<Summary of This Article>

・Differences between ECN and STP

・Trading costs of ECN and STP

・Advantages and disadvantages of ECN and STP

This article introduces the differences of ordering processes between ECN (Electronic Communications Network) and STP (Straight Through Processing).

On this website, you can find the article which explains why you should choose NDD (No Dealing Desk) to do FX trading.

【Difference between Dealing Desk And No Dealing Desk】→

As NDD has no intermediate broker between traders and interbanks, it secures a transparent trading environment.

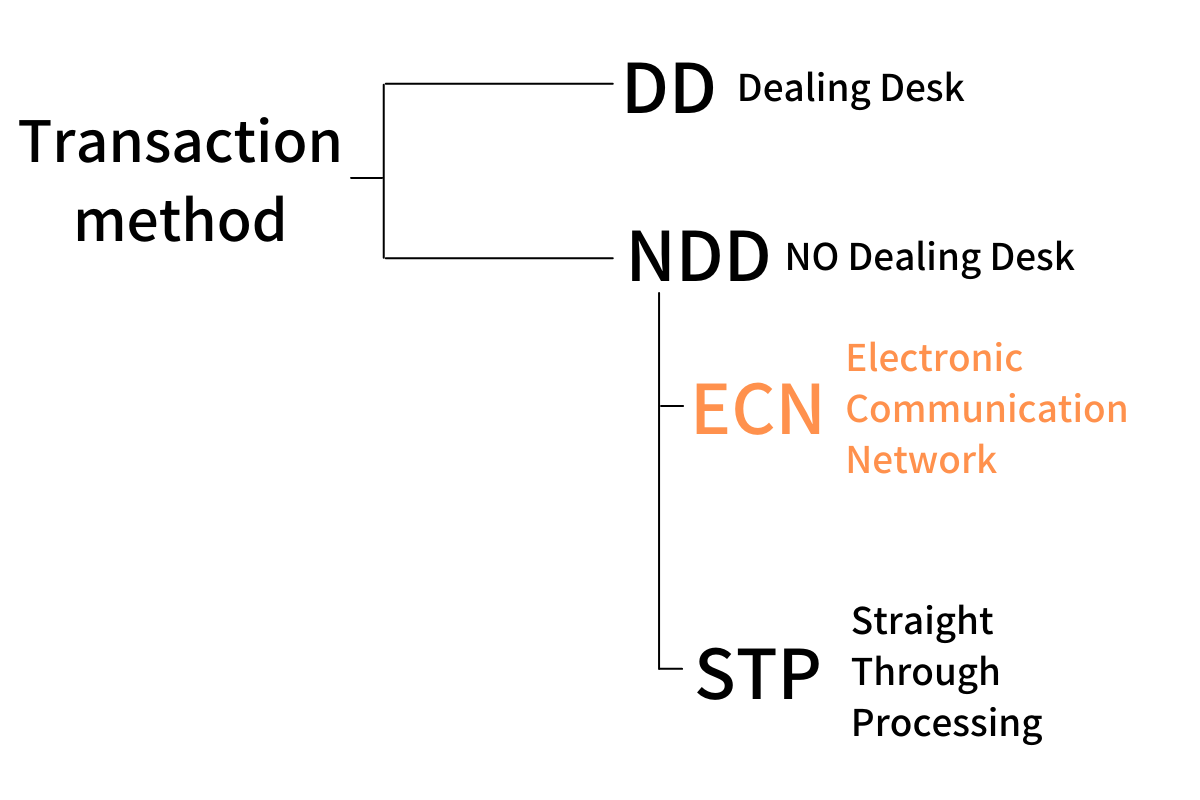

NDD can be further divided into ECN and STP.

In comparison with STP, ECN gives a more transparent trading environment and allows traders to do transactions with a narrower spread, i.e. at a lower cost.

This article would be helpful to traders who want to keep succeeding in FX trading.

In addition, this article introduces Tradeview , one of the most popular brokers in the world when it comes to specializing in ECN.

Tradeview provides traders with an ECN account service with a low transaction cost, has the certified finance license (CIMA) and has an edge in securing traders’ portfolios.

Contents

- 1 Differences between ECN and STP

- 2 Comparison of trading cost between ECN and STP

- 3 Tax Saving

- 4 Advantages/Disadvantages of ECN

- 5 Advantages/Disadvantages of STP

- 6 Who Should Use an ECN Account?

- 7 Who Should Use an STP Account?

- 8 Broker Information - Tradeview’s ILC Account

Differences between ECN and STP

Although both are categorized as NDD, in a precise sense, there is a difference between ECN and STP.

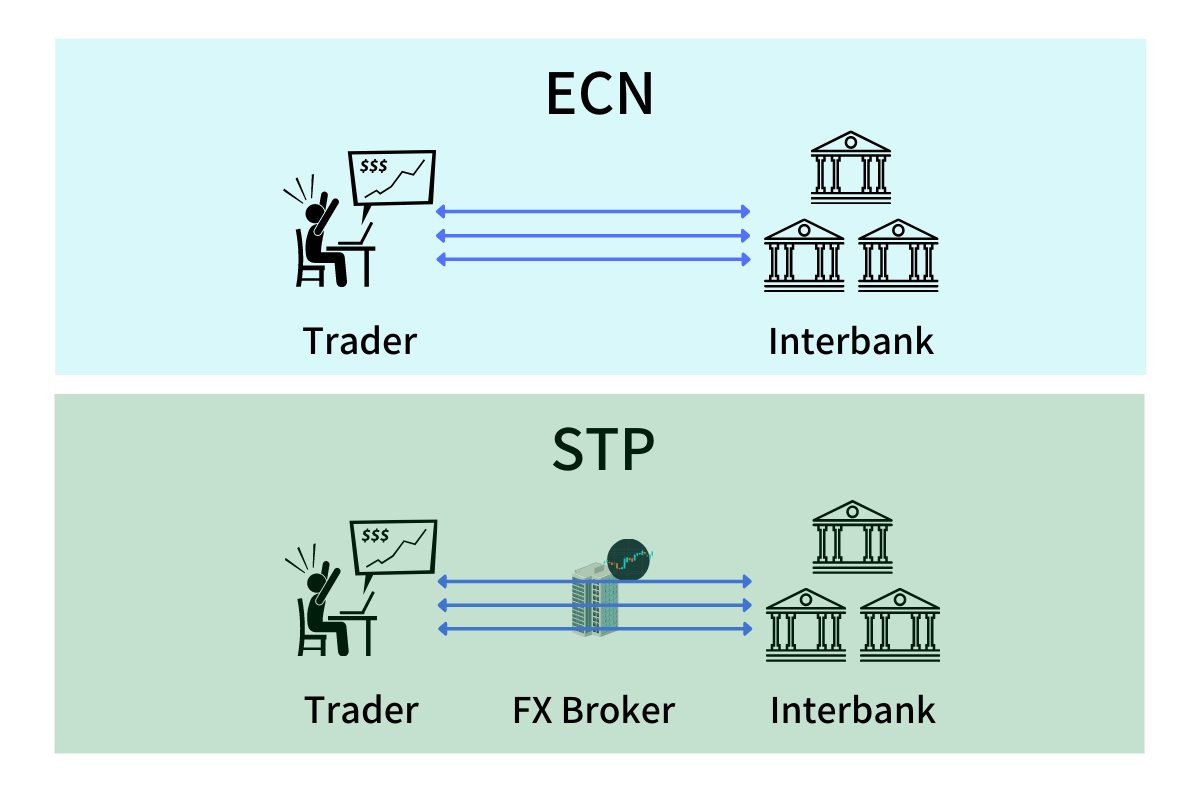

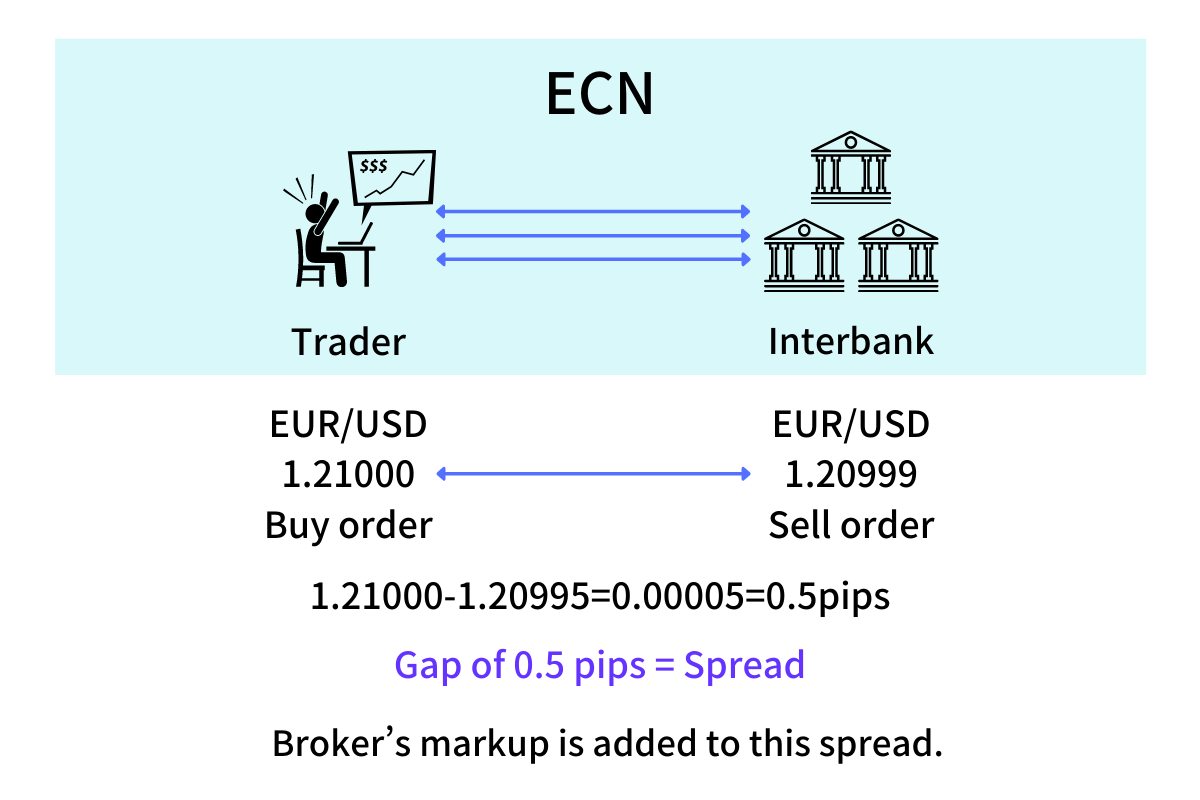

【ECN】

The order from a trader is directly forwarded to an interbank without going through a broker’s system.

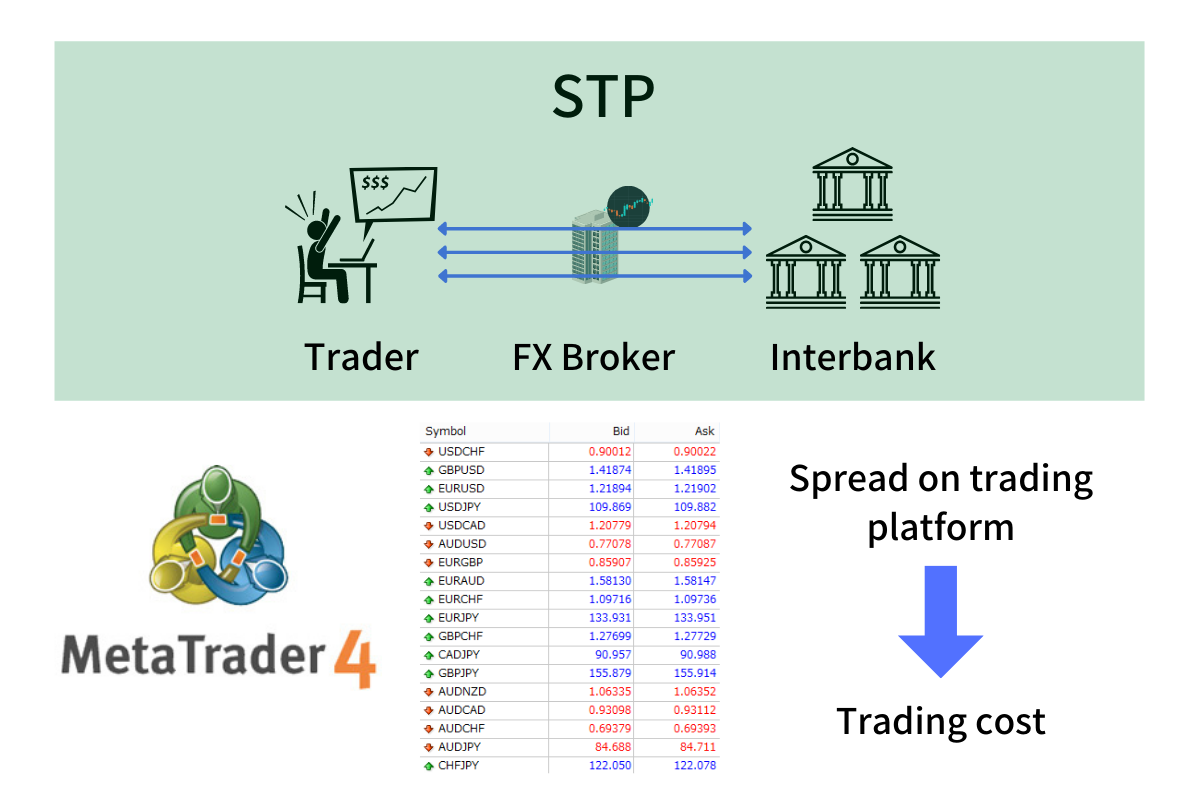

【STP】

The order from a trader goes through a broker’s order processing system to be forwarded to an interbank.

In STP, the order of a trader is forwarded to a broker and then an interbank. Although the broker processes it systematically, it does not necessarily mean that the broker does not arbitrarily configure the system. Meanwhile, ECN makes do without a broker's order processing, which creates a more transparent trading environment.

Comparison of trading cost between ECN and STP

How to calculate trading costs differs between ECN and STP.

【ECN】

Trading cost = Spread + Broker’s markup

【STP】

Trading cost is equal to the spread which appears on the trading platform such as MT4.

Trading Cost of ECN

As a trader's order is directly forwarded to an interbank to be processed, the transaction is automatically matched at the price optimal for both the seller and buyer. As the spread is calculated by the gap of bid/ask prices shown by the trader and interbank, it tends to become low.

To calculate the overall trading cost, the broker’s markup as an agency commission is added separately to the spread so that the service provision by the broker can be guaranteed.

How to Calculate Markup in ECN

Markup differs between brokers as follows;

| Broker | Markup (per 100,000 currencies, RT) | Official Site |

| Tradeview | USD 5.0 (0.5pips) | Official Site |

| HotForex | USD 6.0 (0.6pips) | Official Site |

| XM | USD 7.0 (0.7pips) | Official Site |

| FBS | USD 12.0(1.2pips) | Official Site |

Each broker shows the markup per “one-way” or “round trip”.

・One way: Commission incurred for each entry and exit. Two one-way markups are equal to one round-trip markup.

・Round-trip: Commission incurred per entry and exit

Where RT mark per lot (100,000 currencies) is USD 5.00, the pips can be calculated;

USD 5.00 / USD 100,000 = USD 0.00005 = 0.5 pips

Then, trading cost can be calculated by adding the spread to these pips.

Transaction cost of STP

Spread on trading platform = Trading cost

When a transaction is conducted with an STP account, the broker's markup has already been added to the spread appearing on the trading platform like MT4.

There is no need to do calculations.

Which Trading Cost is Better for Traders ?

ECN accounts offer lower trading cost than STP accounts.

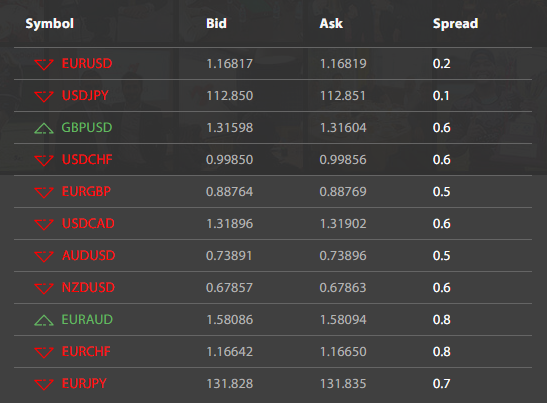

The below table shows the comparison of trading costs on EUR/USD between ECN and STP.

| Broker | Markup | Avg. spread | Total trading cost |

| Tradeview (ECN) | 0.5pips, RT | 0.2 | 0.7 |

| XM (ECN) | 1.0pips, RT | 0.4 | 1.4 |

| FBS (ECN) | 1.2pips, RT | 0.2 | 1.4 |

| Tradeview (STP) | - | 1.6 | 1.6 |

| XM (STP) | - | 1.7 | 1.7 |

| FBS (STP) | - | 1.7 | 1.7 |

ECN accounts have a narrower spread than STP.

Although the markup is separately added to the spread, the overall trading cost of ECN is still lower than that of STP.

If you want to cut the overall costs including spread, trading with an ECN account is recommended.

To open account with Tradeview:

To open a narrow-spread and low-cost ECN account at Tradeview, select “MT4 Innovative Liquidity Connector” (ICL account) from the “Choose a Platform” column.

Tax Saving

When it comes to tax saving, ECN accounts have a much greater advantage than STP.

In STP, since the spread is included into the purchase price, it can not be allocated as an expense. Meanwhile, the holders of ECN accounts are allowed to allocate the external markup as an expense, except the spread directly linked to the interbank.

Advantages/Disadvantages of ECN

Advantages (ECN)

Narrow spread

It is pointed out that one of the disadvantages of NDD is the wider spread in comparison with DD (Dealing Desk) as a flip side of the coin that NDD has high transparency. However, ECN has a tendency that the spread can converge thanks to the automatic matching of orders from many market players.

Quite high transparency

The transaction price in ECN is determined by auctioning between market players, not by brokers. As there is no room for brokers to manipulate the rates or involve in wrongdoing, ECN secures quite a highly transparent environment.

High certainty of execution

In addition to the narrow spread, ECN has an edge in high certainty of execution. As the massive orders flood into the interbank, each order can be executed more surely than STP, where brokers do the matching of orders.

Tax saving

ECN account holders have to pay the markup in addition to the spread. Unlike spread, markup can be declared as a tax-effective expense. It can reduce transaction costs in total in comparison with STP.

Disadvantages (ECN)

Markup is incurred

It is inevitable to bear markup. But in principle, the total of spread and markup is still lower than the STP account’s spread.

Minimum deposit amount and transaction volume are set high

Brokers set stricter conditions to start transactions through ECN than STP. So it is said that ECN accounts are not suitable for beginners but intermediate- or advanced traders.

Low leverage

ECN accounts tend to have lower leverage than STP.

Ineligibility of bonus

Some brokers such as XM provide a bonus program in Asia and other regions, which enables the account holder to increase the margin. But such a program is available for STP accounts, not for ECN.

Some brokers do not even provide ECN

ECN accounts are available at only a handful of brokers.

Advantages/Disadvantages of STP

Advantages (STP)

No markup

In exchange for a little wider spread, STP account holders do not have to pay a markup. It is easy to calculate the trading cost as it is equal to the spread appearing on the trading platform.

High-leverage trading

STP accounts set a higher leverage for trading than ECN.

Minimum deposit amount and volume are set low

STP accounts are suitable for those who want to start FX trading with small amounts of money.

Eligibility of bonus

Some brokers such as XM provide a bonus program for STP accounts in Asia and other regions. Due to restriction by finance license, bonus programs are not available in Europe. For details, please see the following article or make sure to check the official site of the broker.

Disadvantages (STP)

High spread

As mentioned above, STP accounts have a wider spread than ECN. Still, its spread cost is higher than the total of an ECN’s spread and markup.

Less transparency

Both ECN and STP are in the group of NDD, which brokers won’t intervene between traders and interbank. It secures high transparency of the trading environment. But STP has less transparency than ECN as orders are processed via the ordering system of the intermediate broker.

Who Should Use an ECN Account?

・Cash-laden intermediate or advanced level trader

・Trader who wants to enjoy a bonus program and cut transaction costs

・Trader who wants to take advantage of high certainty of execution

・Trader who is doing scalping, day trading or other high-frequent trading

Who Should Use an STP Account?

・Beginner with small amount of money

・Trader who wants to enjoy a bonus program

・Trader taking advantage of high leverage

Broker Information - Tradeview’s ILC Account

Tradeview’s ILC account (Innovative Liquidity Connector) provides the top-level spread.

License

Tradeview is authorized by the highly reliable CIMA license

Portfolio security

Broker’s resources and the account holder’s deposit are completely separated. Account holder is protected at the maximum of USD 35,000 in preparation for the possibility of bankruptcy.

Who should choose this account?

・Trader who focuses on low trading cost more than all

・Trader who needs a high-spec trading environment such as low spread, security

Why does Tradeview gain popularity?

・Compare your broker’s spread with Tradeview’s spread, and you will be astonished at Tradeview’s quite low spread cost.

・Low-spread trading is suitable for scalping and day trading.

・Tradeview provides high security for fund management.

To open account with Tradeview →

To open a low-spread and low-cost ECN account at Tradeview, select “MT4(MT5) Innovative Liquidity Connector” (ICL account) from the “Choose a Platform” column.