This article introduces my personal view as an active trader about the advantages and disadvantages of FX trading to those who want to start FX trading but also want to know its advantages and disadvantages beforehand.

I think that the advantages of FX trading outweigh its disadvantages. Therefore, I will continue to earn money as an FX trader. I hope this article will be helpful to you.

(Profile of webmaster can be seen here. → )

<Advantages>

- You are able to make significantly huge money (thanks to leverage).

- You are free to choose the residence and work location.

- You are able to continue to make money free of times if you acquire trading skills.

- There is a low running cost.

<Disadvantages>

- There is a possibility that your money decreases.

- The more money you have, the more advantageous to you it is.

- The result of trading depends on the market.

Contents

- 1 Advantages of FX Trading

- 2 Disadvantages of FX trading

Advantages of FX Trading

①You are able to make significantly huge money (thanks to leverage).

Provided that you make money by yourself, FX trading is thought to be more efficient than any other businesses when it comes to driving earnings growth. Leverage contributes to it.

Leverage is a ratio that allows you to do trading with the given times more than the deposited money. The most notable feature of FX is that you can multiply funds for investment by applying leverage on margin. This can help increase money more efficiently than other finance commodities.

Let’s look at the difference of revenue when a trader with USD 10,000 for the investment applies leverage on it or does not do it.

<Without leverage>

Rate: USD 1.15000 to the Euro

Purchased EUR 8,695 using his USD 10,000 with 1:1 leverage ratio

(Calculation for leverage: EUR 8,695 x USD 1.15 ÷ USD 10,000 ≒ 1.0)

When EUR-USD market moves from USD 1.15000 to 1.14000,

Revenue: USD 86.95

(Calculation for revenue: EUR 8.695 x USD 1.15 - EUR 8.695 x USD 1.14 = USD 86.95)

<With leverage 1:100>

Rate: USD 1.15000 to the Euro

Purchased EUR 869,500 using his USD 10,000 with 100:1 leverage ratio

(Calculation for leverage: EUR 869,500 x USD 1.15 ÷ USD 10,000 ≒ 100)

When EUR-USD market moves from USD 1.15000 to 1.14000,

Revenue: USD 8,695.00

(Calculation for revenue: EUR 869,500 x USD 1.15 - EUR 869,500 x USD 1.14 = USD 8,695)

Although the above example is based on conducting the same trading with the same amount of money on each case, it shows that applying the leverage makes a difference on the revenue.

Many businesses do not have a leverage model like this. So those who have USD 10,000 have to invest within the range of his/her funds. Sure, there is a case that the funds can be multiplied through the financing such as borrowing money from banks. But quite a few traders are allowed to do it, and it requires a lot of work.

In FX trading, any trader is allowed to multiply the funds through leverage. As it is the most significant advantage, some FX traders can earn a stunning amount of money thanks to leverage.

②You are free to choose the residence and work location.

You can do FX trading as long as you have a PC and internet access. So you can earn money wherever you live and work.

Some of my friends stay holed up in their trading rooms. Others go to their favorite cafes with a laptop PC. Although their lifestyles are different, they share similarities with doing FX trading by analyzing a chart to repeatedly enter the market and make a settlement.

Also, this kind of feature will enable you to make FX trading a side business. I am an office worker as a main job and making money on the side. I feel that more and more people are recently doing FX trading as their side business.

③You are able to continue to make money free of times if you acquire trading skills.

The essence of foreign exchange market is the balance between supply and demand. The balance is dependent on the public mind. When many people buy a certain currency, its price goes up, while they sell it, the price goes down. The balance between supply and demand is shown on the wave chart.

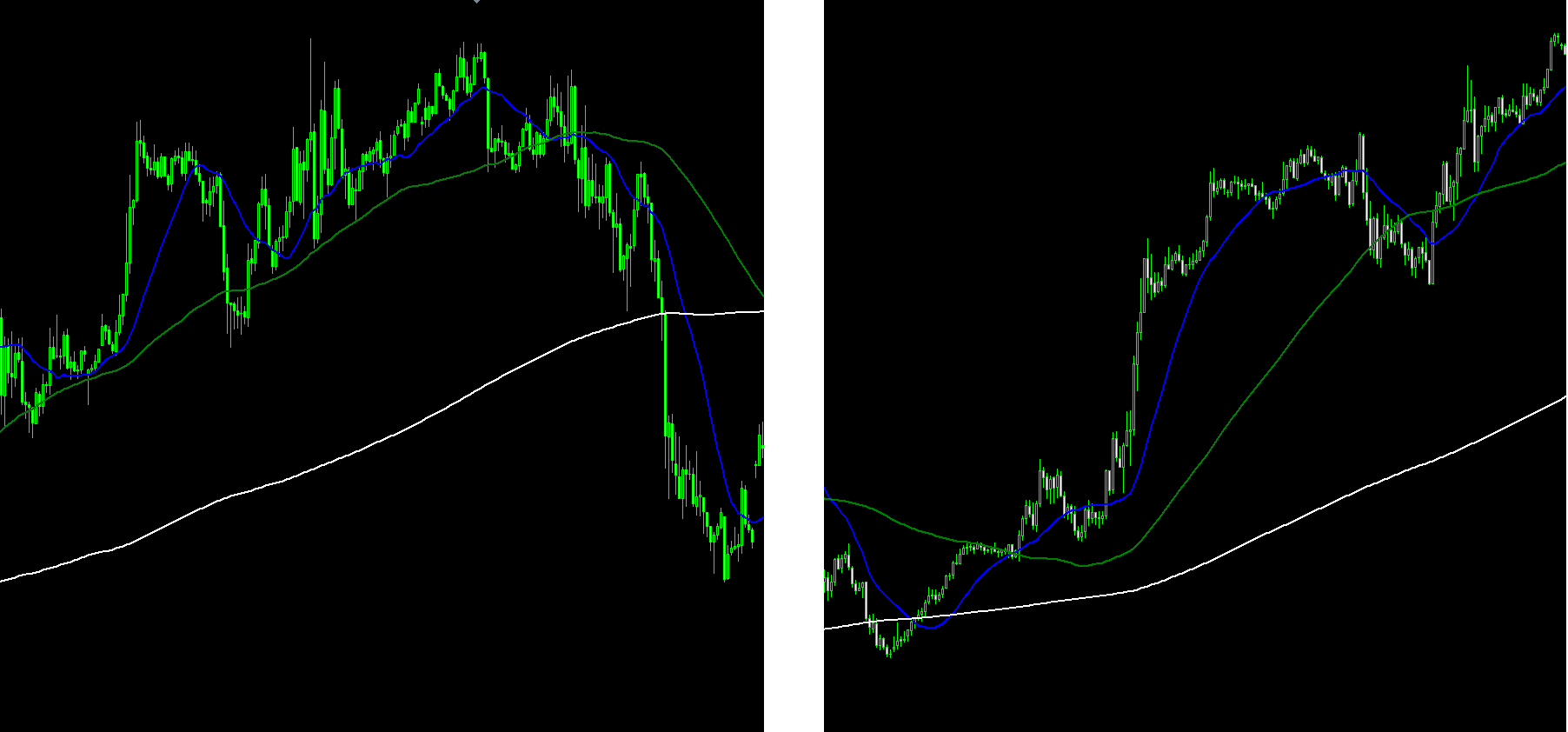

Chart

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

The pictures above are a part of charts in 2010 and 2020. Both show that various sizes of waves appeared and disappeared. No one would guess which chart is the one of either year.

If you look at a part of the chart, it looks rule less. However, there is certain regularity. Variety of regularities have been theorized and spread to many traders. For example, Dow Theory has been popular among traders for more than a century. It means that the theory has worked well for a long time.

The past chart cannot be reproduced now and in the future. But the market repeats itself. Those who can analyze the chart are able to earn money regardless of the market. Although the times have been changing, once you can acquire the trading styles, you can continue to do the same methods.

In a normal business, there is no knowing whether your business style can fit with the times even if you have improved skills and commodity values. There is no knowing how many rivals there are, too. Therefore, the result of business depends on the times, as well as talents and efforts. In the meantime, FX trending gives you a chance to continue to make money as long as you acquire trading skills. This is because FX trade is a self-contained business as a third party does not intervene in the trades, and because the trading is not affected by the times.

④There is a low running cost.

When it comes to running cost, FX trading is by far the lowest of all businesses. In a normal business, the cost increases according to the increase of sales. In FX trading, no matter how much money you may earn, the cost will not increase.

You just have to pay for purchasing a PC, line cost and electricity to do FX trading. This is one of the significant advantages of FX trading.

<In a nutshell>

Advantages of FX trading:

- You are able to make significantly huge money (thanks to leverage).

- You are free to choose the residence and work location.

- You are able to continue to make money free of times if you acquire trading skills.

- There is a low running cost.

Tradeview: Innovative Liquidity Connector (ILC Account) MT4

Disadvantages of FX trading

①There is a possibility that your money decreases.

By its nature, if you lose money through FX trading, your funds for investment will inevitably decrease. You will be able to find on the web the trading methods and EAs which boast that “you can absolutely win in FX trading!”. I am suspicious of them. Any investment is accompanied by the possibility of losing money. You may experience consecutive losses. However, there is no problem as long as you can make money on a monthly or annual basis. What matters is how to mitigate the risk and manage the money. I recognize that, in each trade, it is important to continue to bet on “superiority”, which is thought to temporarily show a high winning percentage.

Even excellent traders had experienced losses before yielding huge profits. Those who have enjoyed higher earnings have continued to win because they are aware of increasing revenues while preventing losses as much as possible.

②The more money you have, the more advantageous to you it is.

The total amount of funds matters most in FX trading. The more money such as margin money and funds for investment you have, the less difficult it is to do the trading. So this is an advantage, not disadvantage, for those who have a huge amount of money.

For example, a trader sets 1% as loss or profit limit per trade. If the trader invests USD 1,000, he/she will receive USD 10.00 as a profit, while it will amount to USD 1,000.00 when USD 100,000 is invested. The amount of profit greatly differs according to how much money is invested.

The revenue yielded through FX trading depends on trading skills and funds for investment.

③The result of trading depends on the market.

As the market closes on Saturdays and Sundays, traders cannot make money on weekends.

Also, while the revenue of a normal business depends on the speed of working, the market itself matters when it comes to earning the money through FX trading.

In my experience, comparing the annual revenues, the year when the range-bound trading method (contrarian trading strategy) fits and the one when the market-following trading method fits come randomly. It is until the year concludes Which method has been more effective and efficient to make money throughout that year cannot be figured out until the year concludes. This is because the rise and fall of funds depend on the market.

I have used multiple trading methods simultaneously as a risk management to secure a budget surplus on an annual basis. I think it better not to be correlated with these methods in consideration of risk management. Therefore, I have made good use of the indicator-trending method to anticipate the rebound, as well as the above-mentioned methods. For your reference, I show the results of past five years’ trading. The range-bound trading method and the market-following trading method contradict each other.

<In a nutshell>

Disadvantages of FX trading:

- There is a possibility that your money decreases.

- The more money you have, the more advantageous to you it is.

- The result depends on the market.

That is a wrap of my explanation about advantages and disadvantages of FX trading.

As mentioned at the front, FX trading is much more efficient than any other businesses when it comes to earning money. However, it is true that there is a risk of losing money through trading. If you cannot accept such disadvantages, you should avoid doing FX trading.

Thank you very much for reading it. My website provides various tips and information about FX.

I also make public my trading on my Instagram account. I would like you to visit there, too.