Overview of Loss Cut

When the latent loss of your position reaches a certain level, “loss cut” is automatically executed to make a forced settlement of your position by the broker. In contrast, when you settle your position at your own will, it is called “stop loss”.

You may have a negative impression of “forced settlement”. It is not always right. The loss cut system plays a role in preventing a trader from having an unexpected loss in excess of the amount of margin. So you must choose this option.

Please note that some brokers may impose a loss in excess of the amount of margin by executing loss cut. But it is not the case with all brokers introduced on this site because they provide Negative Balance Protection. For details of this customer protection system, please refer to the following article:

【Negative Balance Protection】 The Must Option to Hedge Unexpected Loss →

That said, loss cut means that you lose almost the full amount of your margin. So it would be best to avoid it. In fact, succeeding traders definitely have such an ability.

This article introduces the outline of loss cut, how to calculate loss cut line, and how to hedge loss cut. It would be great if you can understand this system correctly and improve your trading ability.

<Summary of This Article>

・Structure of Loss Cut

・How Loss Cut Is Triggered

・How to Calculate Loss Cut Rate

・How to Avoid Loss Cut

Contents

Structure of Loss Cut

Under What Conditions Is Loss Cut Executed?

For a broker to execute the loss cut, the margin percentage should go below a certain level. As shown below, this percentage differs between brokers.

| Broker | Margin Percentage |

| Tradeview | 100% |

| Milton Markets | 100% |

| HotForex | 20% |

| XM | 20% |

| FBS | 20% |

| Axiory | 20% |

| Titan FX | 20% |

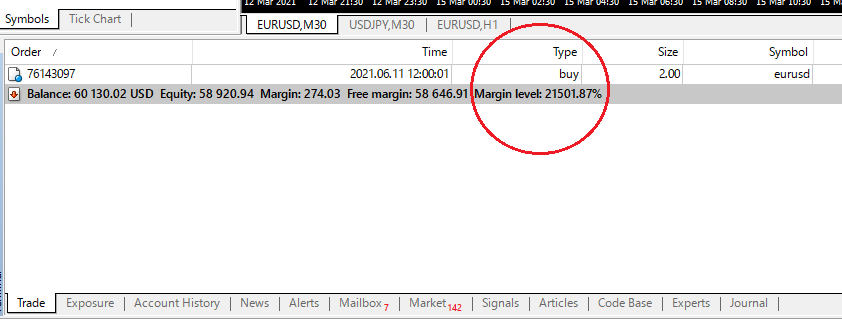

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) can automatically calculate the margin percentage and display it on the platform.

<How to check the margin percentage on MT4 or MT5>

①Proceed to [View] > [Terminal] to display [Terminal] on the chart.

②Show the current profits and losses on the [Trade] tab of [Terminal].

③[Margin level] represents margin percentage. In this example, it is 21501.87%.

When this percentage goes below the level predetermined by each broker, loss cut is executed.

<To Calculate Margin Percentage>

Margin percentage (%) = (Effective margin / Margin requirement) × 100

If you are using MT4 or MT5, you don’t need to calculate it because the platform shows it on the [Trade] tab of the [Terminal] menu. This article digs into the formula so that you can enhance your understanding of loss cut.

How to Calculate Loss Cut

As mentioned, loss cut is executed when margin percentage goes below the predetermined level. Here, we take a look at how to calculate “effective margin” and “margin requirement”.

1. Effective Margin

Effective margin, also called “valuation amount” or “net asset”, is the gross of deposit margin (amount of the account) and the latent gain or loss.

Effective margin = Deposit margin + Latent gain or loss (in an account currency)

Deposit margin = The money deposited to the account as a margin

Latent gain or loss = (Current price - Price at the time of ordering) × Lot size

2. Margin Requirement

Margin requirement is the minimum amount of money to acquire a new position or maintain it.

Margin requirement = (Current price × Lot size) / Leverage ratio

(Leverage ratio is the maximum leverage of a trader's account.)

3. Margin Percentage

Margin percentage is the ratio of effective margin to margin requirement. The higher this percentage is, the more securely you can control your investment fund.

Margin percentage (%) = (Effective margin / Margin requirement) × 100

Once it goes below the predetermined level, your broker executes loss cut. So you should be aware of your position and the sudden fluctuation of the market.

Example of How Loss Cut is Executed

Here, we take a look at how loss cut is executed. Calculation formulae are added to this explanation for the purpose that you can imagine the detailed flow of loss cut.

Note:

To simplify the explanation, spread and other commissions are omitted. As a result, some errors may be observed.

Also, loss cut level is set as 100% of the margin percentage or the below.

1. Before the entry

Account currency: USD

Currency pair: EUR/USD

Net asset (Effective margin): USD 10,000

Leverage ratio: 1:500

| Margin requirement | 0 |

| Valuation gain or loss | 0 |

| Net asset | USD 10,000 |

| Margin percentage | - |

2. Make a buy entry at the rate of USD 1.2000 to hold 200,000 euros.

Margin requirement (USD) = (Price × Lot size) / Leverage ratio

USD 1.2000 × 200,000 euros / 500 = USD 480.00

Margin percentage (%) = (Effective margin / Margin requirement) × 100

USD 10,000 / USD 480.00 × 100 = 2083.3 %

| Margin requirement | USD 480.00 |

| Valuation gain or loss | 0 |

| Net asset | USD 10,000 |

| Margin percentage | 2083.3 % |

3. The slide of EUR/USD price from USD 1.2000 to USD 1.1524 (- 476 pips) triggers loss cut.

Valuation gain or loss:

(USD 1.1524 × 200,000 euros) - (USD 1.2000 × 200,000 euros) = USD - 9,520

Margin requirement: USD 480.00

Effective margin = Deposit margin + Latent gain or loss

USD 10,000 - USD 9,520 = USD 480.00

Margin percentage (%) = (Effective margin / Margin requirement) × 100

USD 480.00 / USD 480.00 × 100 = 100 %

| Margin requirement | USD 480.00 |

| Valuation gain or loss | USD - 9,520 |

| Net asset | USD 10,000 |

| Margin percentage | 100 % |

Note: Margin percentage in this case is 100%. But the loss cut level differs between brokers.

How to Calculate Loss Cut Rate

We take a look at how to calculate a loss cut rate when you make an entry (in this example, buy entry). This calculation tells you the acceptable level of latent loss.

How to Calculate

①Use the broker’s margin percentage and margin requirement to calculate the level of effective margin at which loss cut is executed.

②Calculate the balance between the effective margin and net asset at the time of entry to figure out the latent loss at the time of loss cut.

③Use the above balance to calculate the pips based on the lot size and deduct it from the entry price.

Example

Here, we use the previous section’s example to calculate the loss cut rate.

Account currency: USD

Currency pair: EUR/USD

Net asset: USD 10,000

Maximum leverage: 1:500

Price at the time of entry: USD 1.2000

Lot size: 200,000 euros

Margin requirement: USD 1.2000 × 200,000 euros / 500 = USD 480.00

Margin percentage: USD 10,000 / USD 480.00 × 100 = 2083.3 %

Margin percentage predetermined by the broker to execute loss cut: 100%

Given these conditions, we apply the above processes to calculate the loss cut rate.

<1: Use the broker’s margin percentage and margin requirement to calculate the level of effective margin at which loss cut is executed.>

When the effective margin turns USD 480.00, loss cut is executed.

※ If the broker determines that loss cut is executed when margin percentage reaches 50%, the effective margin is the 50% of the margin requirement.

<2: Calculate the balance between the effective margin and net asset at the time of entry to figure out the latent loss at the time of loss cut.>

USD 10,000 - USD 480 = USD 9,520

<3: Use the above balance to calculate the pips based on the lot size and deduct it from the entry price. >

Lot size: 200,000 euros

200,000 euros × USD 0.0001(*) = USD 20.00

When holding 200,000 euros, 1 pip is equivalent to USD 20.00

(*) 1 pip = USD 0.0001

Related Article: [What is Pip?] →

Loss cut is executed when;

USD 9,520 / USD 20.00 = 476 pips (USD 0.0476)

Loss cut rate can be calculated by deducting the above rate from the one at the time of entry.

Therefore, the loss cut rate for this trading can be calculated as follows;

USD 1.20000 - USD 0.0476 = USD 1.1524

How to Avoid Loss Cut

Successful FX traders generally try to avoid the execution of loss cut. Here, we take a look at what they are doing for it.

It is recommended that you should lock in the acceptable loss per trade at the amount equivalent to a fixed percentage of your investment fund.

In other words, you should not set the lot size without any reason but first lock in the acceptable loss and then adjust the lot size.

To follow this recommendation, you should;

①Set a loss cut line at the time of your entry.

②Understand how much money you may lose in case the rate reaches the loss cut line and calculate the ratio of the loss to the amount of your investment fund.

③Adjust the lot size for entry so that it can match the above ratio.

NOTE:

“Investment fund” in this section should exclude profit and loss of the latest trade in order to prevent its result from affecting the upcoming trade’s yield.

For example, if you have had USD 10,000 as an original investment fund and just earned a profit of USD 100.00, you should NOT add the profit to your funds for investment on the next trade. Instead, you should count the original USD 10,000 as the resource for the next trade.

Successful traders understand the winning percentage yielded by their trading logics and the possible maximum length of consecutive losses. What is important is whether you can keep the lot size for trading even after facing such losses. Therefore, it is recommended that you should adjust the lot size in accordance with acceptable loss. And to determine it, you should have a fixed percentage against your funds for investment.

Example of How Successful Traders Make Settlements

Let’s take for example a trader who sets the acceptable loss at 1 percent of his investment fund. The below table shows his trading results.

<Rules and conditions>

・He made an entry when the width of profit taking turns larger than the one of loss cut.

・He adjusted the lot size so that the acceptable loss can be fixed at 1 percent of his investment fund.

・Net asset: USD 10,000

・Currency pair: EUR/USD

・Account currency: USD

| № | Loss-cut width | Profit-taking width | Lot size* | Result | Gain/Loss (%) | Gain/Loss (USD) |

| 1 | 10 pips | 15 pips | 1.0 | Win | +1.5% | +USD 150.00 |

| 2 | 20 pips | 25 pips | 0.5 | Loss | -1% | - USD 100.00 |

| 3 | 30 pips | 35 pips | 0.33 | Win | +1.1% | +USD 110.00 |

| 4 | 40 pips | 45 pips | 0.25 | Loss | -1% | - USD 100.00 |

| 5 | 50 pips | 55 pips | 0.2 | Win | +1.1% | +USD 110.00 |

* 1 Lot = 100,000 euros

Result:

Win: 3 / Loss: 2

Gain/Loss +1.7% (+ USD 170.00)

This trader has set the acceptable loss as the 1.0 % of his investment fund while the profit margin has been set more than 1.0% thereof respectively. As he has followed the above rules, he could avoid losing huge money and loss cut even if he made one unsuccessful trade. Also, as he made a profit-taking entry only when it was confirmed that the profit margin turned larger than the loss cut width, he could achieve a winning record of over .500 and secure a profit. The better record he achieves, the more profit he can earn.

It is often said that successful traders are cold fish. That is right. They predetermine the range of allowable loss per trade and understand the winning percentage of their own trading logic and risk reward ratio (the potential profit of a trade to its potential loss). Therefore, they know that they will be able to eventually earn a profit through a series of transactions as long as they stick to the logic. They never react nervously to the result of each trade.

If you are achieving the positive record like above, it can be safely said that you are a brilliant trader.

Also, if you increase the width of acceptable loss, the lot size increases accordingly, and it turns into a high-risk, high-return investment. It is best to look back at your past results with your trading method to adjust the acceptable loss. But it seems that many successful traders fix at most three percent of their account amount as an acceptable loss.

Next, we take a look at how to calculate the lot size to minimize the loss per trade.

How to Calculate Lot Size Based on Acceptable Loss

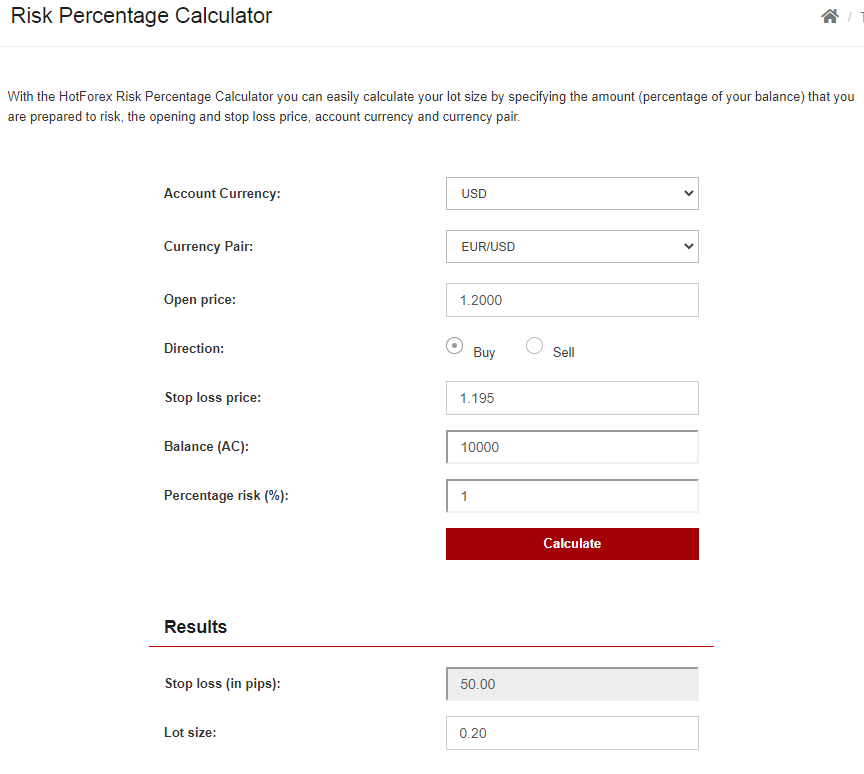

I recommend “Risk Percentage Calculator”, a free-of-charge calculating tool provided by HotForex.

“Risk Percentage Calculator” (HotForex) →

“Risk Percentage Calculator” (HotForex) →

By entering the following information, this tool calculates the lot size which matches the determined acceptable loss.

・Account currency

・Currency pair

・Open price

・Direction (buy entry or sell entry)

・Stop loss price

・Account balance

・Percentage risk (the acceptable loss equivalent to the specified percentage of account balance)

Example:

Supposing that you enter the following information;

Account currency: USD

Currency pair: EUR/USD

Open price: USD 1.2000

Entry direction: Buy

Stop loss price: USD 1.1950

Account balance: USD 10,000

Percentage risk: 1%

The tool provides the calculation results as follows;

Stop loss in pips (difference from the entry price): 50.00 pips

Lot size: 0.2 (20,000 euros)

In this example, if you have USD 10,000 as your investment fund and limit the loss to its 1%, the projected loss cut width should be 50.00 pips, which is equivalent to 0.2 lot (20,000 euros).

Conclusion

Many traders would have experienced loss cut once or twice. It holds true for every successful trader, who would have learnt something to be a brilliant trader through such a bitter experience.

The biggest factor of why loss cut is executed is that the lot size per trade is too huge.

No trader keeps winning in FX trading. There is no absolute in the world of trading. The market often goes against what many market players expect. You should stop doing an all-or-nothing trading because even a one-time market disruption may deprive you of almost all money. To follow or be a model of a successful trader, you should control the lot size, experience a series of winning and losing trades and earn profits as it turns out.

①Set a loss cut line at the time of your entry.

②Understand how much money you may lose in case the rate reaches the loss cut line and calculate the ratio of the loss to the amount of your investment fund.

③Adjust the lot size for entry so that it can match the above ratio.

It is quite important to keep in mind and follow the above principles so that you can achieve a stable performance.

It would be great if you could improve your trading skills through this article.