This article introduces "averaging," an FX trading technique.

In forex, averaging lowers the breakeven point by adding a new position to the existing position when the market moves against the anticipation. Traders can accumulate profit when the market fluctuates. But if the market goes in only one direction, traders can suffer huge losses. Although considered a "forbidden" or "high-risk" technique, it is also true that many successful traders utilize averaging. This article focuses on the overview of averaging and how successful traders utilize it.

[Summary]

- Averaging lowers the breakeven point by increasing position.

- Lowering the breakpoint can increase the possibility of gaining more profits but the risk of suffering huge losses.

- Averaging requires the trading skills sufficient to recognize the support line, which may result in the rebound, and the ability to manage the fund by controlling the loss.

Contents

What Is Averaging?

In forex, averaging lowers the breakeven point (where the assessed value of position becomes positive or negative) by adding position to the existing position when the market moves against the anticipation. The breakeven point can be calculated below, although there is a margin of error depending on the spread and swap.

Breakeven point = Entry price * number of lots / overall number of lots

Breakeven Point without Averaging

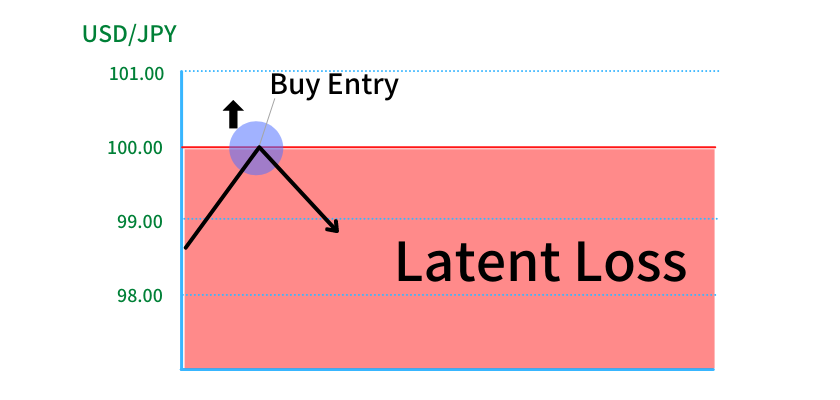

If a trader buys 1 lot at JPY 100.00 to a dollar, the breakeven point can be calculated as follows:

(JPY 100.00 * 1 lot) / 1 lot = JPY 100.00

If the market goes above JPY 100.00, the trader gains latent profit. Meanwhile, the trader suffers latent loss as long as the market stays below JPY 100.00.

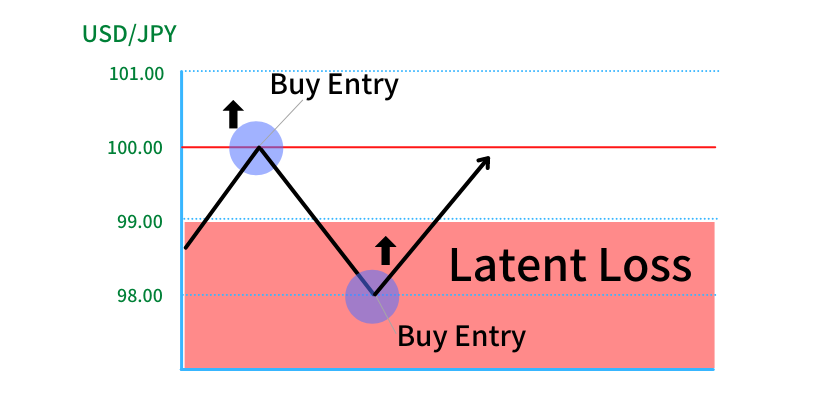

Breakeven Point with Averaging

As shown below, averaging can lower the breakeven point by increasing positions when the market moves against the anticipation.

If a trader bought 1 lot at JPY 100.00 to a dollar and then bought another lot at JPY 98.00 to a dollar, breakeven point can be calculated as follows:

{(JPY 100.00 * 1 lot) + (JPY 98.00 * 1 lot)} / 2 lots = JPY 99.00

If the market goes above JPY 99.00, the trader gains latent profit. Meanwhile, the trader suffers latent loss as long as the rate stays below JPY 99.00.

FYI, if the trader adds 10 lots at JPY 98.00 to a dollar, the breakeven point moves to JPY 98.20, as calculated below.

{(JPY 100.00 * 1 lot) + (JPY 98.00 * 10 lots)} / 11 lots = JPY 98.20

Advantage of Averaging

There are two advantages of averaging.

- Averaging can lower the breakeven point

- Averaging can increase profit

(1) Averaging can lower the breakeven point

Suppose that a trader tries to utilize a bull market to buy in dip using an hourly chart. The trader has a latent loss unless the market goes above the initial entry price.

Source: XM, USD/JPY (hourly)

XM Official Website (Outside Europe)

If the market goes down further than expected and the trader decides to buy in dip for averaging, the trader can decrease the latent loss.

(2) Averaging can increase profit

If the market goes above the breakeven point, which was lowered by the averaging, the trader can earn profits from the original position, increasing the total profit. Thus, averaging can increase profit, as well as decrease loss.

Disadvantage of Averaging

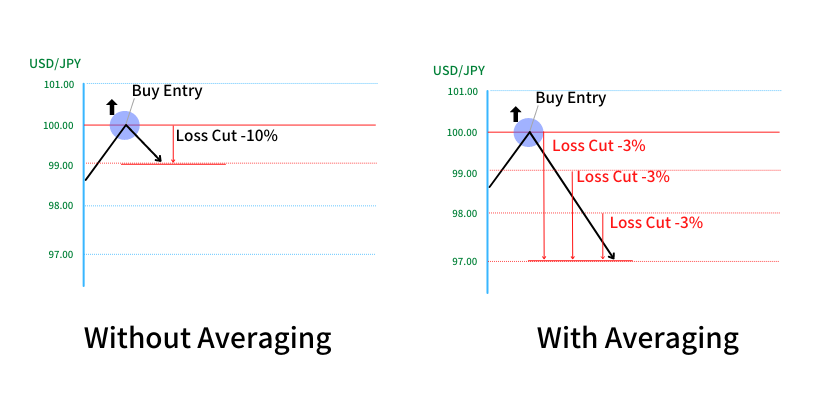

Averaging can increase loss if the market breaks out

If a trader averages down but the market breaks out further, the trader suffers a huger loss. This mistake has been typical for many FX traders who go bankrupt. Traders are inclined to average down more when the market continues to fall, resulting in more losses than when they keep one position. In that sense, averaging is a high-risk strategy.

Required Skills to Succeed in Averaging

To succeed in averaging, traders should have the following skills.

- Have sufficient trading skills

- Have adequate fund management skills

(1) Have sufficient trading skills

This means "Have the ability to recognize the support line resulting in the rebound." As mentioned above, averaging brings a huge loss when the market falls beneath the price the trader averaged down. So, it is required to determine the price level where a functional support line is located.

How to Determine Functional Support Line

Briefly, the following elements are key to determining the functional support line.

- See the line confirmed functional on a long-term chart (at least a four-hour chart)

- Use pivot to understand at what level most traders focus on

1.See the line confirmed functional on a long-term chart

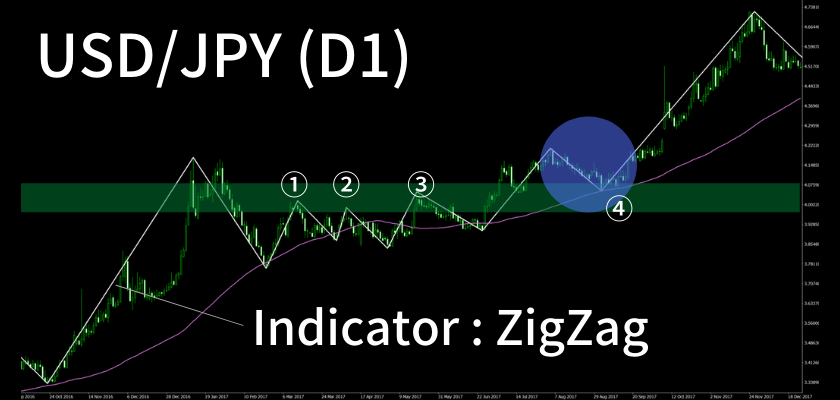

On this daily chart of USD/JPY, the market hits the resistance line, which can be drawn around (1), (2) and (3). After breaking the line, the market dips temporarily (highlighted with a blue circle). Then, the market tries to rebound at (4). If the support line can be confirmed functional with the daily chart, you should use the shorter-term chart, such as 15-minute and hourly charts, to decide to average down.

FYI, it is difficult to determine which price level many traders are aware of. The indicator ZigZag draws a line between highs and lows, as shown above. XM, HotForex and Tradeview offer MT4, which supports this indicator.

Related article: 【Effective Indicator】 Overview of ZigZag and How to Utilize It

2.Use pivot to understand at what level most traders focus on

In the bear market, many traders depend on the daily chart's pivot reversal to decide to hold a short position. Pivot outmatches other indicators because the leading indicator shows the line toward the future. It makes traders possible to align orders with other traders using pivot and EAs that incorporate it in their settlement rules.

Details on pivot can be found below.

Related article:【PIVOT】 How to Utilize Pivot for Technical Analysis

Pivot is available for free at HotForex, where you can also learn how to use pivot for day-trading.

Related Article:【HotForex Custom Indicator】 Introducing How to Utilize Pivot Points

Averaging requires the well-founded reasoning given by support and resistance lines and indicators to decide to make an entry. It is dangerous to ignore the long-term trend and/or rely on the less-founded reasoning for averaging as it results in huge losses.

(2) Have adequate fund management skills

When it comes to fund management, it is important to control the percentage of loss that triggers the loss cut. Some may think that there are some special fund management methods for averaging. But there is no such thing.

It is recommended to set the number of averaging to be conducted and the acceptable amount of loss per trade, and then adjust the lot size.

How to calculate lot size

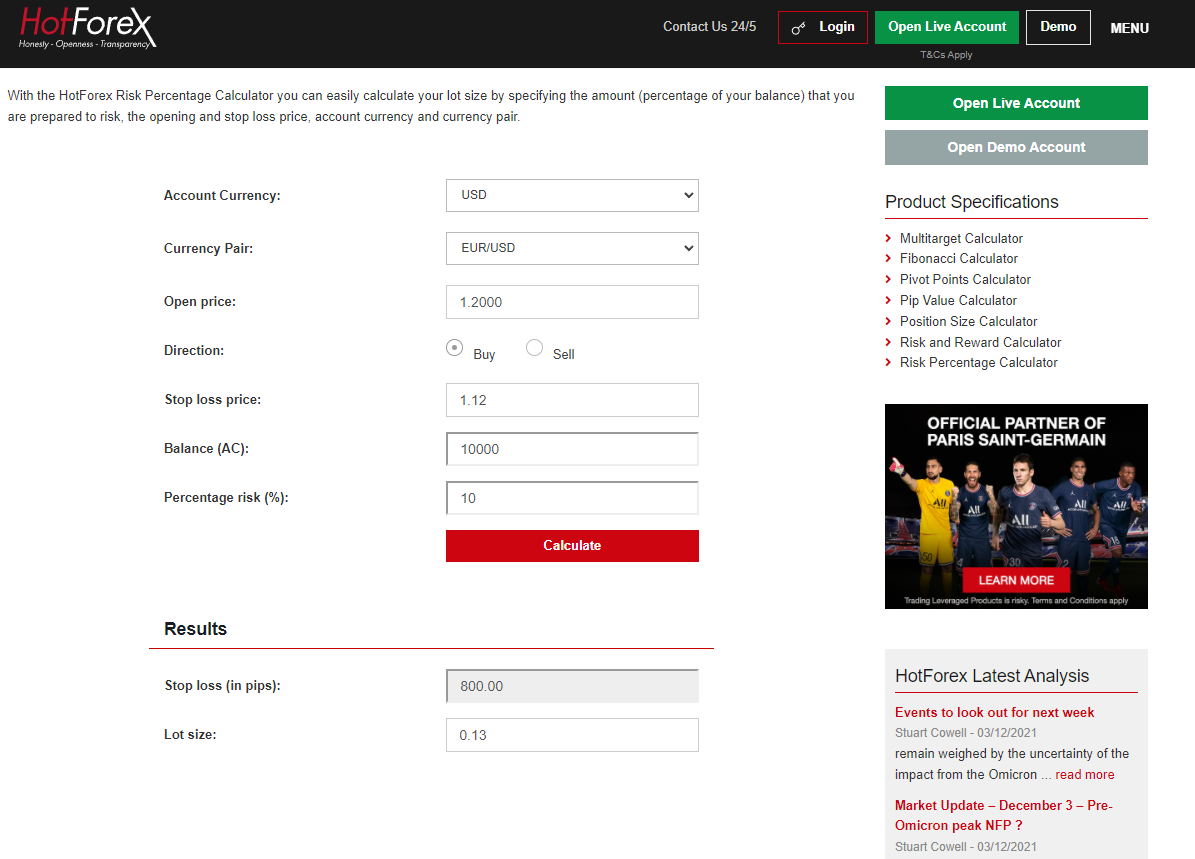

To calculate the lot size in accordance with the balance of margin, use HotForex's Risk Percentage Calculator. The free-of-charge tool calculates the lot size per trading in accordance with the acceptable percentage of loss.

For example, when calculating the lot size with the acceptable percentage of risk as 10% of the investment value should the loss cut be triggered at 1.1200 (800 pips below the entry rate), the lot size to be invested in should be 0.13 lot (13,000 currencies).

Account Currency: USD

Trading Currency Pair: EUR/USD

Entry rate: 1.2000

Direction: Buy

Stop loss price: 1.1200

Balance (amount of margin): 10,000

Percentage risk (%): 10

HotForex Official Website [Risk Percentage Calculator]

Conclusion

- Averaging lowers the breakeven point by increasing position.

- Lowering the breakpoint can increase the possibility of gaining more profits but the risk of suffering huge losses.

- Averaging requires the trading skills sufficient to recognize the support line, which may result in the rebound, and the ability to manage the fund by controlling the loss.

Because of the high risk involved, averaging is considered an advanced technique. However, it is very helpful as it can lower the breakeven point and increase profits. Many successful traders have mastered the use of averaging. If you are interested in it, it is worth learning this technique to utilize it for actual trading.

Information on Best Broker by country

This site also introduces the best broker(s) for each trader's country of residence.

【Popular Broker】 Well-reputed FX Broker by Country

Just select your country, and you will be able to find a list of the best broker(s) operating in your country. I hope this will be also helpful to find the best broker for you.