread | 0.9 pips | USD 7.00 | |

| T-6 | Exclusive Markets | Exclusive | 1.0 pips | USD 3.00 | |

| T-6 | FOREX EXCHANGE | MT4 | 1.0 pips | – | |

| T-6 | Milton Markets | Elite+ | 1.0 pips | – | |

| T-9 | Exness | Zero | 1.1 pips | USD 10.00 | |

| T-9 | HotForex | Zero Spread | 1.1 pips | USD 6.00 | → (Asia) |

| T-9 | Titan FX | Blade | 1.1 pips | USD 7.00 | |

| T-9 | Traders Trust | Pro | 1.1 pips | USD 6.00 | |

| T-13 | Ava Trade | MT4 | 1.2 pips | – | |

| T-13 | easyMarkets | VIP | 1.2 pips | – | |

| T-13 | Land-FX | ECN | 1.2 pips | USD 7.00 | |

| T-13 | OANDA | Basic | 1.2 pips | – | |

| T-13 | OANDA | Tokyo srv. | 1.2 pips | – | |

| T-18 | Exclusive Markets | Professional | 1.3 pips | USD 6.00 | |

| T-18 | FXDD | Premium | 1.3 pips | USD 5.98 | |

| T-18 | Milton Markets | Elite | 1.3 pips | – |

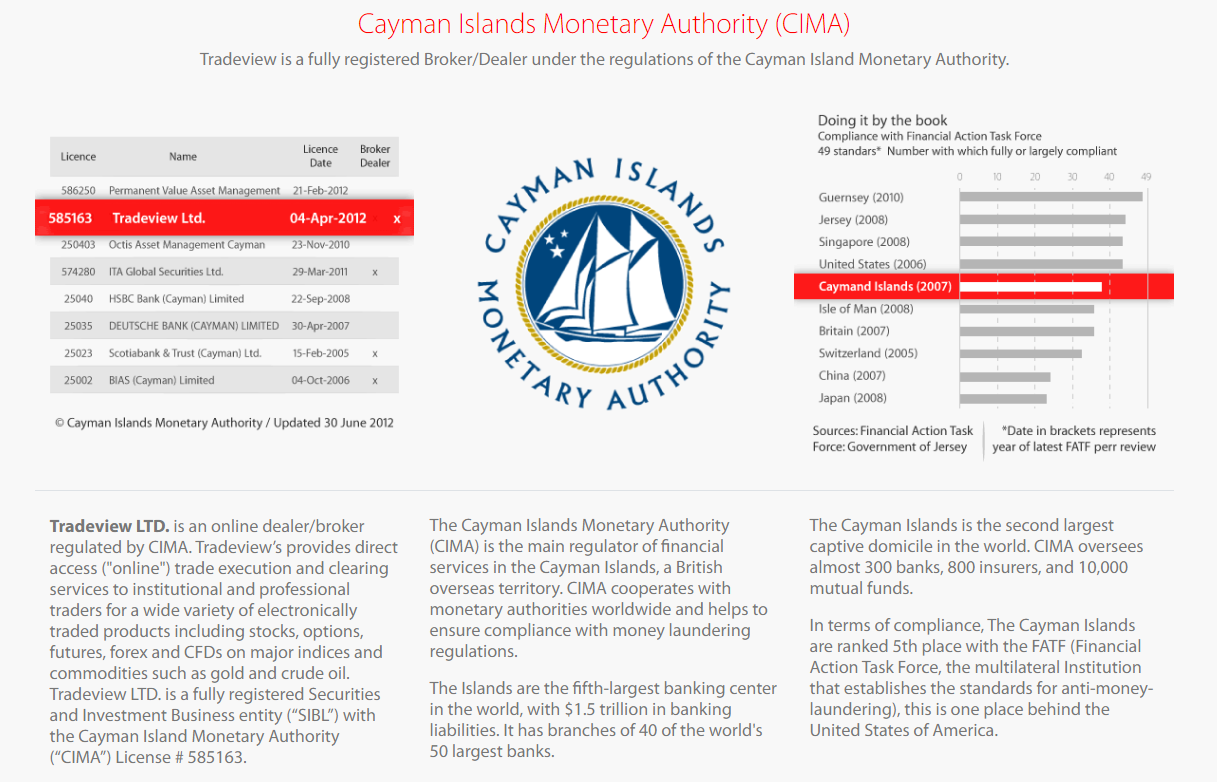

(2) As licensed by CIMA, there has been no trouble in relation to withdrawal

The CIMA license is a globally trusted finance license.

Brokers with a highly reliable license have a system of investor protection and thus are suitable for traders with large amounts of money.

All investment forms, including FX, start with a trader depositing the money to a broker. Therefore, it is necessary to choose a broker reliable enough to entrust their money to. The CIMA license and Tradeview fully meet the reliability.

For details of the financial license, please refer to the below site.

Related Article: Overview of Finance Licenses in the World

This section provides a summary of the CIMA license.

What is Financial License?

A financial license is a permit required to operate a financial business, including FX, and is issued by each country to financial institutions operating in its country. There is a rating (degree of rigidity of regulation) for financial licenses. It also plays a role in a standard to measure the trustability of a broker because a firm holding a highly regulated license can be expected to have sound operations in terms of business conditions and investor protection.

Overview of CIMA License

| Abbreviation | CIMA |

| Official Name | Cayman Islands Monetary Authority |

| Web Site | https://www.cima.ky/ |

| Authorized Broker | Tradeview |

| Trustability | High |

The Cayman Islands, a British Overseas Territory, are a group of small islands in the Caribbean Sea, south of the United States. The financial regulatory body is different from that of its mainland but follows British laws and regulations in principle.

When you think about the Cayman Islands, you may have an image that has nothing to do with finance. But in fact, this territory is very famous as one of the world's leading financial centers. About 80% of the world's major banks have branches there, and their total banking assets are 1.5 trillion dollars (the second largest in the world).

Features 1: Rigorous License Requirements

Brokers are required to ensure that the items that fall under the requirements are properly managed and administered to be authorized.

- Annual external audit

- Submission of proof of compliance

- Report on the status of internal fund management

- Monthly reporting of transaction details

- Submission of financial statements

Feature 2: Role as Offshore Broker

CIMA is popular with offshore brokers, that is, unregulated brokers that allow them to open investment accounts outside of their original country's jurisdiction. They pay an annual license fee and in return are not subject to any taxes on profits earned outside the Cayman Islands. This factor enables Tradeview, a CIMA licensed broker, to have by far the lowest spread costs compared to its competitors.

There are concerns that offshore markets can be used for money laundering or as tax havens. But CIMA has taken all possible measures to prevent them. It draws a line from other offshore licenses.

(3) It offers a fully equipped investor protection system to secure up to USD 35,000.

In addition to the CIMA license, Tradeview’s reliability stems from its investor protection system, as the broker secures up to USD 35,000 for each client.

The amount of compensation is one of the highest in the FX industry and guarantees clients that their deposit money is risk-free.

Related Article:【Secured Broker】 How to Choose a Broker Which Provides Secured Investor Protection

(4) It offers 36 currency pairs

Available Currency Pairs in Tradeview

Tradeview brokers stock, FX, ETF and CFDs on a stock index and commodities. This article focuses on FX currency pairs.

Tradeview’s Currency Pairs

EURUSD, USDCHF, USDJPY, USDCAC, EURJPY, EURCAD, CHFJPY, CADJPY, GBPUSD, EURGBP, GBPJPY, NDZUSD, GBPCHF, AUDUSD, AUDJPY, EURAUD, NZDJPY, GBPCAD GBPAUD, AUDNZD, AUDCHF, AUDCAD, USDTRY, USDNOK, EURTRY, EURCHF, GBPNZD, USDMXN, USDSGD, USDZAR, EURCZK, USDCZK, USDPLN, EURPLN, USDHUB, EURHUF

Total 36 currency pairs

Comparison of Currency Pairs Available in Major Brokers

Compared to other major brokers, Tradeview offers fewer currency pairs. However, since Tradeview covers the major pairs many traders prefer, such as EUR/USD, it can be regarded as one of its strengths. There would be no inconvenience for traders.

| Broker | Number of Currency Pairs |

| Tradeview | 36 |

| XM | 57 |

| HotForex | 53 |

| FBS | 36 |

(5) It employs Negative Balance Protection, which does not require additional margin.

Negative Balance Protection is a system that in the event that a client has a loss greater than the margin, the broker bears the amount of the loss and reduces the negative balance of the client to zero.

Related Article: [Negative Balance Protection] The Must Option to Hedge Unexpected Loss

For risk aversion purposes, it is recommended to select an FX broker with Negative Balance Protection. As Tradeview employs it, it can be regarded as one of its strengths.

(6) It employs highly transparent NDD.

NDD system stands for No Dealing Desk. It is characterized by transparency in trading and the absence of conflicts of interest between clients and brokers.

Related Article: Difference Between Dealing Desk And No Dealing Desk

Tradeview also employs the ECN system, a more transparent NDD form, giving it a higher level of transparency than other brokers. Many traders select Tradeview thanks to this ECN environment.

Related Article: [ECN] Differences between ECN Account and STP Account

(7) MT4, MT5 and cTrader are available for trading.

Tradeview offers three trading platforms.

Currently, it is said that MT4 is the most widely used platform by traders around the world. In other words, if you want to align the perspectives of charts with others, MT4 is the best. If you don't have a particular preference between these three types of platforms, you should use MT4.

Related Article: [MT4 MT5] What are MT4 and MT5?

Weakness

(1) Maximum leverage is 1:200 (1:30 in some regions), and the loss cut level is 100%.

Tradeview's loss cut level is 100%, and the maximum leverage is 1:200. Its loss cut level is higher, and the maximum leverage is lower than other brokers.

| Tradeview Account Type | Maximum Leverage |

| Standard Account | 1:500 |

| ILC Account | 1:200 |

| cTrader Account | 1:400 |

The lower maximum leverage means the lower-risk and lower-return investment environment is provided.

Maximum Leverage of Each Broker

| Broker | Maximum Leverage |

| Tradeview (ILC) | 1:200 |

| XM | 1:888 |

| HotForex | 1:500 |

| FBS | 1:3,000 |

| FX PRO | 1:200 |

※ The number may differ depending on account types

※ The maximum leverage may vary depending on the account type and the trader's country of residence. Please make sure to check the official website for details.

The loss cut level means the rate of retention requirement at which the loss cut is executed. Tradeview executes a loss cut when the rate reaches 100%. A higher loss cut level means the loss cut is more likely to be executed than other brokers with a lower level.

Loss-cut Level of Each Broker

| Broker | Loss Cut Level (Retention Requirement) |

| Tradeview (ILC) | 100% |

| XM | 20% |

| HotForex (Premium Account) | 20% |

| FBS | 20% |

| FX PRO | 50% |

Details on how the loss cut works are explained in the following article. The example of calculating the loss-cut rate is explained, so please look at it if you are interested in it.

Related Article: [Loss Cut] Overview of Loss Cut and How to Hedge It

100% Loss-cut Level and 1:200 Maximum Leverage Are Supported by Advanced Traders.

Tradeview's loss cut level and maximum leverage indicate that it prefers solid management and does not want to provide clients with a high-risk and high-return service.

Many traders, especially advanced ones, feel comfortable providing low spreads, investor protection, and the above settings because successful traders stably earn profits without risky trading and even the 100% loss-cut level suffices them. However, this article regards it as one of the weaknesses since it does not give the option to traders who prefer high-risk and high-return trading.

(2) Clients are required to deposit USD 1,000 at the minimum and conduct trading with at least 10,000 currencies.

Clients are required to deposit an amount more than the specified minimum deposit amount when opening an account to start the transaction. Tradeview’s ILC Account requires clients to deposit at least USD 1,000 to open an account and invest at least 10,000 currencies per trade. These levels are higher than other brokers. In other words, Tradeview sets a higher threshold for a trading environment and prefers to provide the service to those who have a sufficient amount of money, such as advanced traders. To the contrary, this hinders beginners from starting FX trading at Tradeview. It is a disadvantage.

Below are the minimum deposit amount and the minimum trading volume for each major broker (the number may differ depending on account types).

Minimum Deposit Amount for Each Broker

| Broker | Minimum deposit |

| Tradeview (ILC) | USD 1,000.00 |

| XM (Standard) | USD 5.00 |

| HotForex (Premium) | USD 100.00 |

| FBS (Standard) | USD 100.00 |

| FX PRO | USD 100.00 |

The number may differ depending on account types

Minimum Trading Volume per Trade for Each Broker

| Broker | Minimum Trading Volume |

| Tradeview (ILC) | 10,000 Currencies |

| XM (Standard) | 1,000 Currencies |

| HotForex (Premium) | 1,000 Currencies |

| FBS (Standard) | 1,000 Currencies |

| FX PRO | 1,000 Currencies |

The number may differ depending on account types

(3) The official site provides only a little information, which is not customer-friendly.

Some people feel that the amount of information on the official website of Tradeview is less than that of other brokers. It is understandable.

For example, the languages available on its official site are English, Japanese, Chinese (Simplified), Spanish, Arabic, Russian, French, Italian, Korean, Hindi, and Portuguese. It is less than other global brokers like XM and HotForex. But Tradeview may improve the support system in the future.

Supporting Languages and Available Contact Method

| Available Language | Contact Method | |

| Tradeview | 11 | Email, Chat |

| XM | 22 | Email, Chat |

| HotForex | 20 | Email, Chat, Phone |

(4) No Bonus Program Is Offered.

The absence of any bonus program is one of the key features of Tradeview.

It won’t satisfy traders taking advantage of various bonus programs offered by XM and HotForex. True, the bonus programs allow clients to expand the margin and help increase the trading efficiency. In fact, many traders have been benefited from it and made money thanks to it. Tradeview’s lack of a bonus program is a disadvantage.

But in other words, it can be said that Tradeview focuses on providing well-equipped trading environments including spread cost, the reliability of execution, and investor compensation.

Conclusion: Who Should Select Tradeview?

The following types of traders should select Tradeview as the main broker.

- Traders who want to reduce the trading costs to the limit by using a low-spread account

- Traders who want to trade with a highly secure broker

Also, since the support system for beginners is insufficient, intermediate or advanced level traders should use Tradeview.

It would be good if you could grasp the image of the low-transaction trading environment of Tradeview’s ILC Account. Thank you for sparing your time to read this article.