This article introduces the overview of cross order, including its advantage and disadvantage, as well as arbitrage.

< Summary of This Article>

What is cross order in FX?

- Holding both long and short positions in the same currency pair.

What is the disadvantage of cross order?

- Cross order is not recommended for beginners.

What is arbitrage?

- The cross order over the different accounts can be regarded as arbitrage.

- Some brokers which offer the bonus program like XM prohibit arbitrage.

Contents

What Is Cross Order in Forex?

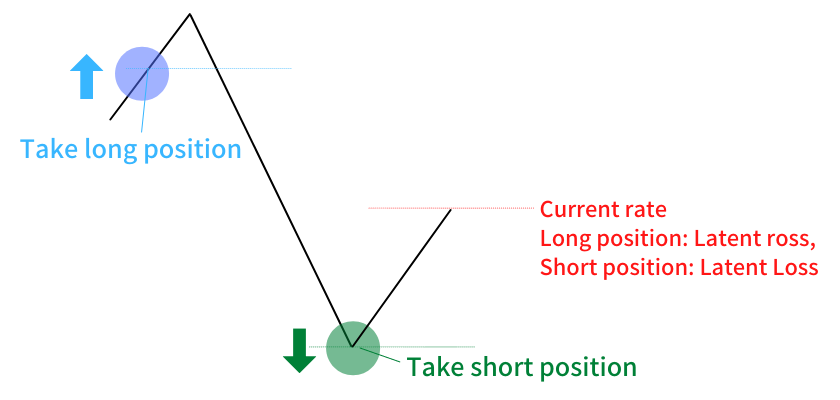

Cross order in FX is a trading method that holds both long and short positions in the same currency pair.

If both positions are held at the same time with the same lot size, the valuation profit and loss can be paused.

Most brokers allow the cross order in the same account. But some brokers disallow the cross order over the different accounts within the same broker or across multiple brokers, because it is regarded as a prohibited act of “arbitrage”, as explained below.

Permissibility of Cross Order

| Broker | Coverage Area | Cross Order

(same account) |

Cross Order

(different account |

Official Site |

| XM | Europe | Allowed | Disallowed | Official Site |

| XM | Asia | Allowed | Disallowed | Official Site |

| HotForex | Europe | Allowed | Disallowed | Official Site |

| HotForex | Asia | Allowed | Disallowed | Official Site |

| Tradeview | World | Allowed | Disallowed | Official Site |

First, we take a look at the cross order in the same account.

Advantage of Cross Order

Cross Order Gives An Opportunity to Earn Profits in Both Upward and Downward Phases

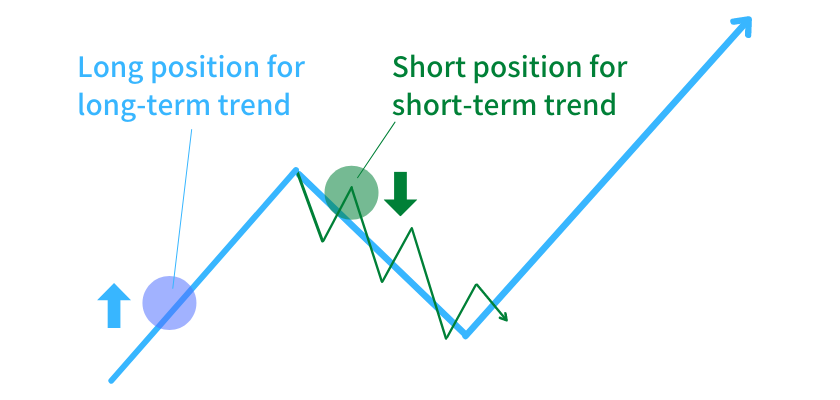

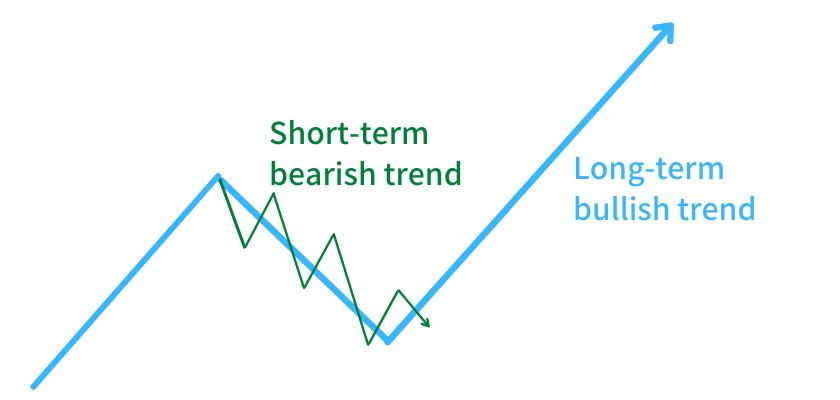

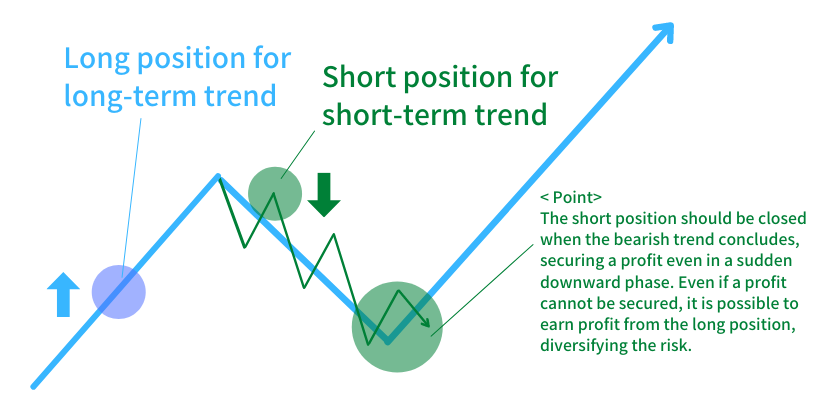

Cross order enables traders to have the opportunity to earn profits both in the long-term bullish (upward) phase and short-term bearish (downward) phase.

If you can implement a short position to follow a short-term bearish trend while holding a long position to follow a bullish upward trend, you can consider yourself as an advanced trader.

For example, a currency pair is thought to be steadily bullish in the long term. But when the unexpected situation triggers the temporal fall such as the covid shock, you should keep holding a long position and take a short position. In fact, some traders place a cross order like this to earn profits.

Disadvantages of Cross Order

Loss May Increase by Difference in Swap Point

When you move an open position to the following date (rollover), swap points are given. When the swap is positive, you can earn profits. But if it turns negative, you have to cover the difference in the swap point.

Spread Doubles

As cross order means you have two positions, you have to pay more spreads than when placing a normal order.

Cross Order Is Not Recommended for Beginners

Due to its risky feature, beginner FX traders should not conduct a cross order. This section introduces the case where the risk of cross order increases.

Decrease in Margin Triggered by Cross Order

When a cross order is placed amid the huge unrealized losses under the name of risk diversification, the risk of cross order increases.

The above figure shows the typical case where the risk increases.

First, it is important to have enough money to place a cross order. If an unexpected fluctuation causes the loss but there is sufficient money to cover it, it is no problem to place a cross order. But placing a cross order means the decrease in margin and the increase in the possibility of loss cut. In a typical case where a loss cut is about to be executed, the trader has incurred the latent losses arising from both long and short positions.

Arbitrage

As mentioned above, some brokers prohibit a cross order using different accounts.

Such a method can be regarded as arbitrage. This section introduces the arbitrage taking advantage of the bonus.

This section intends to introduce what can be regarded as a prohibited activity so that you can avoid it beforehand. In some cases, traders tend to unknowingly commit an arbitrage and later are pointed out that the latest trade is a prohibited act. So do not mimic this activity.

What Is Arbitrage?

Generally, arbitrage is referred to as “a practice of taking advantage of a difference in prices in two currencies to earn profits.” In other words, arbitrage is “a trading method that eliminates the risk of exchange loss and makes a profit.” In theory, arbitrage can bring profit. But many brokers prohibit it as a fowl.

When arbitrage comes to light, the trader is penalized as the account is frozen or the earned profit is nullified.

Related Article

【Arbitrage】 Prohibited Acts as Arbitrage

Arbitrage Taking Advantage of Bonus

[NOTE] THE FOLLOWING ACT IS PROHIBITED. The following explanation is just a reminder.

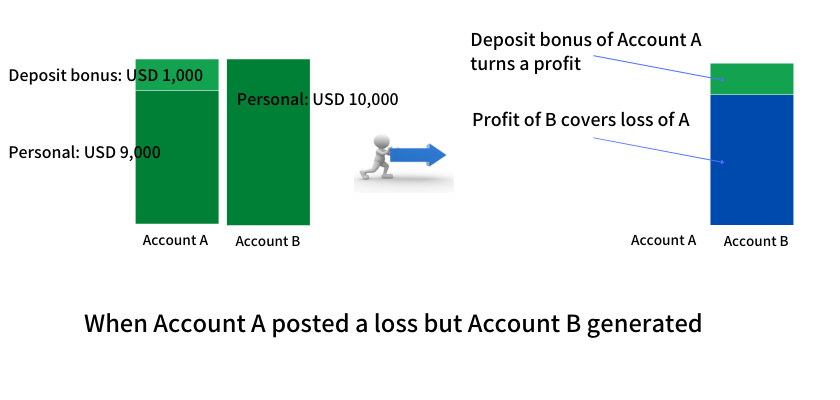

1) Take advantage of the deposit bonus and use two different accounts (account A and account B)

2) Adjust the balance of each account as follows;

Account A: USD 1,000 as a deposit bonus + personally-owned USD 9,000

Account B: USD 0 as a deposit bonus + personally-owned USD 10,000

3) Place offsetting orders as A is used for a long position and B is used for a short position

(this falls under the cross order using the different accounts, which is prohibited by XM and HotForex).

4) The order of A posts a loss while the order of B generates enough profit to fill the loss. However, as the balance of A includes the bonus, the profit of B virtually surpasses the loss of A. The profit-and-loss margin turns plus.

You may think that this is an unforgivable act. Yes, you are right. That is why some brokers such as XM prohibit arbitrage.

For details of the arbitrage, please refer to the following article as well.

Related Article:

[FYI] XM Deposit Bonus

If you want to take advantage of the deposit bonus, XM is the way to go. The applicability of the bonus program depends on the trader's country of residence.

[XM] A List of XM Group Companies, Coverage Area, and Features of Each Company.

For more information about XM's deposit bonus, please visit the official website.

XM ( XM Global Limited ) Official Site →

Conclusion

What is cross order in FX?

- Holding both long and short positions in the same currency pair.

What is the disadvantage of cross order?

- Cross order is not recommended for beginners.

What is arbitrage?

- The cross order over the different accounts can be regarded as arbitrage.

- Some brokers which offer the bonus program like XM prohibit arbitrage.

As mentioned above, beginners of FX traders should avoid cross order. Also, the cross order intended for risk avoidance does not work well. A successful example accidentally emerges when a trader placed a cross order just by obediently reacting to the entry chance.”

It would be good if this article is helpful to your trading strategy. Thank you very much for sparing your time to reading this article.