Dow Theory is so important that it is widely applied to many technical analyses. It was developed a century ago. But it is still popular among many traders. It means that the theory has worked effectively for a long time.

Dow Theory gives you the general ideas of

・How to trade without resistance to trend.

・How to determine the occurrence of a new trend

・How to determine the reversal of a trend

They will be of help in improving your winning chance and increasing your margin.

General Principle of Dow Theory

Dow Theory consists of six general principles:

- There are three primary kinds of market trends; short term, middle term and long term.

- Primary trends have three phases.

- The market discounts everything.

- Indices must confirm each other.

- Volume must confirm the trend.

- Trends persist until a clear reversal occurs.

Now, let’s see the details of each principle.

Contents

①There are three primary kinds of market trends; short term, middle term and long term.

The orientation of trend depends on the time basis, such as "The market keeps the upward trend on the long-term basis, but on the short-term basis, it is in the downward trend."

Short Term

In the following chart, the blue-colored area shows short-term downward trend.

Middle Term

On the middle-term basis, shown by the black thick line, the market is in a temporal downward phase amid the upward trend.

Long Term

On the long-term basis, shown by the green lines, it tells that the market stays within the range and changes constantly.

②Primary trends have three phases.

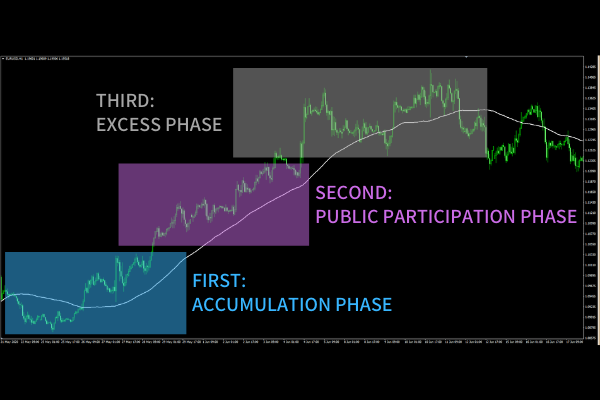

First: Accumulation phase (Blue area)

Expert investors build the position on a certain issue prior to the uptrend. If you enter the market at the accumulation phase, you may be involved in the failure caused by trend reversal and required to repeat divisional loss cuts.

Second: Public participation phase (Green area)

Many market players notice the move of experts and participate in it.

Third: Excess phase (Red area)

As the flow of investment reaches excess phase, some traders start to liquidate the position.

If you enter the market at the excess phase, you will be unlikely to grow a profit because the existing traders who entered the trend long ago take profits. In other words, as those who purchased early start the liquidation, the rate is likely to go down in accordance with the number of sellers.

Conclusion

Excess phase is the "distribution phase" of the trend of opposite direction, and the public participation phase follows. To grow a profit, you should not focus on all of three phases in the upward trend but improve the skills to respond at the public participation phase.

Chart

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

③The market discounts everything.

The price of the forex market depends on all events and elements including interest spread, price level, economic trend, regional conflict and natural disaster. In other words, the price on the chart consolidates all of them and represents the consensus of market players. Therefore, we should put more weight on technical analysis than fundamental analysis.

④Indices must confirm each other.

Looking into the market and being aware of correlation are important to confirm the credibility of trends.

If you confirm that EUR/USD is in the downward trend, make sure to check the trend of USD/JPY. And if USD/JPY is in the upward trend, your confirmation is proved highly credible because both trends show the strong dollar.

⑤Volume must confirm the trend.

The price movement unaccompanied by the volume tends to run counter to trader's expectation. For example, it results in a small trend as a previous step to the boost. Also, the trend with high volume will wind down with the decreased volume. The movement of volume is a key to look into the reversal of trend.

⑥Trends persist until a clear reversal occurs.

This principle is more important than others in trading.

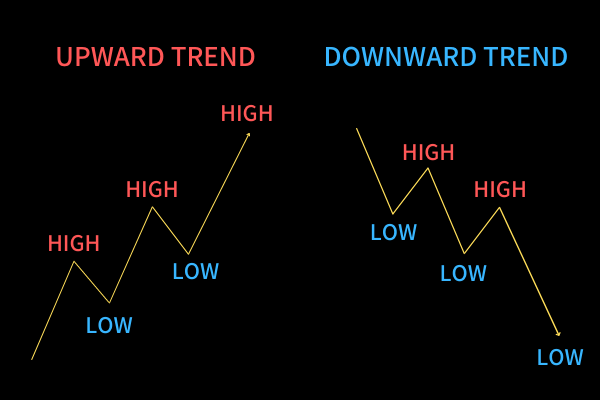

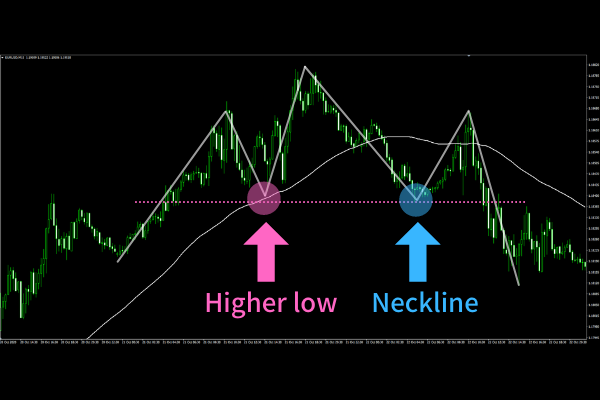

Dow Theory considers it as the upward trend if the price continuously hits new highs while rebounding at the higher level than the preceding lows, as shown in the left chart. And if the price goes to the contrary as shown in the right chart, it is considered as the downward trend. As long as either movement continues, the trend is thought to be under way. And the trend comes to an end when the movement faces the reversal.

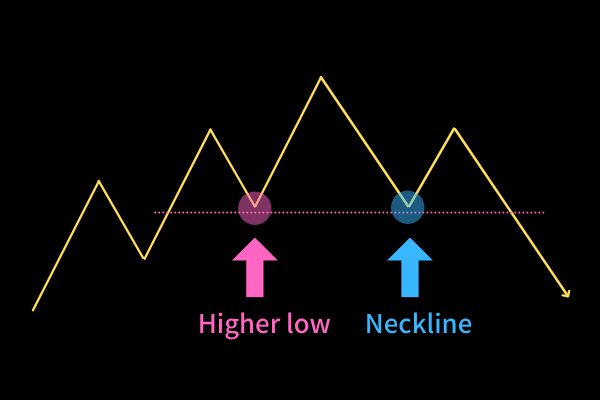

There are two criteria with which you can determine the conclusion of uptrend;

①The market falls below the higher low, the level of upward movement's origination which broke a new high later.

or

②The market falls below the neckline, the level of upward movement's origination which failed to break a new high later.

Likewise, there are two criteria with which you can determine the conclusion of downtrend;

①The market breaks above the lower high, the level of downward movement's origination which broke a new low later.

or

②The market breaks above the neckline, the level of downward movement's origination which failed to break a new low later.

When you build the trade based on the idea that "a trend persists until a clear reversal occurs", you should follow the below strategies.

- Prepare for the reaction until the upward trend ends.

- Prepare for the selling on rally until the downward trend ends.

- When the market stays within the range, pass on the trend or apply the strategy for the range.

- Wait for the occurrence of the trend.

Summarization

In conclusion of the explanation of Dow Theory, here is the summarization of the essential point of each tenet.

①There are three primary kinds of market trends; short term, middle term and long term.

Understand the essence of each trend and clarify the target.

②Primary trends have three phases.

Understand in advance at which phase your own strategy works.

③The market discounts everything.

Use technical analysis to develop the strategy with high expectations.

④Indices must confirm each other.

Check other currencies if you have the time to spend.

⑤Volume must confirm the trend.

It is highly credible if the continuance and reversal of trend is accompanied by the volume.

⑥Trends persist until a clear reversal occurs.

Focus on the high and low prices and clarify your target.

Dow Theory tells us the importance in daily trade. You are required to have the persistence to thoroughly carry out ordinary things, not the sophisticated skills, to constantly earn a profit through trading. This is both simple and difficult. I will explain the practical trading strategies based on the theory later.