<Purpose of This Article>

In this article, we take a closer look at two ordering methods in FX trading, Dealing Desk and No Dealing Desk.

Many traders do not know where their orders go and how they are transacted. As an FX trader, I think it is very important to know the “fact” of these flows.

<Summary of This Article>

・Difference Between Dealing Desk and No Dealing Desk

Dealing Desk: FX brokers serve as an intermediate between individual investors and interbanks.

No Dealing Desk: There is no broker between individual investors and interbanks, which directly deal with investors.

・Advantage and Disadvantage of Dealing Desk

Advantage: Low commission fee (spread cost)

Disadvantage: There is a lack of transparency in transactions which may arise conflict of interest between the customer and broker.

・Advantage and Disadvantage of No Dealing Desk

Advantage: Transparency in transactions is ensured and no conflict of interest arises.

Disadvantage: High commission fee (spread cost)

・Which has the edge?

NDD has the edge for having transparency in transactions.

Contents

Difference between Dealing Desk and No Dealing Desk

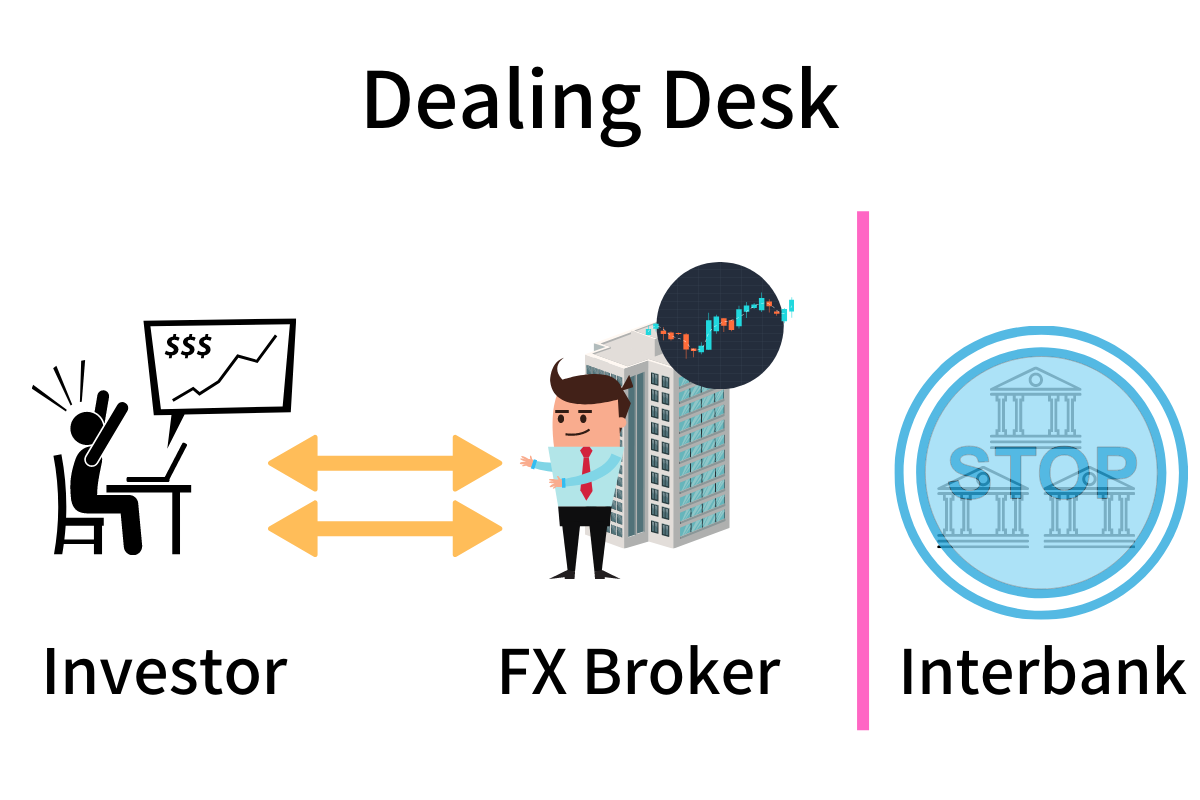

What Is a Dealing Desk?

There are three actors in the world of FX; individual investor, FX broker and interbank. An individual investor opens an account with an FX broker to do transactions, while the broker uses his/her order to conduct cover deals with an interbank. Dealing Desk brokers serve as an intermediate between individual investors and interbanks.

Dealing Desk brokers have dealing facilities, where dealers decide whether to use orders of individual investors to conduct cover deals with interbanks.

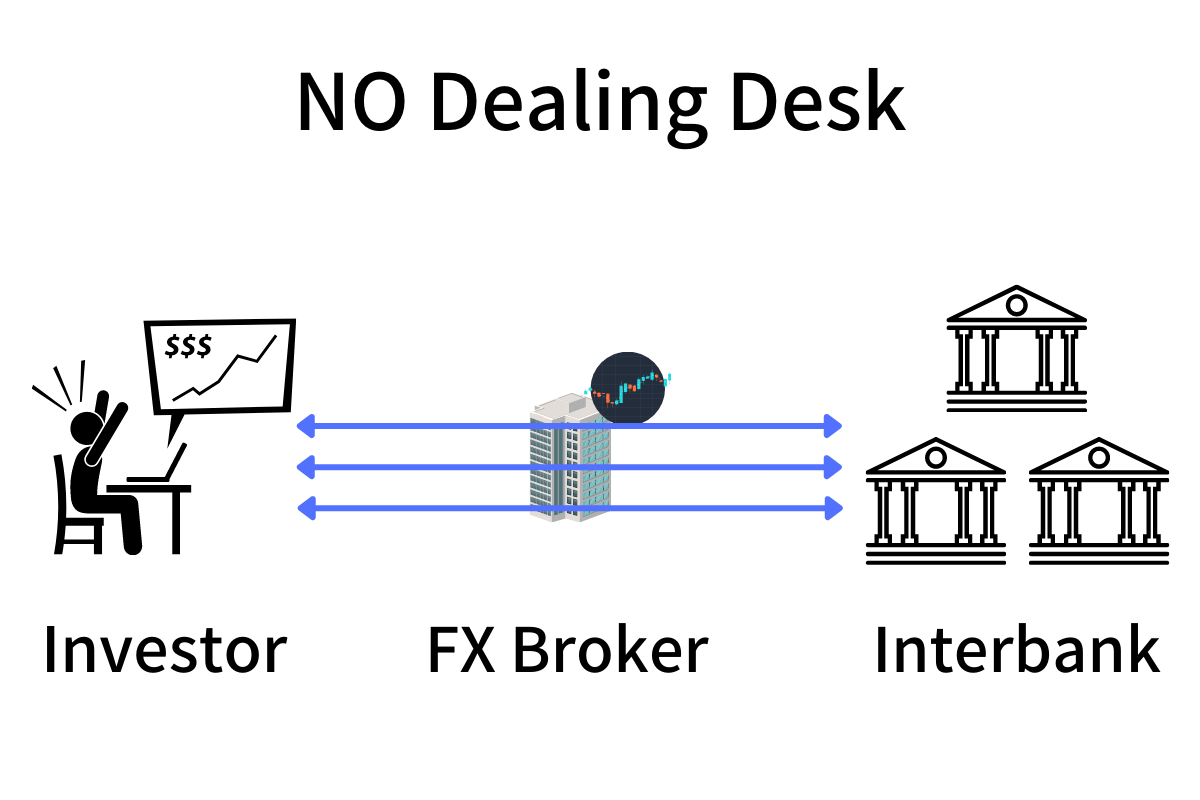

What is a No Dealing Desk?

In a No Dealing Desk method, there is no broker between individual investors and interbanks. Instead, interbanks directly conduct a cover deal with investors.

As any brokers are not intermediated, orders of individual investors directly go to interbanks.

Summary

Dealing Desk: Brokers serve as an intermediate between individual investors and interbanks.

No Dealing Desk: There is no broker between them. Instead, interbanks directly deal with investors.

Advantage and Disadvantage of Dealing Desk

Advantage of Dealing Desk

In a Dealing Desk method, investors can do transactions with low commission fee, or spread cost. As shown below, spread cost of brokers employing Dealing Desk is lower than that of Tradeview(*), which employs No Dealing Desk.

Comparison of Average Spread Cost in Main Currency Pairs

| Broker A | 0.85pips | Dealing Desk |

| Broker B | 0.87pips | Dealing Desk |

| Tradeview (ILC Account)

Inc. fees |

0.94pips | No Dealing Desk |

Details of brokers A and B shall be anonymized here.

(*) Tradeview’s spread cost is lower than other brokers employing a No Dealing Desk.

Disadvantage of Dealing Desk

Advantage of Dealing Desk, a lower spread cost, and its disadvantage are two sides of the same coin. To come right to the point, Dealing Desk may have less transparency in transactions as investors are placed at a weakened position.

As we have seen above, the most prominent difference between Dealing Desk and No Dealing Desk is the existence of a broker as an intermediate, and the former has it. The broker plays a role in deciding whether to let interbanks cover the orders of customers. It means that the broker can transact customers’ orders by themselves instead of transferring it to interbanks.

So what happens when the broker transacts orders of a customer? The customer has to do the trading at the rate designated by the broker.

When a customer places a buy order, his/her broker has a short position. It causes the conflict of interest between them as the customer’s profit can be the broker's loss, and vice versa.

Also, the broker can adjust the price offered by interbanks and then show its price to the customer who placed an order. It enables the broker to lower the spread cost and attract more would-be customers. That is why Dealing Desk brokers can employ a lower spread cost.

In other words, customers of a Dealing Desk broker do the transactions not on the basis of the market price but the one offered by the broker.

・As there is a conflict of interest between a customer and a broker, the customer's loss turns into the broker's profit.

・When the customer earns huge profits, the broker suffers huge losses, and vice versa.

・The broker can adjust the transaction rate.

・While Dealing Desk brokers are prospering, many traders are losing.

From the above standpoints, it cannot be denied that Dealing Desk customers are placed at a weakened position and forced to do unfavorable transactions. This is the main reason for lack of transparency in transactions. But please don’t misunderstand that all Dealing Desk brokers are bad.

Finally, Dealing Desk brokers usually employ the fixed spread because they tend to retain orders of investors instead of transferring them to interbanks and transact them at their own rate.

Advantage and Disadvantage of No Dealing Desk

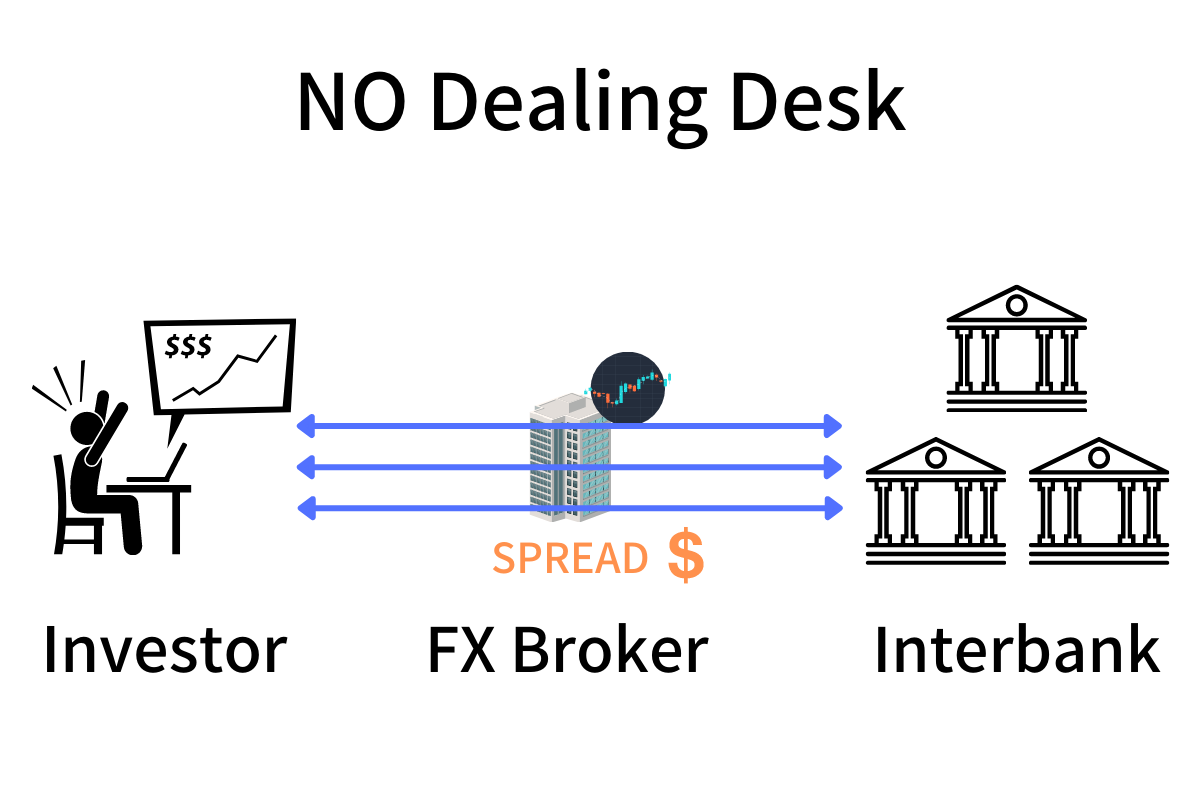

Advantage of No Dealing Desk

In contrast to Dealing Desk, No Dealing Desk brokers ensure transparency in transactions because all orders are directly sent to interbanks.

In this case, brokers play a role in only transferring their customers’ orders to interbanks. Brokers’ revenue is applied to the customer’s spread cost, or commission fee. As explained above, Brokers of Dealing Desk cannot earn revenue unless their customers lose money. But No Dealing Desk brokers care little about their customers’ results. Instead, they should pay attention to preparing the best and secured trading environment so that their customers can repeatedly do the transactions. There is no room for conflict of interest between customers and brokers.

Also, No Dealing Desk brokers usually employ variable spread because the slight gap of rates may arise during the transferring process of orders to interbanks.

Disadvantage of No Dealing Desk

In contrast to Dealing Desk, the spread cost employed by No Dealing Desk brokers is higher. But it is safe to say that the spread cost of Dealing Desk is too low.

Which has the edge?

You should choose No Dealing Desk brokers due to the following reasons;

・Transparency in transactions is ensured.

・Dealing Desk brokers do not hope for the success of their customers. If an investor earns huge profits via a Dealing Desk broker, the broker may freeze his/her account or deny the contract incomprehensible for the investor.

・Investors can put reliance on No Dealing Desk brokers for transactions.

・In comparison with Dealing Desk brokers, No Dealing Desk brokers employ wider spreads. But there is no worry about the manipulation of orders as made by a Dealing Desk broker and it is better to earn enough profits through the ensured transparent transaction.

Recommended No Dealing Desk Broker.

・XM (official site→)

・Tradeview (official site→)

・HotForex (Official Site →)