You may think that applying a high leverage is too risky to make a huge profit in FX trading. Is this correct? The purpose of this article is to eliminate such skepticism.

FX trading attracts many traders thanks to the system called “leverage,” which allows them to increase their capital, invest more money than they actually have and improve the efficiency of earning rate.

Many websites emphasize the negative aspect of high leverage. However, I do believe that you should make the most of it as long as you are equipped with good fund management skills and willing to accept the risk. Rather, having an accurate understanding literally becomes “leverage” for you.

[Summary]

- Utilizing high leverage is NOT dangerous.

- High leverage dispenses with the necessity to prepare a lot of money.

- Leverage ratio depends little on profit or loss.

- It is more important to calculate and manage the risk as you should set the allowable loss per trade.

Contents

Why Applying High Leverage Is NOT Dangerous

Understand Nature of High Leverage

High leverage does not require traders to prepare a lot of money, or margin, by themselves.

How Leverage Works: Increase Amount of Investable Money

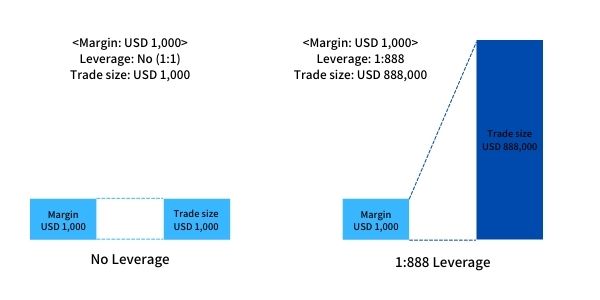

If you deposit USD 1,000 as a margin, you have to make an investment within that amount. However, leverage allows you to hold a position worth in excess of the amount of margin.

As shown below, if you deposit USD 1,000 as a margin but there is no leverage ratio or you don’t apply leverage, your investable money remains USD 1,000.

However, if your broker offers the 1:888 leverage ratio and you utilize it, you can increase the amount of money or trade size, to as much as USD 888,000.

[NOTE]

The applicable maximum leverage differs between the authorized finance licenses as it is 1:30 in Europe and 1:25 in Japan. Additionally, country-specific conditions may apply.

How Leverage Works: Reduce Amount of Margin Required to Hold Positions

As leverage can increase the amount of investable capital, traders can reduce the amount of margin required to hold positions.

For example, if you want to trade 1 lot (100,000 currencies) in EUR/USD (at the rate of 1:1.1000), you are required to deposit USD 100,000 without leverage. However, the 1:100 leverage allows you to prepare only USD 1,100 to hold the same size of position.

Thus, leverage makes it possible to make a large investment with small amounts of money. Many people misunderstand that high leverage increases both profit and loss because it allows traders to hold a position worth in excess of their own money. Rather, as mentioned above, you should understand that high leverage allows traders to invest with less amount of money in hand.

Also, more importantly, as we take a look below, whether high or low leverage has been applied does not affect the amount of loss per trade.

Leverage Ratio Does NOT Affect Profit and Loss Amounts

Many people misunderstand that the higher leverage increase the likability of incurring loss, as well as earning profit. However, as long as the volume (number of lots) is the same, the profit and loss on currency fluctuations is the same, regardless of whether high leverage or low leverage has been applied. The difference is the percentage of profit and loss to the trader’s own capital.

The table below summarizes the amount of loss and the percentage of loss when a trader prepared USD 110,000 and USD 1,100 to do trading in EUR/USD with 1 lot (100,000 currencies) at the rate of 1.1000.

| Trader’s capital | USD 111,000 | USD 1,100 |

| Leverage | No leverage (1:1) | 1:100 |

| Loss when the rate goes down 100 pips | USD 1,000 | USD 1,000 |

| Loss percentage against trader’s capital | 0.9% | 91% |

In this case, regardless of the application of leverage, the trader anyway loses USD 1,000. But the percentage of loss differs according to the leverage ratio. The amount of gain or loss does NOT increase with the leverage ratio.

Rather, we should learn from it the importance of portfolio management skill. Leverage allows traders to invest larger than their own capital in hand. Therefore, traders who applied leverage can go broke in a flash. It makes some traders misunderstand that applying high leverage is risky.

But you should keep in mind that “Don't bite off more than you can chew.” That is, you should limit the lot size in trading in consideration to own capital.

As mentioned below, you should calculate the loss percentage per trade against the amount of capital traded and then adjust the number of lots based on the possible maximum number of consecutive losses. And you will be able to understand that applying high leverage is not risky but very helpful.

High Leverage Trading Entails Portfolio Management Skills

An explanation of portfolio management can be found in this article.

【Why Portfolio Management Matters】 Differences between Successful Traders and Unsuccessful Traders

Successful traders recommend the method that we should set the amount or percentage of the acceptable loss per trade and then adjusting the number of lots to be invested. The details are summarized in the article above.

Adjusting Position Size to Manage Money for Investment

Here, we use the below example to take a look at how to manage your portfolio.

This trader has now USD 10,000 and decides to limit the loss per trade to 1% of the amount of initial investment. Therefore, the trader is allowed to lose USD 100.00 per trade.

Amount of Investment: USD 10,000

Leverage 1:50

Currency Pair: EUR/USD

Deposit Currency: USD

| No. | Result | Profit (%) | Earning | Balance |

| 1 | Win | +2.0% | USD +200.00 | USD 10,200 |

| 2 | Win | +1.0% | USD +100.00 | USD 10,300 |

| 3 | Win | +1.0% | USD +100.00 | USD 10,400 |

| 4 | Win | +1.0% | USD +100.00 | USD 10,500 |

| 5 | Lose | -1.0% | USD -100.00 | USD 10,400 |

| 6 | Win | +1.7% | USD +170.00 | USD 10,570 |

| 7 | Lose | -1.0% | USD -100.00 | USD 10,470 |

| 8 | Win | +1.0% | USD +100.00 | USD 10,570 |

Calculation

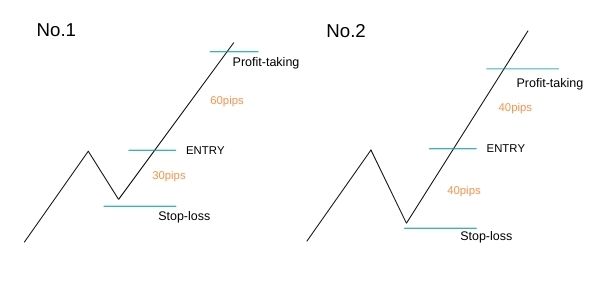

Case No. 1

Stop-loss Line: 30 pips below the entry line

Estimated Stop-loss Amount: USD 100.00 (1.0 % of the amount of investment)

Amount of Transacted Currency: USD 100.00 / 30 pips (USD 0.0030) = EUR 33,333

When the amount of transacted currency is EUR 33,333, a stop-loss line should be drawn at the level of 30 pips below the entry line. In this case, the trader luckily got 60 pips which amount to twice as much as the estimated stop-loss amount (30 pips, or 1.0%).

Case No. 2

Stop-loss Line: 40 pips below the entry line

Estimated Stop-loss Amount: USD 100.00 (1.0 % of the amount of investment)

Amount of Transacted Currency: USD 100.00 / 40 pips (USD 0.0040) = EUR 25,000

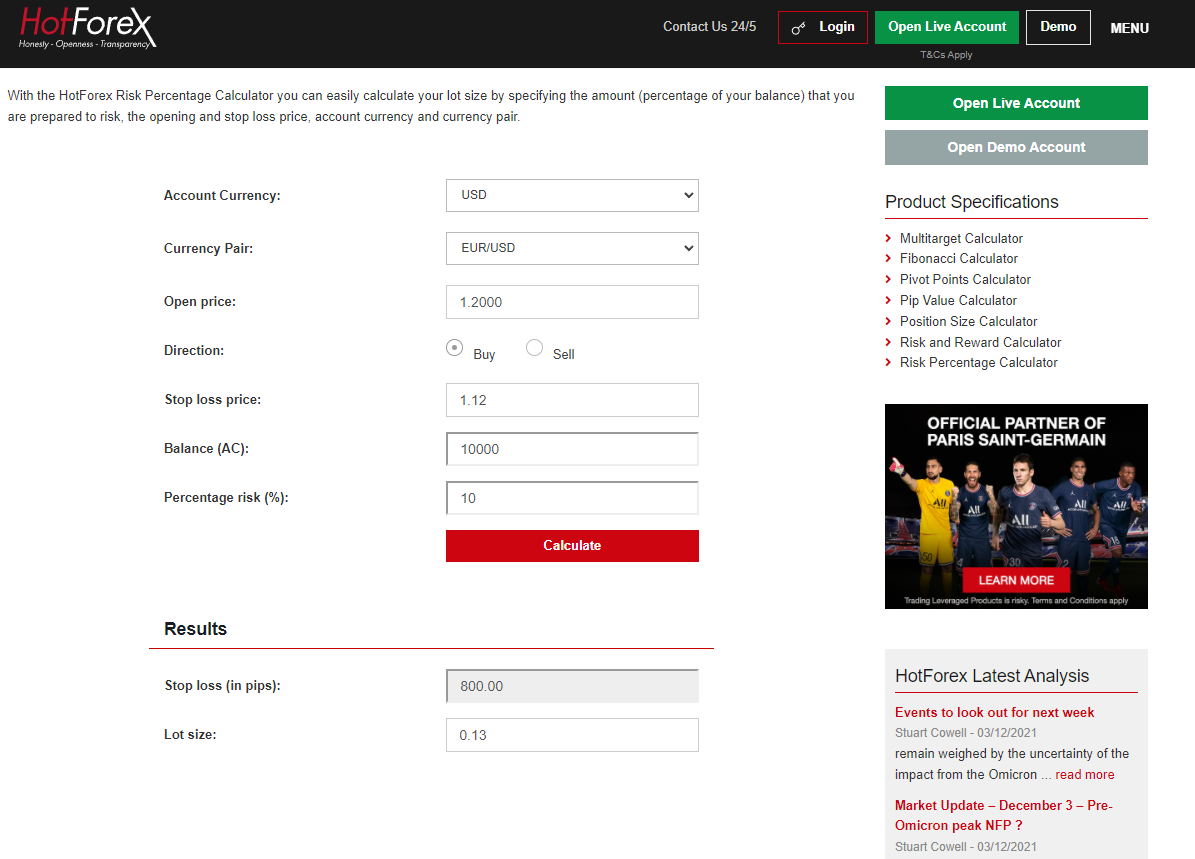

[Supplemental]

In order to do trading with a fixed amount of loss per trade, it is necessary calculate the trading volume (number of lots).

HotForex offers a free calculation tool (Risk Percentage Calculator).

Enter the required numbers or select the relevant items in the form below, and it will give you “lot size” per trade in accordance with the calculated stop loss level.

Recognizing Risk

Suppose that a trader with USD 10,000 holds a position size of 3 lots (300,000 currencies). The leverage at this time is approximately 1:30 as -10 pips is equivalent to -3.0%. This means that this trader has applied the leverage of as high as 1:30. However, as long as the trader sets the stop loss line at 10 pips below the entry line, the trader may lose no more than USD 300.00, or 3.0 % of the initial capital.

You may think it dangerous to apply such a high leverage. However, since this trader fixed the allowable loss amount before the trade, the trader can lose only 3.0 % of the initial capital, or USD 300.00. Is this trade really risky? I do NOT think so. Nevertheless, if you stick to your belief, it is a difference of risk tolerance (Note: as risk tolerance varies from person to person, having low risk tolerance itself is no problem).

Rather, it is more important to calculate and manage the maximum risk, i.e., the amount of money you can lose per trade or allowable loss percentage against your money in hand and invest the amount of lots in consideration of the allowable loss per trade. By doing so, even trading with a leverage as high as 1:100 is not risky.

Sure, the letter “1:100 leverage” may frighten you. However, applying a high leverage based on the careful portfolio management is different from the reckless trading without knowing the possible loss. It is one of the typical mistakes beginner traders with little knowledge of portfolio management tend to make as they invest too much amount of money to keep balance with his or her own capital.

Again, please keep in mind that applying a high leverage itself is not dangerous. The reckless trading without management skills is dangerous. You should distinguish both, and you will be able to realize that the notion of linking high leverage with risk is false, contrary to what is said in general.

Summary

- Utilizing high leverage is NOT dangerous.

- High leverage dispenses with the necessity to prepare a lot of money.

- Leverage ratio depends little on profit or loss.

- It is more important to calculate and manage the risk as you should set the allowable loss per trade.

Contrary to what many websites say, applying a high leverage is NOT dangerous as long as risk management skills are equipped. Leverage attracts many traders into FX trading because it allows them to do trading with a larger amount of money than they actually have and improve the investment efficiency. If you have not yet been able to succeed as expected, do more practices and verification on your trading style.

Thank you for sparing your time to read this article.

Information on Best Brokers

There are quite a few brokers in the world, with varying characteristics. It takes quite a lot of time to gather information on each broker and find the best broker suitable for you.

This site introduces the best brokers with a financial license. Since the below brokers in particular have a distinctive advantage each other, you will be able to find the best broker which fits your trading style.

XM Official Website (Outside Europe)

Information on Best Broker by country

This site also introduces the best broker(s) for each trader's country of residence.

【Popular Broker】 Well-reputed FX Broker by Country

Just select your country, and you will be able to find a list of the best broker(s) operating in your country. I hope this will be also helpful to find the best broker for you.