The main feature of FX trading is that traders can multiply funds for investment by applying leverage on their margin money. It makes FX more attractive in comparison with other commodities and side businesses when it comes to earning a huge amount of money. Why I chose FX trading is because it has such a unique system. This article introduces what leverage is, how to calculate it and advantages and risks leverage has.

Unlike stock trading, FX trading has a concept of leverage. It is because FX trading is based on margin trading. If you are interested in what margin trading is, please kindly refer to the following article. <What is FX trading? →>

Contents

What is Leverage?

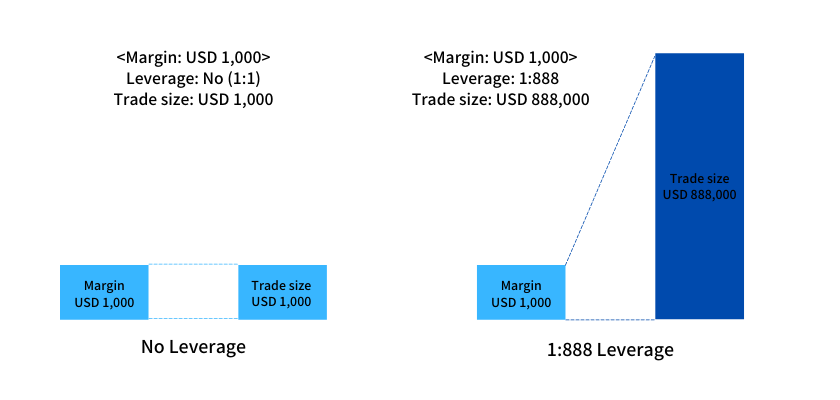

Leverage is the ratio of the amount of money available for investment to the margin.

Trade size: The assumed amount of money available for investment

Originally, when USD 1,000 is deposited as a margin (funds for investment), the trader can hold the position within USD 1,000. However, when the maximum leverage ratio is 1:888, the trader can hold the position of as much as USD 888,000.

Leverage can be divided into maximum leverage and effective leverage.

Maximum Leverage

Maximum leverage indicates up to how many times higher a trader can invest. It varies between brokers and depends on the finance service license to which the country of trader’s residence belongs.*

* Limitation of maximum leverage by finance service license

Europe: 1:30

Japan: 1:25

Other areas: no limitation (country-specific conditions may apply)

Effective Leverage

Effective leverage indicates the ratio of effective margin to the valuation of holding position at the time of trading, or holding a position. In other words, it compares the available volume for transactions with the deposit and varies according to the currency rate of holding position.

What is Effective Leverage?

How to Calculate Effective Leverage

As mentioned above, effective leverage indicates the ratio of effective margin to the valuation of a holding position at the time of trading, or holding a position. It can be determined by the relation of the deposit equity, number of holding positions and valuation gain or loss at the time of trading.

Formula of calculating effective leverage

Effective Leverage = Valuation of holding positions (number of positions × present rate) / Effective margin (deposit equity + valuation gain or loss)

We take a look at this calculation with an example.

<Conditions>

Deposit Currency: USD

Deposit Equity: USD 10,000

Holding Position: Long position, 50,000 currencies (EUR 50,000) at the rate of EUR 1.00000=USD 1.21000

Present Rate: EUR 1.00000=USD 1.22000

Valuation Gain or Loss: (1.22000-1.21000) × EUR 50,000 = + USD 500.00

Valuation of Position: EUR 50,000 × USD 1.22000 = USD 61,000

Effective Margin: USD 10,000 + USD 500 = USD 10,500

Effective Leverage: USD 61,000 / USD 10,500 = 5.81

As this trader holds the position of USD 61,000 against the effective margin of USD 10,500, effective leverage can be calculated as 1:5.81.

* Effective leverage varies in accordance with the present rate.

Meaning of “Setting Effective Leverage”

When explaining the effective leverage, many websites and materials, including this site, would say “supposing that effective leverage is set as 1:10, then...” But strictly speaking, no trader adjusts it on the screen of the chart. Effective leverage is a result of calculation by using the ratio of margin of the trader to the valuation of position at the time of trading. Therefore, you may have the risk of unexpectedly high leverage. To hedge such a risk, it is required to have an adequate amount of positions and the ability to cut a loss in a calculated manner.

Advantage of Leverage

①Traders can utilize the multiplied funds to make a huge investment

Multiplied funds enable traders to have a large sum of positions. This factor distinguishes FX trading from other businesses as it gives traders a wider opportunity to earn an enormous profit.

| Profit earned when a trader gains 10pips (Deposit currency: USD, Currency pair: EUR/USD) | |||

| Margin | USD 10,000 | USD 10,000 | USD 10,000 |

| Amount of purchase | EUR 41,667 | EUR 833,340 | EUR 4,166,700 |

| Leverage | 1:5 | 1:100 | 1:500 |

| Gain or loss (pips) | 10 | 10 | 10 |

| Amount of gain or loss | +USD 41.667 | +USD 833.34 | +USD 4,166.7 |

| Rate: EUR 1.0000:USD 1.20000 | |||

The above table shows the amount of profit in each leverage case when a trader deposits USD 10,000 as a margin and does the transaction with 10 pips. At the 1:5 leverage ratio, the trader can earn a profit of USD 41.667. Likewise, it is USD 833.34 and USD 4,166.7 when the leverage ratio is 1:100 and 1:500 respectively. As the leverage ratio increases, so does the profit.

②Traders can utilize the multiplied funds to have as many positions as possible.

Another advantage of leverage is that multiplied funds enable traders to have as many positions as possible. By doing so, traders can enjoy the trading opportunities simultaneously occurring in multiple currencies. This effect can be glaringly apparent in the annual yield.

Advantages of leverage can be also found in the following article:

Advantages and Disadvantages of FX Trading

Risk of Leverage

Leverage has two sides of the same coin. As it allows traders to enjoy an enormous profit, leverage may inflict on them a risk of having the same amount of deficit.

| Deficit taken when a trader loses 10 pips (Deposit currency: USD, Currency pair: EUR/USD) | |||

| Margin | USD 10,000 | USD 10,000 | USD 10,000 |

| Amount of purchase | EUR 41,667 | EUR 833,340 | EUR 4,166,700 |

| Leverage | 1:5 | 1:100 | 1:500 |

| Gain or loss (pips) | -10 | -10 | -10 |

| Amount of gain or loss | -USD 41.667 | -USD 833.34 | -USD 4,166.7 |

| Rate: EUR 1.0000:USD 1.20000 | |||

The above table shows the amount of deficit in each leverage case when a trader deposits USD 10,000 as a margin and does the transaction with 10 pips. At the 1:5 leverage ratio, the trader may have a deficit of USD 41.667. Likewise, it is a deficit of USD 833. 34 and USD 4,166.7 in the case of 1:100 and 1:500 leverage cases respectively. As the leverage ratio increases, so does the deficit.

The downside of leverage is that traders may have the same amount of deficit as the expected profit.

In other words, leverage can amplify both profit and deficit. Therefore, you should have to keep in mind that leverage can drive earning growth efficiently but at the same time extend the deficit.

Regardless of utilizing or forgoing leverage, there is the same chance that you have a risk of having the deficit, or a chance of succeeding in trading. On FX trading, you should take your trading style and winning percentage into consideration to have a better understanding of suitable leverage.

Many brilliant traders in the world adopt around five-percent effective leverage. Those who earn money stably won’t bet on one position but choose to have multiple positions simultaneously to aim at taking an overall profit. The higher maximum leverage is offered, the more entries a trader can possess, even if each position has lower than 1:5 effective leverage. Therefore, the fact remains that the maximum leverage should be as high as possible.

Conclusion

From my experience, reading the exposition of leverage won’t help you fully understand how to increase the funds for investment without doing actual trades. So I recommend you to first open a demo account to simulate the trading so that you can experience the power of leverage. And you will be able to effectively understand the essence of leverage.