There are so many currency pairs that FX traders have difficulty choosing the pair to put their money on. This article introduces the volume of each currency. Then, it summarizes my trading performance using the indicator-responsive method and the relationship between the performance and the volume of currency pairs so that you can narrow down the choice of currency pairs.

[Summary of This Article]

- Overall daily volume in the FX market has increased from $5.1 trillion in 2016 to $6.6 trillion in 2019.

- The most traded currency (key currency) is the US dollar, followed by the euro and Japanese yen.

- EUR/USD, USD/JPY and USD/GBP are the top three currency

- EUR/USD is recommended as the main currency pair for trading.

[Why EUR/USD Is Recommended]

- As EUR/USD is the most traded currency pair in the FX market, a stable price movement can be expected.

- As many market players prefer this pair, the rate is likely to show the response to the leading indicators like pivot.

- As this pair has high liquidity, spread cost becomes lower.

(NOTE) This article is based on my personal view and experiences. I assume no responsibility whatsoever for any losses resulting from the reference of this article.

Contents

Survey of Volumes in FX Market

This section takes a look at the volumes in the FX market from Foreign Exchange Turnover in April 2019 by Bank for International Settlements (BIS).

https://www.bis.org/statistics/rpfx19_fx.pdf

About BIS

Founded in 1930, BIS is an organizing body for central banks and is headquartered in Basel, Switzerland. As of 2021, 63 central banks take part in it.

BIS official website

About This Report

This triennial report summarizes the total volume in the FX market, trading volume by country, and the share of currency pairs. The next version will be issued in 2022.

What This Report Tells Us

1. Overall Volume

Overall daily volume in the FX market has increased from USD 5.1 trillion in 2016 to USD 6.6 trillion in 2019.

The U.S. dollar was the most traded currency in 2019, followed by the euro and the Japanese yen. When it comes to the currency pair, EUR/USD, USD/JPY and USD/GBP are the top three currency pairs. USD/EUR accounted for 24.0 percent of overall daily FX trading in 2019 while USD/JPY is 13.2 percent and USD/GBP is 9.6 percent, respectively.

To be strict, EUR/USD and USD/JPY can be considered as major currency pairs. Anyway, pairs except above have lower volume and can be excluded from the major currency pair company.

EUR/USD has a high daily trading volume, which yields high liquidity and accordingly makes the spread narrow. High liquidity and narrow spread attract investors in the sense that they can trade on a large number of volumes while giving little impact on the market.

It would be good if you read this report and understand that USD is the most traded currency and EUR/USD is the most selected currency pair.

My Trade Performance Using Pivot as an Indicator-responsive Trading Method

In this section, we take a look at how the volume of each currency gave an impact on my trading performance.

In 2019, EUR/USD outperformed other pairs by using the trading logic that targets the rate’s response to the leading indicator “pivot”. I believe that this is related to the fact that this pair has the highest volume. Pivot lines are updated every day. In addition to the popularity of pivot, so many market players prefer USD/EUR that its rate shows the more recognized response to pivot than other pairs.

Before explaining my performance, let’s take a look at what pivot is.

Applicability of Pivot

What Is Pivot?

Many FX traders are aware of pivot because it can be used for the technical analysis to determine the settlement points for the entry, profit taking and loss cut.

For details of how pivot is calculated, please refer to the below article;

Related Articles

[PIVOT] How to Utilize Pivot for Technical Analysis

Features of Pivot

There are mainly two factors that pivot attracts more traders than other indicators;

Feature(1)

Pivot is calculated from the previous day's (previous week's or previous month's, depending on the timeframe of the chart) data using the specified formula. So traders around the world can share a common view.

By contrast, moving average line (MA) differs between traders as they are allowed to set different parameters. It holds true for the trend line and horizontal line as the discretion of each trader is reflected on the line.

Feature(2)

Since pivot displays pivot lines on the current chart based on the previous data, they can be drawn on the right side of the chart, meaning that the future movement can be predicted.

Most indicators analyze and visualize past price movements. So they can only analyze the past data.

How I Have Utilized Pivot

An overview of my trading method utilizing pivot except filters is detailed in the following page.

Related article:

[HotForex Custom Indicator] Introducing How to Utilize Pivot Points

(Since the applied filters are kept private, the trade results described below should be used only as a reference.)

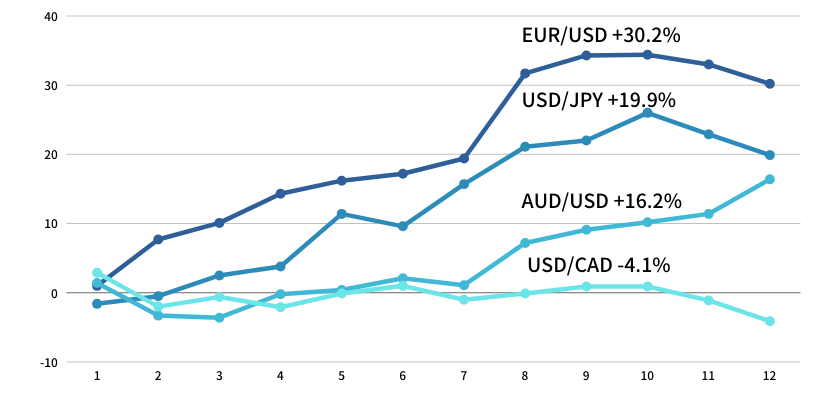

My Trade Performance by Currency Pair (2019)

EUR/USD:30.2 %

USD/JPY:19.9%

AUD/USD:16.2%

USD/CAD:-4.1%

My pivot logic worked quite well in 2019. Traders who had the trading logic of the response to the pivot point would have made a lot of money.

In contrast, this logic didn't work well in 2017. The performance may differ year by year. The performances of USD/JPY and AUD/USD have also switched places year by year. But my pivot logic has steadily generated profits with EUR/USD.

The above is just one example. However, when I used the trading logic aiming at aligning the settlement direction with others like the above indicator-responsive method, I could steadily make a profit with EUR/USD more than other pairs.

Conclusion

- Overall daily volume in the FX market has increased from $5.1 trillion in 2016 to $6.6 trillion in 2019.

- The most traded currency (key currency) is the US dollar, followed by the euro and Japanese yen.

- EUR/USD, USD/JPY and USD/GBP are the top three currency pairs.

- EUR/USD is recommended as the main currency pair for trading.

On this site, I would like to introduce practical information about FX trading. Please also refer to the below article;

Related Article:(Trade Column)

Thank you for sparing your time to read this article.