<Purpose of This Article>

Those visiting this article would consider risk management in FX trading more seriously than others. So this article introduces “Negative Balance Protection”, a must option to hedge the unexpected huge losses, to such readers.

<Summary of This Article>

・What Is “Negative Balance Protection”?

When a trader loses money in excess of the amount of the deposited margin, the broker covers the loss and wipes it off the books.

・What Happens If a Trader Uses a Broker without “Negative Balance Protection”?

In the volatile market environment, the trader may suffer unexpected losses due to the delay of stop out.

・Broker’s Advantages of “Negative Balance Protection”

①It gives traders reassurance and attracts many would-be customers.

②It increases commission revenue as traders actively do the trading.

Contents

Overview of Negative Balance Protection

What is Negative Balance Protection?

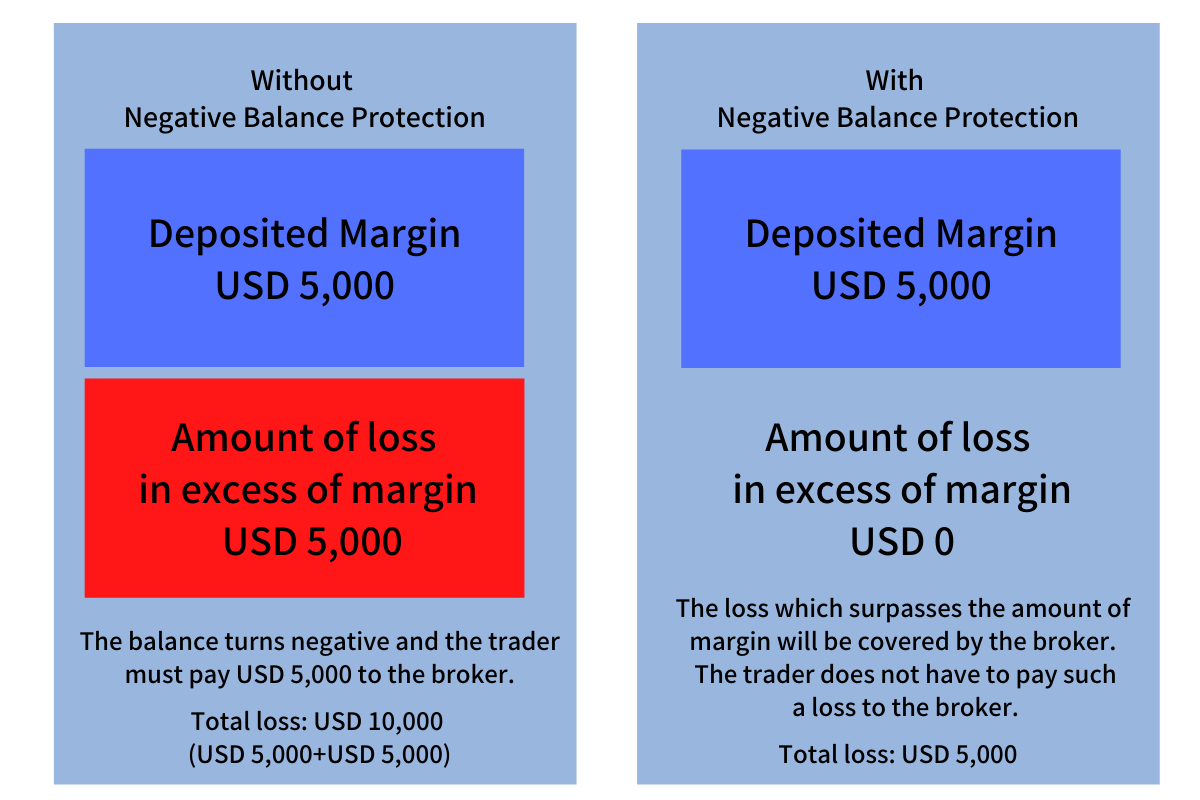

An FX trader may have the losses in excess of the amount of deposited margin and a negative account. With Negative Balance Protection, the broker covers such a deficit and resets the negative account to zero.

When the failure of mandatory loss-cut order in the high-volatile market causes the loss of USD 10,000.

What Happens If a Trader Uses A Broker without “Negative Balance Protection”?

When does a trader have losses in excess of the amount of margin?

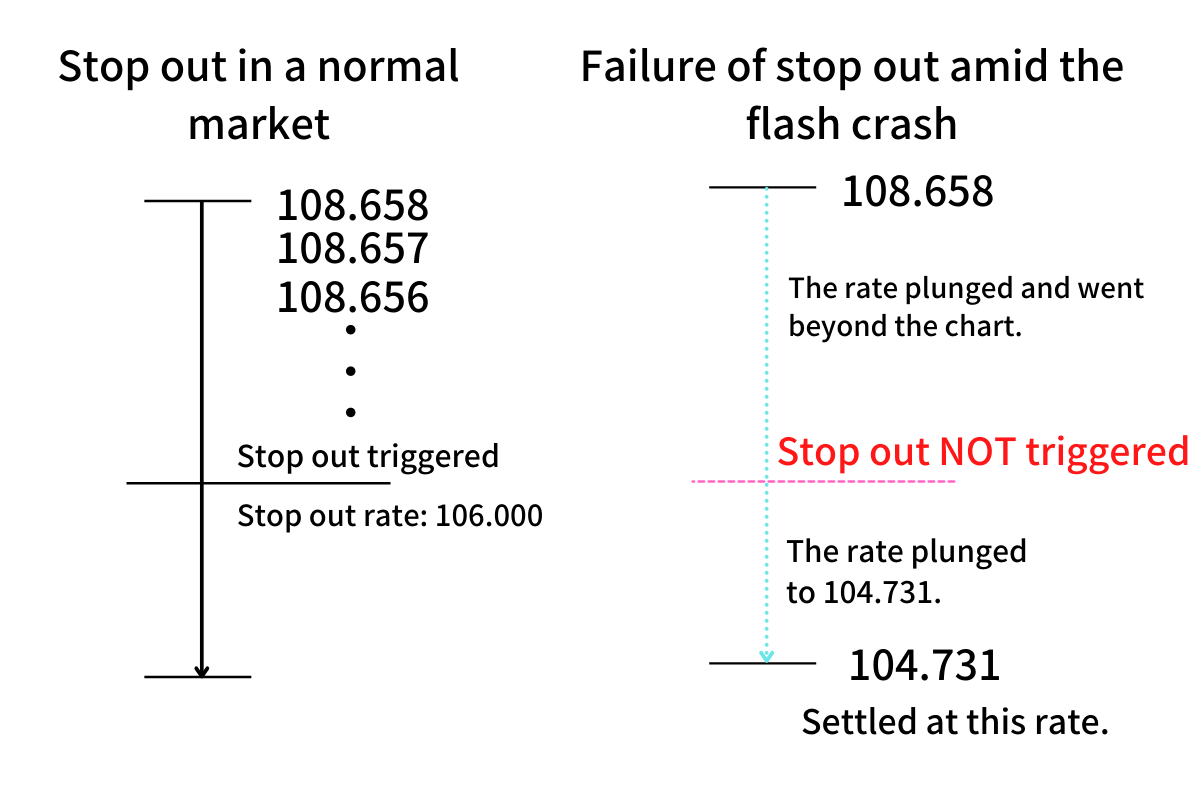

When the deposited margin closes to zero, the forced stop out is triggered to settle the holding positions. It saves traders from having the loss in excess of the amount of margin.

However, the flash crash and other volatile price movements may force the traders to make settlement at the rate much lower or higher than the predefined stop out line. Then, they have losses in excess of the amount of deposited margin.

・Example of flash crash of USD/JPY, around JST 07:30, January 3, 2019

Fifteen-minute chart of USD/JPY

Before the crash: JPY 108.658

Lowest during this fifteen minutes: JPY 104.731

Difference: JPY 3.927 (392.7pips)

When the flash crash occurs, the rate won’t go down gradually but plunges in a flash. In this case, the USD/JPY rate suddenly went down from 108.658 to 104.731.

As shown above, if the rate had gone down in a phased manner, the trader could have made a settlement at the level of JPY 106.000. But in the volatile market like when the rate fell sharply to 104.731, the trader was forced to make a settlement at a disadvantageous level.

If a trader who had the position of USD 500,000 suffered losses in this case, the balance of this trader can be calculated as below;

Account Currency: USD

Currency Pair: USD/JPY

Original position: USD 500,000

Predefined stop out line: JPY 106.000 (the level deposited margin turns 0)

Actual settlement line: JPY 104.731

Difference: JPY 1.269 (126.9 pips)

Deficit: USD 500,000 × 0.01 × 126.9 pips = JPY 634,500 = USD 6,058.00 (USD/JPY=104.731)

※ Stop out line differs between brokers.

In this case, the trader, who had losses in excess of the amount of deposited margin, has to pay USD 6,058.00 to the broker in order to cover the deficit.

However, if the trader has an account at a broker with Negative Balance Protection, he/she does not have to pay this USD 6,058.00 because the deficit is covered by the broker.

<Key Point>

Negative Balance Protection protects traders from suffering from the tragedy that he/she has to dig into the savings or borrow money to cover the calamitous deficit caused by the unexpected financial accident, because the broker covers the deficit balance.

How many accounts have turned negative?

The brokers introduced in this site offer Negative Balance Protection. Therefore, their account holders will not have negative balances. For your information, we take a look at how many accounts at brokers without this protection have turned negative in Japan in the past flash crashes.

Related Article

【Flash Crash】 Overview of Flash Crash and How to Prevent It

<Accounts at Japanese securities>

Japanese financial regulator prohibits brokers from employing Negative Balance Protection because it is deemed as an act of compensation for damage, a reminiscence of the past illegal contracts major securities made with some good customers such as offering the compensation for damages and other favorable treatments.

| Date | No. of accounts | Total amount of losses |

| March 22, 2021 | 3,458 | USD 12,554,545 |

| January 3, 2019 | 6,598 | USD 8,572,727 |

| August 24, 2015 | 4,999 | USD 8,354,545 |

| January 15, 2015 | 1,229 | USD 30,800,000 |

Source: The Financial Future Association of Japan https://www.ffaj.or.jp/library/monitoring/

Total of private and corporate accounts and their losses

USD/JPY = 110.000

Many traders unexpectedly suffered huge losses on January 15, 2015, when the inflation of CHF triggered the flash crash. Traders who had negative balance accounts were obliged to pay money to the broker. Some might have losses within the affordable range but others might suffer them too huge to cover.

If you open an account with the broker with Negative Balance Protection, the account holder will be able to hedge such a huge risk, as the deficit can be covered by the broker.

Why Is Employing “Negative Balance Protection” Good for Brokers?

As mentioned above, some Japanese individual investors might have suffered huge losses which resulted in big negative balances. If they could have held an account with a broker with Negative Balance Protection, they would not have had it. So why is it advantageous for brokers to employ this protection system? Generally, guaranteeing the negative balance for account holders lays a burden on brokers. But the merit outweighs the burden.

First, Negative Balance Protection gives customers reassurance and attracts many traders who want to open an account. Also, the assured trading environment gives traders an opportunity to actively do transactions. It leads to the increase of commission revenue for the broker.

In addition, this protection system can save brokers from responding to legal actions from investors for collecting the huge unpaid money which shall be applied to cover negative balances.

In general, brokers earn revenue from commission fees, or spread cost. The less frequent transactions account holders do, the lesser revenue the broker earns. It is important for brokers to offer an environment where traders can do the transactions with security so that they can increase their revenues. That is why employing Negative Balance Protection is good for brokers.

Also, the CySEC license and other high-class financial licenses require brokers to offer Negative Balance Protection. It is a must to acquire a license and ensure the sound operation.

Conclusion

Trading always entails risks. So please keep in mind that Negative Balance Protection will help you hedge the unexpected risks. Thank you very much for sparing your time to read this article.

Brokers Offering Negative Balance Protection

| Broker | Cover Areas | Operating Company | Finance License | Official Site |

| XM | Europe | Trading Point of Financial Instruments Ltd | CySec | Official Site |

| XM | Asia (Far East) | XM Global Limited | IFSC | Official Site |

| XM | Australia | Trading Point of Financial Instruments Pty Ltd | ASIC | Official Site |

| HotForex | Europe | HF Markets (Europe) Ltd. | CySec | Official Site |

| HotForex | Asia (Far East) | HF Markets (SV) Ltd | SV | Official Site |

| Tradeview | Whole world,

except some areas |

Tradeview Ltd | CIMA | Official Site |

Click here for recommended brokers by country of residence.