This article introduces the overview of a flash crash and examines how to prevent it.

[Summary of This Article]

- “Flash crash” means the price instantaneously makes a huge rise or fall.

- The biggest flash crash occurred on January 15, 2015 (3,500 pips, EUR/CHF).

- In the past, every time a flash crash occurred, the rate eventually came back to the pre-crash level.

- To prevent a flash crash, it is necessary to avoid three unstable factors - unstable market environment, unstable currency pair and unstable time - and to have the ability of portfolio management.

- The important thing in portfolio management is to adjust the trading volume by assuming the amount of loss in a flash crash in advance.

- Negative Balance Protection is a must-have option.

First, we take a look at notable flash crashes and lessons learned from them.

Contents

- 1 What Is A Flash Crash?

- 2 Flash Crash (1) March 9, 2020: USD/JPY

- 3 Flash Crash (2) January 3, 2019: AUD/USD

- 4 Flash Crash (3) January 3, 2019: USD/JPY

- 5 Flash Crash (4) October 7, 2016: GBP/USD

- 6 Flash Crash (5) January 15, 2015: EUR/CHF

- 7 How to Prevent a Flash Crash

- 8 How to Calculate Lot Size in Consideration of Flash Crash

- 9 Conclusion

What Is A Flash Crash?

“Flash crash” means the price instantaneously makes a huge rise or fall.

It can occur in any financial product. However, as mentioned later, it is typical that the price eventually returns to the pre-crash level. Therefore, if you invest in a volume that can withstand a large unrealized loss, there is no need to panic and cut your losses.

Notable Flash Crashes in FX

| Date | Currency Pair | Floating Range (pips) |

| March 9, 2020 | USD/JPY | 107.8 |

| January 3, 2019 | AUD/USD | 262.4 |

| January 3, 2019 | USD/JPY | 392.7 |

| October 7, 2016 | GBP/USD | 698.4 |

| January 15, 2015 | EUR/CHF | 3513.9 |

Flash Crash (1) March 9, 2020: USD/JPY

| Floating Range | Number of days required to return to pre-crash level | Maximum latent loss |

| 107.8 pips | 1.9 days | 410.1 pips |

What Caused Flash Crash?

It is widely thought that this flash crash occurred spontaneously.

It was caused by the concern that the new coronavirus might disrupt the economy and accordingly the disruption might trigger the oversupply of crude oil.

Lessons Learned from This Flash Crash

Do not have the over-the-weekend position.

This flash crash was unpredictable with the wisdom of hindsight. Meanwhile, this crash also reminds us of the importance that we should be aware of the risk of price volatility after the weekend and lower the over-the-weekend position.

Flash Crash (2) January 3, 2019: AUD/USD

| Floating Range | Number of days required to return to pre-crash level | Maximum latent loss |

| 262.4 pips | 0.7day | 262.4 pips |

What Caused Flash Crash?

There is a strong view that this crash was caused by the Australian economy's heavy dependence on China and the fact that AUD is highly linked to the stock market.

Markets in some countries were still closed on January 3 for the new year’s holidays. But the European market started the first trading of the year the day before. On January 2, 2019, Apple CEO Tim Cook announced a downward revision to the company's financial results for the first quarter of the fiscal year 2019 due to a significant drop in iPhone sales in China.

Lessons Learned from This Flash Crash

Prevent trading when there is little liquidity in the market.

During the holidays, the market becomes quiet. For example, the Japanese market usually closes until January 3 for the new year’s holidays. As there are fewer market participants, the liquidity decreases, and price volatility increases. Therefore, it is important to close the position in advance.

Flash Crash (3) January 3, 2019: USD/JPY

| Floating Range | Number of days required to return to pre-crash level | Maximum latent loss |

| 405.0 pips | 3.2 days | 392.7 pips |

What Caused Flash Crash?

This flash crash occurred in parallel with (2).

Lessons Learned from This Flash Crash

Prevent trading when there is little liquidity in the market.

Especially, this crash occurred when the Japanese market was closed for holidays.

Flash Crash (4) October 7, 2016: GBP/USD

| Floating Range | Number of days required to return to pre-crash level | Maximum latent loss |

| 698.4 pips | 25.0 days | 698.4 pips |

What Caused Flash Crash?

The lingering market instability since “Brexit” caused this crash.

The U.K. electorate decided to leave European Union on the June 23 referendum. Soon afterward, GBP fell to 1.27993. However, in October 2016, GBP breached the resistance line and tried to go down further for two days. Then, this sudden fall occurred. In consideration of a series of the move, it is thought that some technical factors were attributed much more than other crashes.

Lessons Learned from This Flash Crash

Remove the currency with major fundamental concerns from the trade plan.

Flash Crash (5) January 15, 2015: EUR/CHF

| Floating Range | Number of days required to return to pre-crash level | Maximum latent loss |

| 3,513.9 pips | 1,190 days | 3,513.9 pips |

What Caused Flash Crash?

Swiss National Bank had previously carried out the market intervention to sustain EUR/CHF at the 1.2000 level. However, the central bank’s sudden announcement of suspending the intervention caused the flash crash as the market lost the support line. This is the biggest flash crash in the foreign exchange world ever.

Lessons Learned from This Flash Crash

- Keep in mind that it is dangerous to have a position against the market consensus (heavy dependent on the reaction of SNB).

- Close the related positions before a major financial event (SNB's monetary policy meeting).

How to Prevent a Flash Crash

Day Trading (short-term traders making a leveraged trade)

- Do not have the over-the-weekend position (or limit the volume of leverage)

- Prevent trading during a time of low liquidity such as the holiday season

- Prevent trading in low-liquidity minor currencies

- Remove currency pairs with major fundamental concerns from the trading plan

- Do not depend on the market intervention

- Close the related positions before major financial events

Swing Trading (long-term traders)

- Conduct trading with a lot size that can prevent a loss cut even in the case of a flash crash (see below for details)

- Follow the above-mentioned principles for day trading

Past flash crashes showed that the market retrieved the calamity and eventually returned to the pre-crash level. In other words, some traders who had adjusted their trading volume to withstand unrealized losses were able to get through the crash unscathed in the end. This reminds us of the importance of position size.

There are some other countermeasures as using the broker which has the server with high execution capacity and setting a stop loss. However, they don’t always work, especially against the huge flash crash.

What Is "Negative Balance Protection"?

In the event that a trader suffers a loss which exceeds the deposited margin, the broker which offers Negative Balance Protection will bear the loss excluding the lost margin and write the negative balance off. Without this option, the trader will be in debt for the negative balance (or required to remargin).

Related Article

【Negative Balance Protection】 The Must Option to Hedge Unexpected Loss

If you open an account with a broker which offers Negative Balance Protection, you will not have a negative account balance even if a flash crash occurs. That is why the broker with the must-have option for traders is recommended. All brokers mentioned on this site (see the list below) have this option.

Brokers Offering Negative Balance Protection

| Broker | Cover Areas | Operating Company | Finance License | Official Site |

| XM | Europe | Trading Point of Financial Instruments Ltd | CySec | Official Site |

| XM | Asia (Far East) | XM Global Limited | IFSC | Official Site |

| XM | Australia | Trading Point of Financial Instruments Pty Ltd | ASIC | Official Site |

| HotForex | Europe | HF Markets (Europe) Ltd. | CySec | Official Site |

| HotForex | Asia (Far East) | HF Markets (SV) Ltd | SV | Official Site |

| Tradeview | Whole world,

except some areas |

Tradeview Ltd | CIMA | Official Site |

Click here for recommended brokers by country of residence.

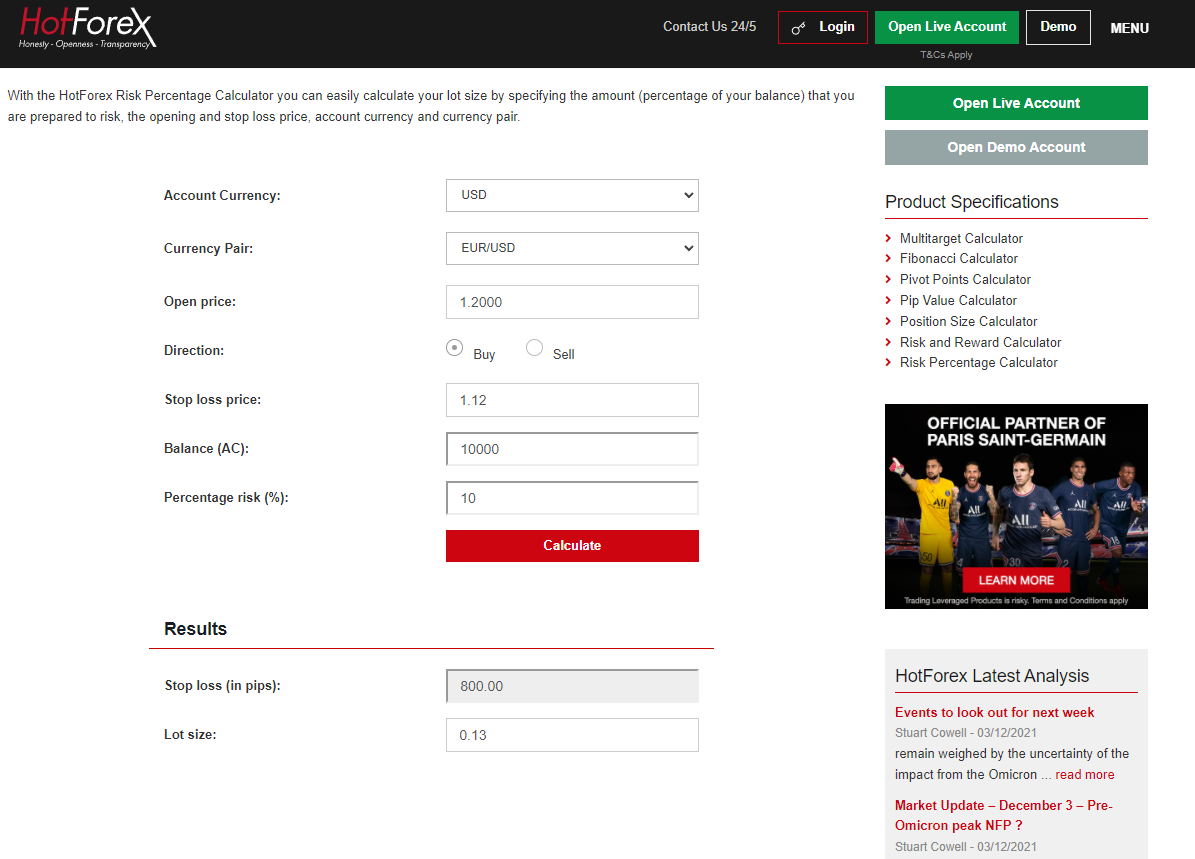

How to Calculate Lot Size in Consideration of Flash Crash

It is widely said that an FX trader should invest in the amounts of lot size reasonable enough to prevent the loss cut even if a flash crash occurs. But some may wonder how to calculate the amount.

This section introduces a simple method to calculate the adequate lot size against the investment amount given that the flash crash may happen.

Related Article:

【Why Portfolio Management Matters】 Differences between Successful Traders and Unsuccessful Traders

How to Calculate Loss-Cut Rate

This is based on an example that you want to calculate the lot size to limit the loss up to 10% in case the stop loss is executed at the level of 800 pips below the entry rate.

[Conditions]

Account Currency: USD

Currency Pair: EUR/USD

Buy-entry Rate (Open price): 1.2000

Margin (Account balance): USD 10,000

The price stop loss is triggered: 1.1200

Acceptable Loss Against Account Amount (%): 10%

HotForex Risk Percentage Calculator

HotForex prepares the tool to calculate the adequate lot size based on the acceptable loss.

HotForex Risk Percentage Calculator (HotForex Official Site)

Just enter the respective numbers on the tool, and it will tell you the lot size for the specified percentage risk.

In this case, you can invest in up to 0.13 lot (13,000 currencies).

This tool is available for free even if you do not have a HotForex account.

Conclusion

Once again, here are the essential points to understand “flash crash.”

- “Flash crash” means the price instantaneously makes a huge rise or fall.

- The biggest flash crash occurred on January 15, 2015 (3,500 pips, EUR/CHF).

- In the past, every time a flash crash occurred, the rate eventually came back to the pre-crash level.

- To prevent a flash crash, it is necessary to avoid three unstable factors - unstable market environment, unstable currency pair and unstable time - and to have the ability of portfolio management.

- The important thing in portfolio management is to adjust the trading volume by assuming the amount of loss in a flash crash in advance.

- Negative Balance Protection is a must-have option.

It would be great if this article can help you understand the overview of a flash crash and establish the countermeasures. Thank you very much for sparing your time to reading it.