In the world of FX trading, you may see the comments like "I got 100 pips in a month" or "I set my stop loss line at 20 pips”. This article introduces what “pips” is and how to calculate profit and loss using pips to those not familiar with it.

Contents

What is “pip”?

Pip, an abbreviation for “Percentage In Point”, stands for one-hundredth of the smallest unit in each currency.

JPY

Minimum unit = JPY

JPY 1 × 0.01 = JPY 0.01 = 1 pip

1 pip of JPY = JPY 0.01

US Dollar

Smallest unit = 1 cent

1 cent × 0.01 = 0.01 cent = USD 0.0001 = 1 pip

1 pip of USD = USD 0.0001

What is “point” (and how does it differ from pip)?

In the world of FX, the unit “point” is also used in addition to pip. Since it can be troublesome to confuse, we take a look at “point” here.

Point is “the number that is counted as the first digit of the smallest decimal point of the rate displayed by each broker”.

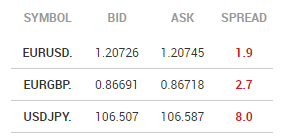

We will use the above rates from XM as an example.

EUR/USD rate is quoted with five decimal places while USD/JPY is quoted with three decimal places. Therefore, the fifth decimal place is the first digit of “point” of EUR/USD, and for USDJPY, it is the third decimal place.

<Example>

EUR/USD 1.20745

USD/JPY 106.507

EUR/USD: USD 0.0001 = 1 pip = 10 point

USD/JPY: JPY 0.01 = 1 pip = 10 point

XM quotes EUR/USD rate with five decimal places or USD/JPY with three. So 1 pip is equivalent to 10 points. However, as shown below, some brokers which quote the rate with four (or two) decimal places employ the system of “1 pip=1 point”.

<Example>

EURUSD 1.2072

USDJPY 106.50

EUR/USD: USD 0.0001 = 1 pip = 1 point

USD/JPY: JPY 0.01 = 1 pip = 1 point

The definition of point may vary between brokers. But many brokers tend to employ the former system, displaying to the fifth or third decimal place of each currency pair. While the definition of point may be inconsistent between brokers, that of pip has consistency.

How to calculate profit and loss using pips

Next, we take a look at how to use pips to calculate profit and loss. Here, I will use an example to explain how much profit and loss you will make when you gain some number of pips in a certain currency pair.

Amount of profit and loss earned =

Amount of currency traded × Base value per pip × Number of pips earned

Base value per pip

Currency pair with JPY = 0.01

Other currency pairs = 0.0001

Example (1)

Account currency: USD

Currency pair: EUR/USD

How much money does a trader make when he/she trades with 100,000 currencies and earns 50 pips?

<Answer>

USD 500.00

<How to calculate>

EUR 100,000 × 0.0001 × 50 pips = USD 500.00

Example (2)

Account currency: JPY

Currency pair: USD/JPY

How much money does a trader make when he/she trades with 100,000 currencies and earns 50 pips?

<Answer>

JPY 50,000

<Calculation>

USD 100,000 USD × 0.01 × 50 pips = JPY 50,000

Why is pip used in FX trading?

One of the reasons why pip is used as a common unit in the forex market is to make transactions easier to understand. Since FX trading involves various currencies with different units, it is necessary to have a common unit which can be used for all currencies. That is why the concept of pip was born.

You may be confused by this unfamiliar unit at first. But you are not alone. The concept of pip is the foundation of FX and a necessary knowledge to conduct transactions in the forex market.

If you still feel it difficult, you have to just understand that, in JPY, 1 pip is equivalent to JPY 0.01 and, in other currencies, 1 pip is equivalent to 0.0001 of the corresponding currency.

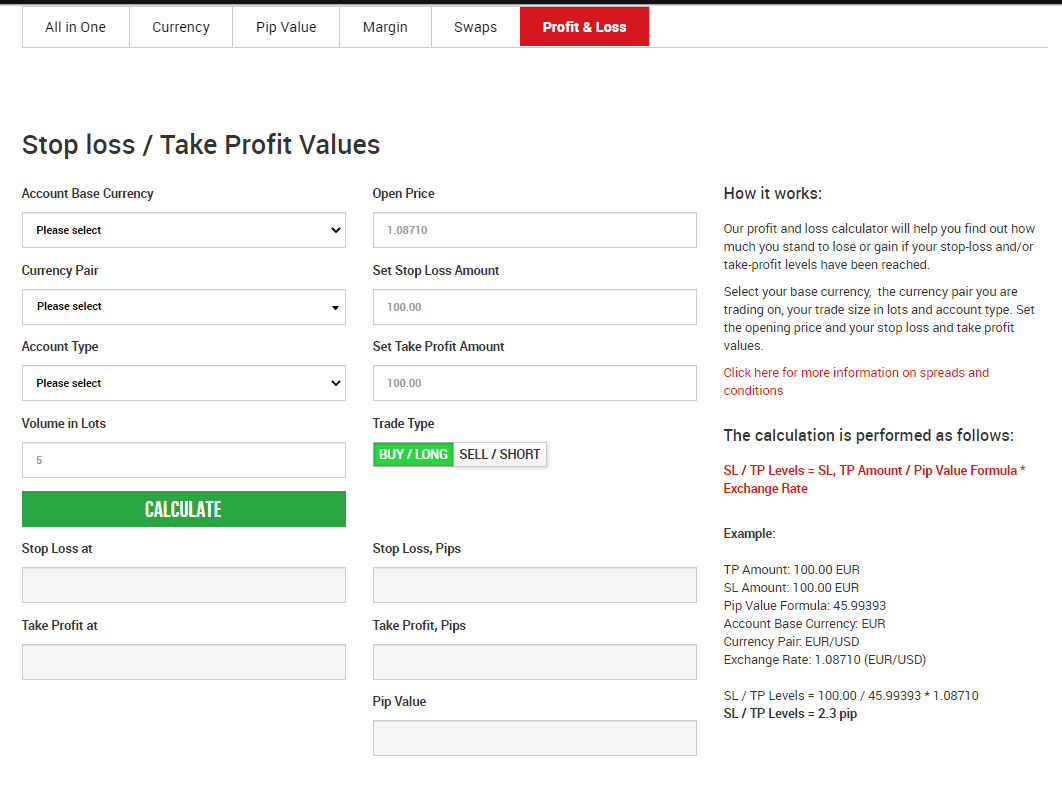

Useful tool for profit and loss calculation

I think that calculating profit and loss using pips can be done in your head once you get used to it. However, you may feel insecure until you reach such a level. In case you make a mistake, your trading plan might be distorted. Therefore, I would like to introduce an automatic calculation tool. This tool is provided at XM's official website. Even if you don't have an account with XM, you can use it for free, so please give it a try.

Free-of-charge Profit and Loss Calculator →

<What you can do with this calculation tool>

This tool automatically calculates the rate of your stop-loss and profit-taking lines, and how many pips away from the entry price the rate is. I believe that many traders will find it useful to be able to instantly know the rate and pips by entering stop-loss and profit-taking lines in your account currency.

What information is required

By entering the following information, you can perform profit and loss calculations.

①Account Base Currency

Select your account currency

②Currency Pair

Select the currency pair of your trade.

③Account Type

Select an account type.

(Even if you don't have an account with XM, you can still calculate the correct value by choosing the appropriate amount of currency per lot.)

④Volume in Lots

Enter the number of trading lots (amount of currency).

⑤Open Price

Enter the rate at which you plan to enter (or you have entered).

⑥Set Stop Loss Amount

Enter the stop-loss price in the account currency chosen at 1).

Example: If you want to cut your losses at a rate of USD 500.00, enter "500.00".

⑦Set Take Profit Amount

Enter the profit-taking price in the account currency chosen at 1).

Example: If you want to make a profit of USD 500.00, enter "500.00".

⑧Trade Type

Select whether it is a buy entry or a sell entry.

When you have completed the input, press the green button CALCULATE, and the tool starts the calculation and the following information will be shown.

Calculation results

By completing the input, you can confirm the below calculation results.

A: Stop Loss at

The rate at which the specified stop-loss line is reached.

B: Take Profit at

The rate at which the specified profit-taking line is reached.

C: Stop Loss, Pips

The range of pips to reach the specified stop-loss line.

(How many pips after entry are required to reach the specified stop-loss line.)

D: Take Profit, Pips

The range of pips to reach the specified profit-taking line.

(How many pips after the entry are required to reach the specified profit-taking line.)

E: Pip Value (USD)

The amount of money moved by a 1-pip change

<Calculation Formula>

Pip Value=1 pip(*)/rate × lot size

(*)1pip

Currency pair with JPY = 0.01

Other currency pairs = 0.0001

Example of pip value calculation:

Account currency: USD

1 pip: 0.0001

Trading currency: EUR/USD

EUR/USD rate 1.22260

Lot size: 100,000 currencies (EUR)

Pip Value = 0.0001/1.22260× 100,000 = USD 8.1792

An up or down by 1 pip is equivalent to the change of rate by $8.1792.

This article only introduces the profit and loss calculation tool. But XM has various tools which can be used for other calculations necessary for FX trading. I will explain them in other articles, so please have a look if you are interested.

XM Calculation Tool →

Related Articles

【XM】XM’s Free Calculation Tool

This concludes the explanation of pips. Thank you for sparing your precious time to read this article.