This article introduces how to place an order through MetaTrader 4 (MT4), which provides two methods to place an order, market order and pending order.

Without any difficulties, MT4 enables you to;

・make an entry via a market order and close via a pending order, or

・make an entry via a pending order and close via a market order.

Also, it is required to set “Limit” and “Stop” to place a pending order. However, beginners may be unsure of them.

So, this article introduces the details of each ordering method so that you can solve the problems regarding the order procedures.

<Summary of This Article>

Order Management Window of MT4

What Are Bid and Ask?

Market Order (Market Execution)

Pending Order

What Are “Limit” and “Stop”?

“Buy Stop Limit” and “Sell Stop Limit”

“Buy Limit” and “Buy Stop Limit”

Contents

Order Management Window of MT4

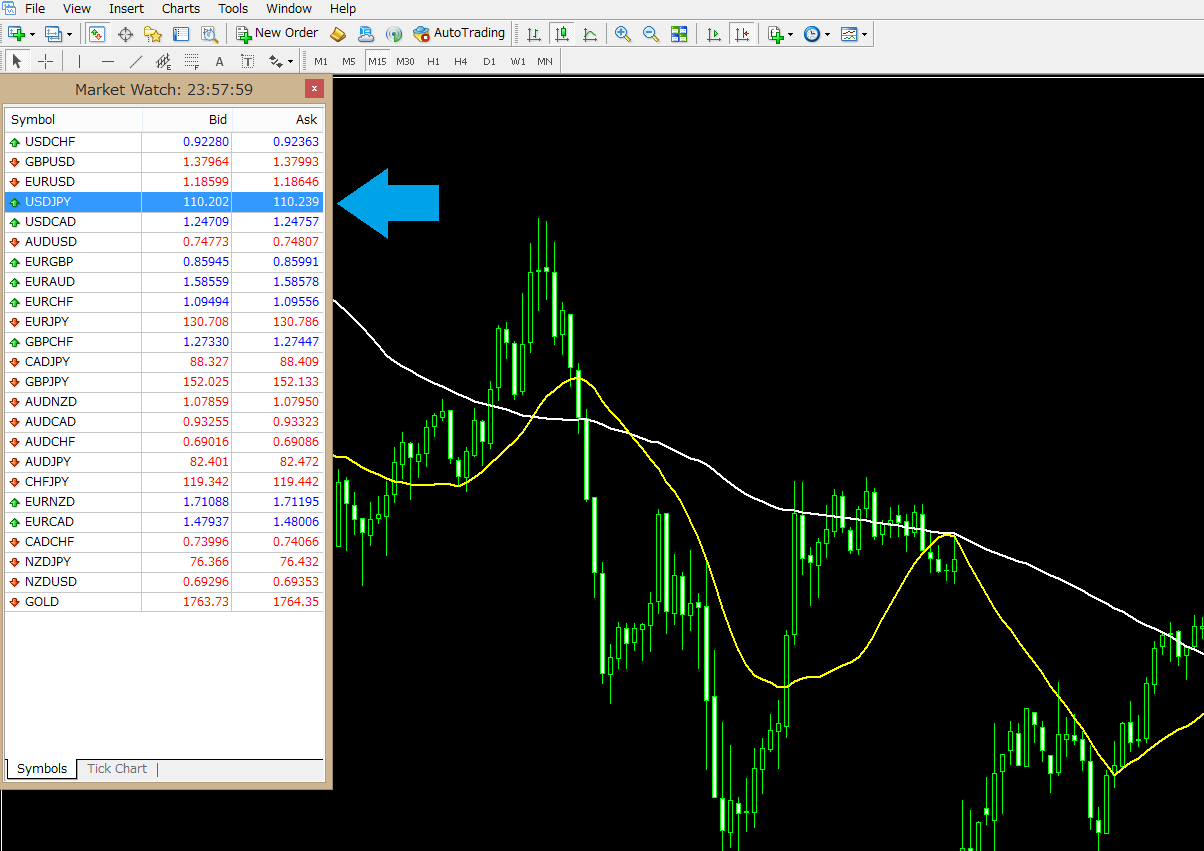

First, we take a look at how to display the order management window of MT4.

Method 1:

On the chart window, proceed to [View] > [Market Watch] to find the appropriate currency pair and double-click it for order.

Method 2:

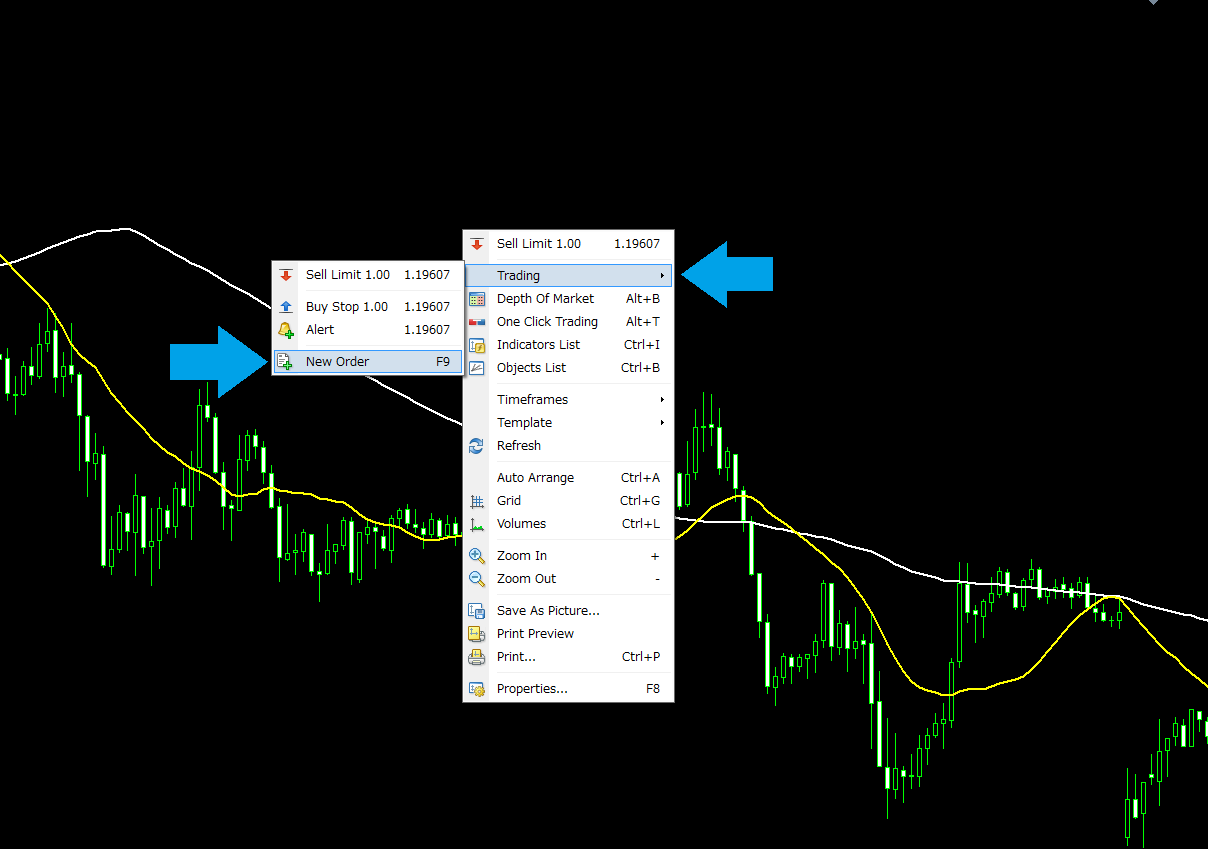

Display the chart of the appropriate currency pair and right-click to proceed to [Trading] > [New Order].

There are multiple ways to display the order management window, but in either way, the following window will appear, where you place an order.

(Chart: Tradeview’s ILC Account)

What Are Bid and Ask?

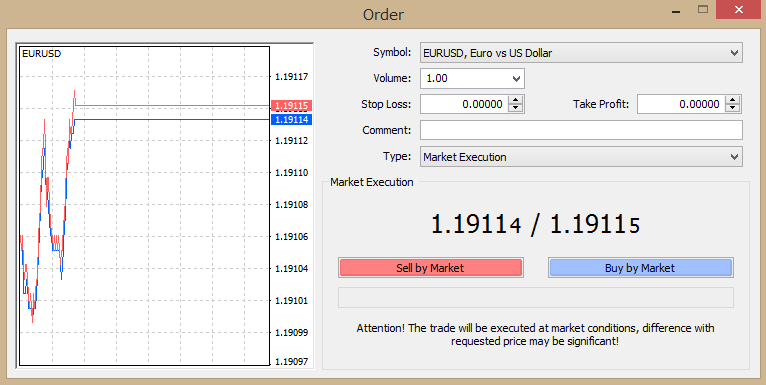

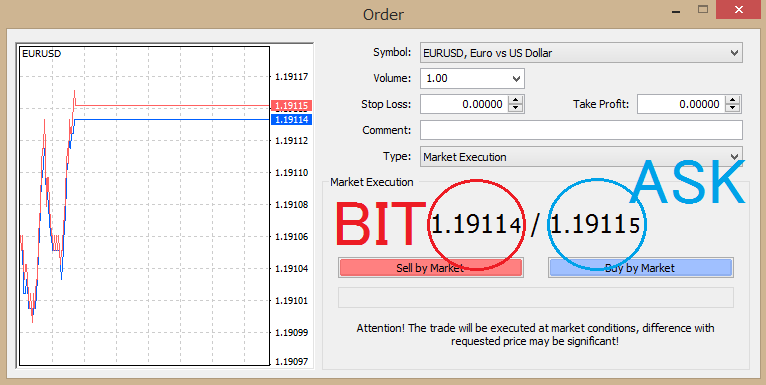

The order management window shows two types of prices, bid and ask.

(Chart: Tradeview’s ILC Account)

“Ask” is the price a trader uses to place a buy order.

“Bid” is, meanwhile, the one used to place a sell order.

The difference between them is called “spread”, in other words, a commission borne by a trader when placing an order and a source of revenue for a broker.

In the above case, spread can be calculated as follows;

1.19115 - 1.19114=0.00001=0.1pips (Tradeview’s ILC Account)

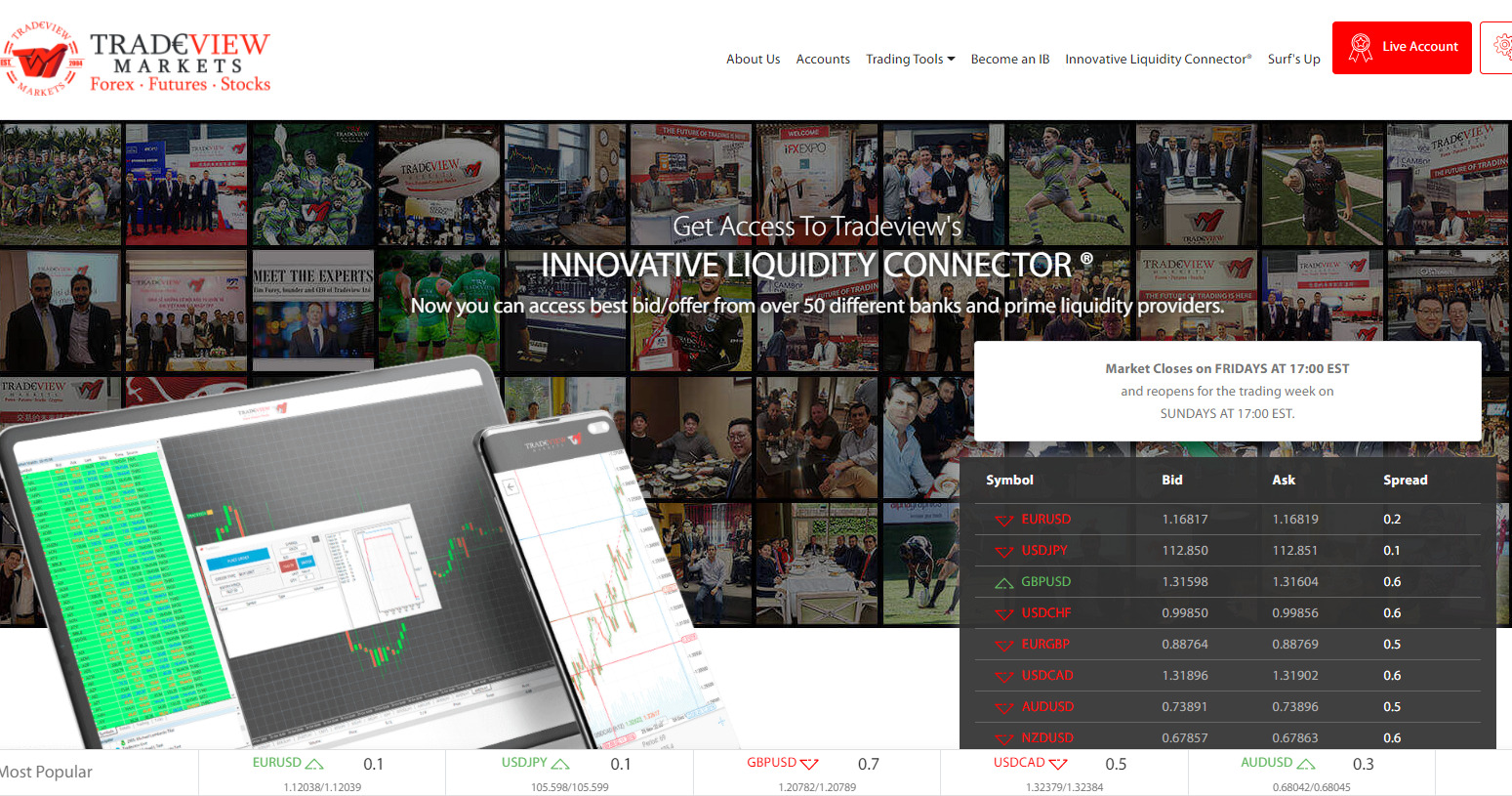

FYI, this explanation is based on Tradeview’s ILC Account.

This account provides one of the lowest spreads among FX brokers.

If you want to keep costs low, please refer to the following article.

Related Article:【ECN】 Differences between ECN Account and STP Account

Tradeview Official Site → https://www.tradeviewforex.com/

Market Order (Market Execution)

Market order (“Market Execution” in MT4) is an ordering method on the basis of the market price at the time of ordering.

Market order is widely used among trend-following traders like day traders, who watch the price movement to determine the trading style and then make an entry, or scalping traders, who need to repeatedly make an instantaneous entry and close in reference to a chart.

How to Place a Market Order (Market Execution)

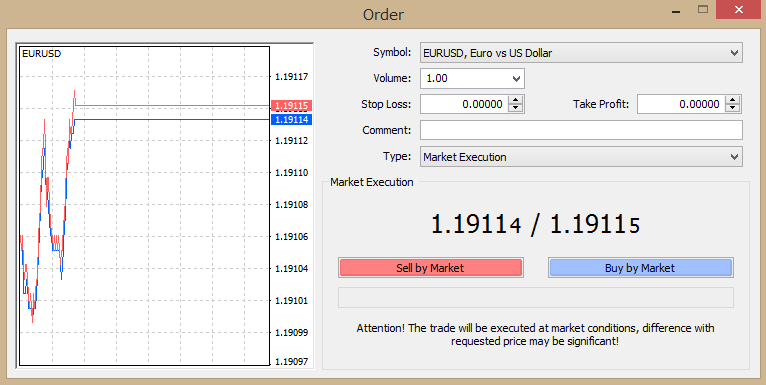

・Symbol

Choose the appropriate currency pair.

・Volume

Input the lot size, or a trading volume. 1 lot is generally equivalent to 100,000 currencies, although some brokers employ a rate of 1:10,000 currencies.

・Stop Loss / Take Profit

When placing a market order, you can predetermine the lines to make a stop loss and take profit. This setting can be omitted.

・Type

Select “Market Execution” to place a market order.

After completing the above input and selection, click “Sell by Market” or “Buy by Market” to execute your order.

Pending Order

You can place a pending order via MT4 and MT5.

<What can be set in “Pending Order”?>

・Price where you want to make an entry: When the market reaches the price, the predetermined order is automatically executed.

・Lines where stop loss and profit-taking should be made

・Deadline by which your order should be executed

<Available only in MT5>

・You can predetermine a price where your pending order should be executed (explained later).

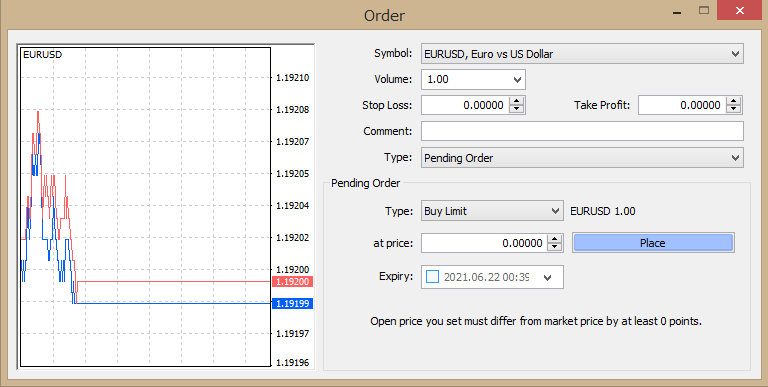

How to Place a Pending Order (ex: Buy Limit Order)

・Symbol

Choose the appropriate currency pair.

・Volume

Input the lot size. 1 lot is generally equivalent to 100,000 currencies, although some brokers employ a rate of 1 lot = 10,000 currencies.

・Stop Loss / Take Profit

When placing a pending order, you can predetermine the lines to make a stop loss and take a profit. This setting can be omitted.

・Type

Select “Pending Order” to display the detailed options of “Pending Order” below.

[Pending Order option]

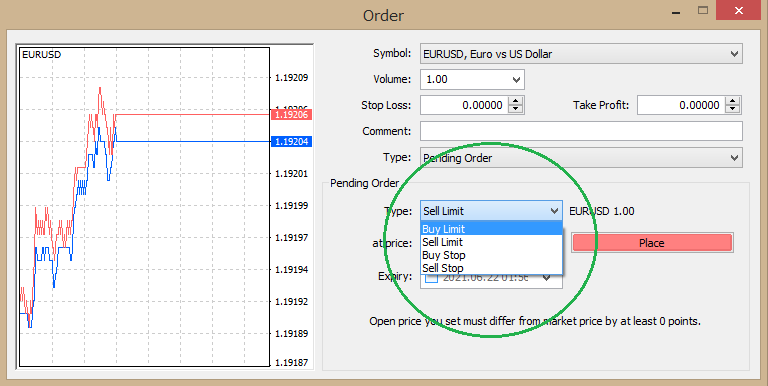

・Type

Choose one from “Buy Limit”, “Sell Limit”, “Buy Stop” or “Sell Stop”. Details of them will be explained later. In addition to them, MT5 has the options of “Buy Stop Limit” and “Sell Stop Limit”.

・At Price

Input the price where you want to make an entry.

・Expiry

Set the expiration time of your pending order.

・Place

Fix your pending order.

What Are “Limit” and “Stop”?

MetaTrader provides four types of pending orders. Here, we take a look at each ordering type.

Overview

・“Buy Limit” enables you to make a buy entry at a price lower than the current price.

・“Sell Limit” enables you to make a sell entry at a price higher than the current price.

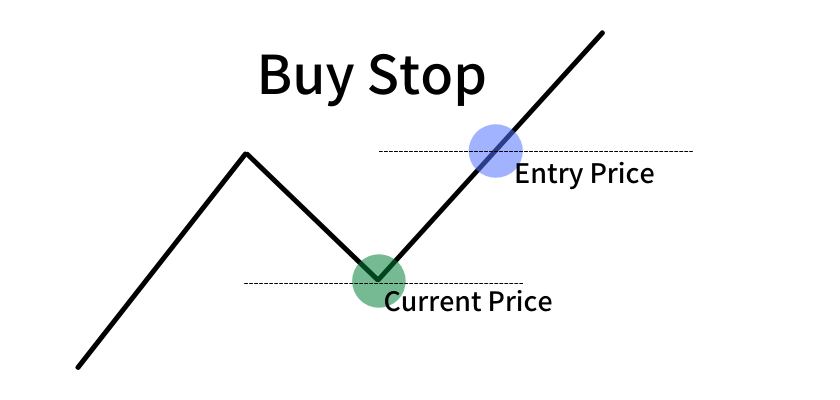

・“Buy Stop” enables you to make a buy entry at a price higher than the current price.

・“Sell Stop” enables you to make a sell entry at a price lower than the current price.

Buy Limit

“Buy Limit” enables you to make a buy entry at a price below the current price.

“Limit order” means that you can conduct a transaction at a favorable price.

If you want to make a buy entry, it must be favorable to you to purchase at a price as low as possible.

That is why this type of pending order is called “Buy Limit”.

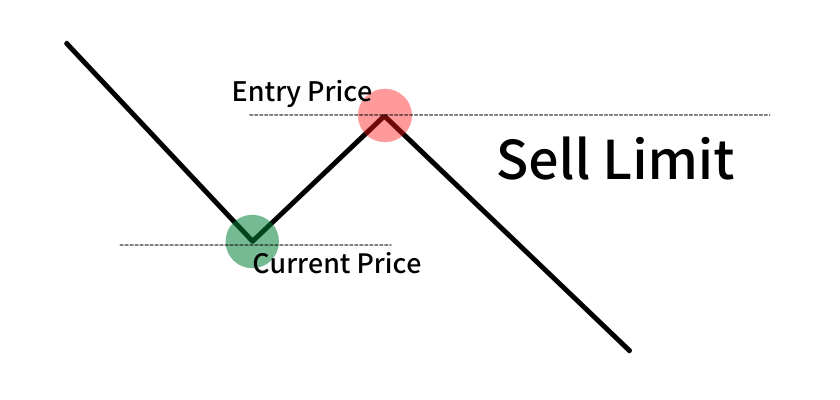

Sell Limit

In contrast, “sell Limit” enables you to make a sell entry at a price above the current price.

Buy Stop

“Buy Stop” enables you to make a buy entry at a price above the current price.

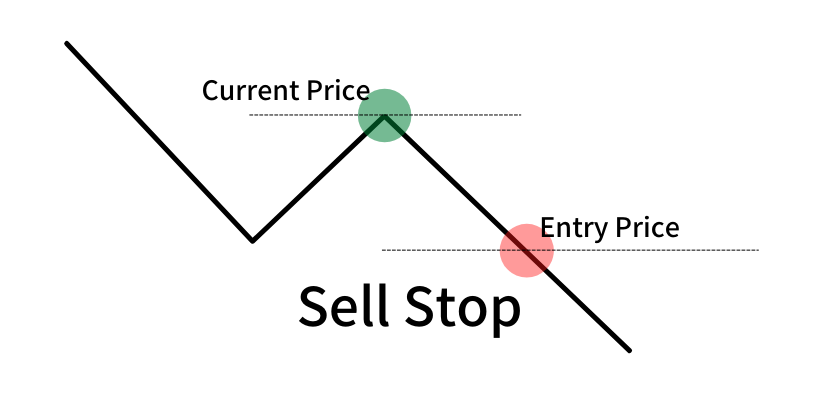

Sell Stop

“Sell Stop” enables you to make a sell entry at a price below the current price.

Failure of Order Execution

Pending orders sometimes fail to be executed due to some errors. Please check below if you encounter an error, although the conditions of No.2 and No.3 differ between brokers.

①A trader wrongly selects a type of pending order.

②The entry price is too close to the current price.

③The prices of TP (take profit) and SL (stop loss) are too close to the entry price.

“Buy Stop Limit” And “Sell Stop Limit”

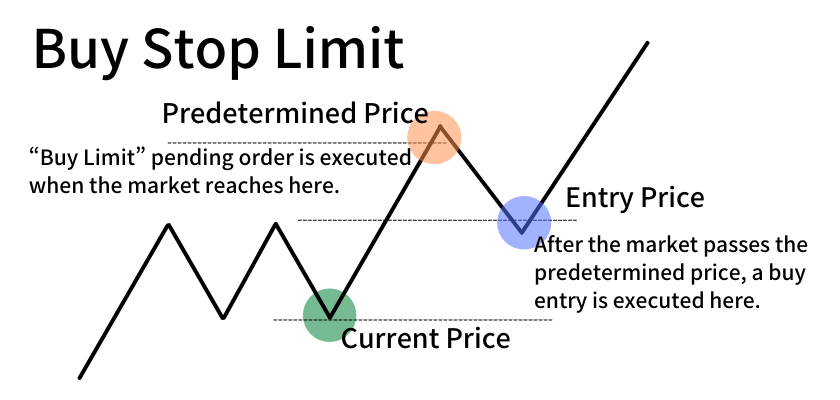

In addition to the above ordering types, MT5 has the options of “Buy Stop Limit” and “Sell Stop Limit”. Here, we take a look at them.

・“Buy Stop Limit” enables you to predetermine a price where a buy limit order should be executed.

・“Sell Stop Limit”, in contrast, enables you to predetermine a price where a sell limit order should be executed.

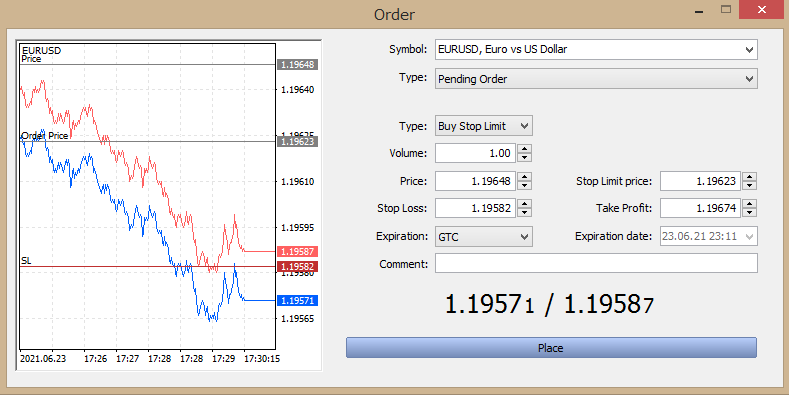

How to Place a “Buy Stop Limit” Order

Price

Specify the price where your buy limit order should be executed.

Stop Limit Price

Specify the price where your buy entry should be made.

Stop Loss / Take Profit

Specify the prices to make a stop loss and take profit.

Expiration

Specify the expiration time of your pending order.

Conditions of “Price” and “Stop Limit Price” differ between brokers as they usually set the minimum width of pips from the price at the time of ordering.

“Buy Limit” and “Buy Stop Limit”

“Buy Limit” enables you to make a buy entry at a price lower than the current price. “

Meanwhile, “Buy Stop Limit” enables you to predetermine a price where a buy limit order should be executed.

Procedures of “Buy Stop Limit” have one step more than “Buy Limit” as it is required to predetermine a price where a buy limit order should be executed. Accordingly, “Buy Stop Limit” is more challenging for traders than “Buy Limit”.

It seems that many traders use market execution and/or either of pending orders while a limited number of traders use “Buy Stop Limit” and “Sell Stop Limit”. This is probably because, when it comes to predetermining the price for execution, many traders put importance on the processes that the market reaches there, such as the time required and the width of price movement, as well as whether the market reaches there. If so, traders prefer to check the chart frequently over predetermining a price so that they can improve their performance.

That concludes this article. It will be good for you to try various ordering methods.