This article first introduces the overview of swap trade in forex for beginners and then looks at how XM handles swap trade.

As mentioned below, XM is not suitable for traders who want to do the swap trade, although it offers high-swap currency pairs. I hope readers of this article would think twice before doing the swap trade via XM.

[NOTE]

XM is not a swap-point-oriented broker but one of the best forex brokers when it comes to the company size, licensing and trading environment. It is suitable for day and swing traders. For your information, GEMFOREX is suitable for swap traders.

[Summary]

XM is not suitable for swap traders for the following reasons.

- Cross order entry results in negative.

- A currency pair with a large swap point has a wide spread.

- A currency pair with a large swap point is subject to volatility.

XM Official Website (Outside Europe)

Overview of Swap Point

What Is "Swap Point"?

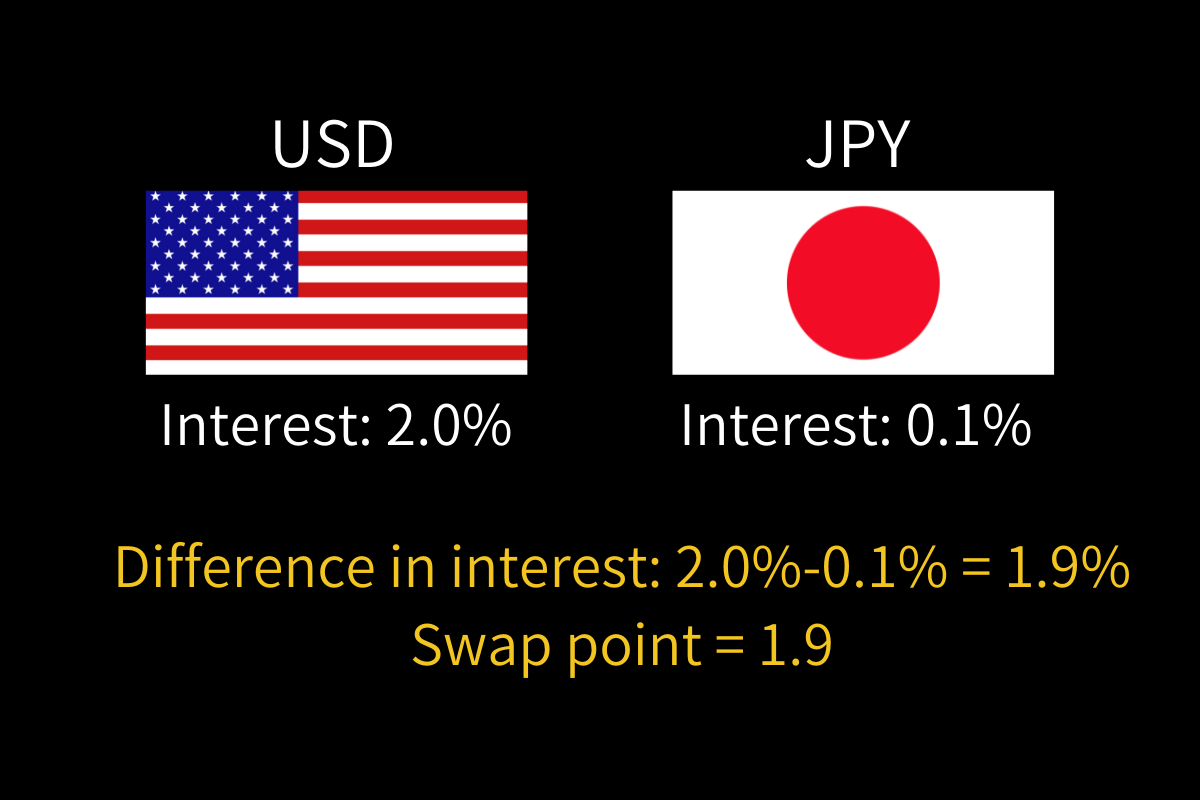

In FX trading, swap points represent the difference in interest rates between a currency with a higher interest rate and a currency with a lower interest rate.

If you hold a long position in a currency with a high-interest rate, you will receive swap points. Conversely, if you hold a short position in a currency with a high-interest rate, you must bear swap points.

In the below example, if you buy USD and sell JPY, you will receive a swap point of 1.9. But if you sell USD and buy JPY, you must pay a swap point of 1.9.

How Swap Points Are Determined

Swap points represent the difference in interest rates, but they do not reflect the difference in the actual interest rates. Each broker can set its own swap point based on the difference. As the intention of each broker is intervened, swap points are not always the same between brokers.

USD/JPY Swap Point by Broker

| XM | 5.58 |

| TitanFX | 3.76 |

| LAND-FX | 6.87 |

| GEMFOREX | 0.22 |

How to Check Swap Points

There are two ways to check swap points.

(1) Use MT4 or MT5.

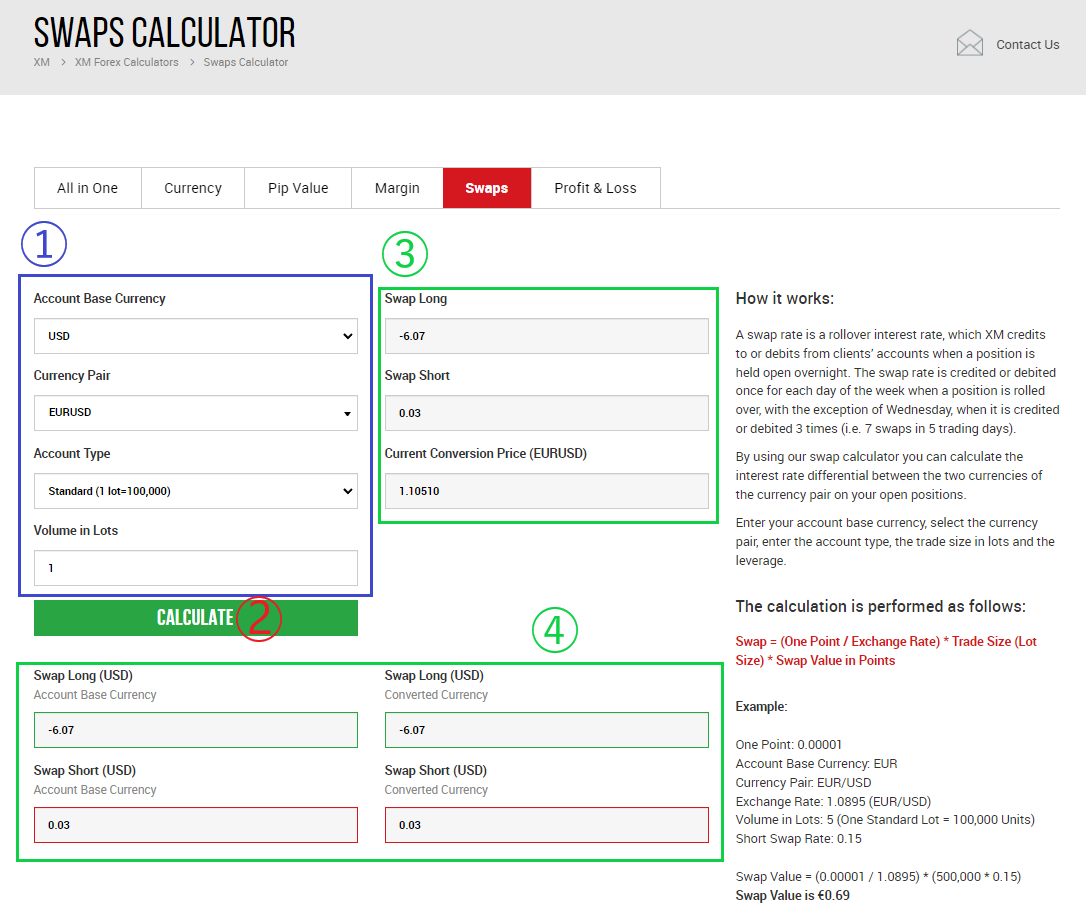

(2) Use XM's Swaps Calculator

(1) Use MT4 or MT5

- Click [View]

- Click [Symbols]

- Select the currency pair to check the swap point

- Click [Properties]

- See the lines of [Swap long] and [Swap short] to check the swap point per lot

(2) Use XM's Swaps Calculator

As finance license differs depending on the country of the broker's residence, XM has multiple official sites.

Click either below to access XM Forex Calculators and select Swaps Calculator.

XM Forex Calculators (Europe):

XM Forex Calculators (Outside Europe):

- Select and enter [Account Base Currency] [Currency Pair] [Account Type] and [Volume in Lots].

- Click [CALCULATE].

- [Swap Long] and [Swap Short] per lot (equivalent to MT4 and MT5's "Swap long" and "Swap short") and Currency Conversion Price appear.

- Swap points of designated account currency pair, account type and lot size appear.

How to Calculate Swap Point

When the designated currency pair includes JPY:

[Swap Long] or [Swap Short] × Lot Size × 0.001 = Swap Value per Day

When the designated currency pair does not include JPY:

[Swap Long] or [Swap Short] × Lot Size × 0.00001 = Swap Value per Day

The difference between 0.001 and 0.00001 stems from the fact that swap points are calculated in points, which depend on the number of digits after the decimal point of the rate. Like many brokers, XM employs 0.001 for the currency pair with JPY (ex: USD/JPY:106.507) and 0.00001 for others (ex: EUR/USD:1.20745).

The difference between pips and points can be found in the following article.

[Calculation Example]

Currency Pair: EUR/USD

Lot Size: 100,000 currencies

Buy entry

Swap Long: -6.07

-6.07 × 100,000 × 0.00001 = USD -6.07 (per day)

When Swap Points Are Credited

XM aligns the time of crediting swap points with the one when the date changes on MT4 or MT5, usually midnight (GMT+2.0). The time, called "rollover time," depends on the trader's country. Swap points will be credited as soon as the below time.

Rollover Time in Major Cities (MT4 and MT5)

| City | Rollover Time |

| Tokyo | 7:00 |

| Singapore | 6:00 |

| Kuala Lumpur | 6:00 |

| Bangkok | 5:00 |

| Barcelona | 23:00 |

| London | 22:00 |

| New York | 17:00 |

[NOTE]

Daylight saving time is not considered in the above table. But recently, there has been a growing trend, especially in Europe, to abolish daylight saving time.

For your information, MT4 and MT5 provided by XM and many other brokers sets the GMT+2.0 time setting to align the closing time of financial institutions and brokers in New York (approx. 17:00) with the time of date change on MT4 and MT5.

Rollover Time on Thursdays

Swap points credited every Thursday are three times more than those credited on other days to cover the swap points of weekends.

Three Reasons Why XM Is Not Suitable for Swap Traders

[Summary]

- Cross order entry results in negative.

- A currency pair with a large swap point has a wide spread.

- A currency pair with a large swap point is subject to volatility.

Cross order entry results in negative.

XM sets the swap points of a currency pair so that the absolute value of the negative swap is larger than that of the positive swap. If you place a cross order with the same amount of currencies, you will certainly lose a certain amount of swap points.

The top three currency pairs with large swap points are shown below.

Top 3 Currency Pairs with Large Swap Point

| Currency Pair | Swap Long (USD) | Swap Short (USD) |

| EUR/TRY | -89.63 | +29.16 |

| USD/TRY | -78.37 | +23.6 |

| EUR/ZAR | -24.57 | +7.93 |

Below is the case in that you placed a cross order for EUR/TRY in USD.

Note on Cross Order in XM

Some may think that we should use XM and another broker to place a cross order to keep the swap points positive. However, like other major brokers, XM prohibits cross order of this style.

A Currency Pair with A Large Swap Point Has A Wide Spread

The average spread in EUR/TRY is 20.0 pips. It means that, if you invest in 100,000 currencies, you will start the transaction after deducting USD 13.60 (account currency: USD, EUR/TRY=16.38971). Considering the effort to earn 20.0 pips and USD 13.60, it is better to avoid such a pair.

Spread of Currency Pairs with Large Swap Point

| Currency Pairs | Spread |

| EUR/TRY | 20.0 pips |

| USD/TRY | 18.0 pips |

| EUR/ZAR | 150.0 pips |

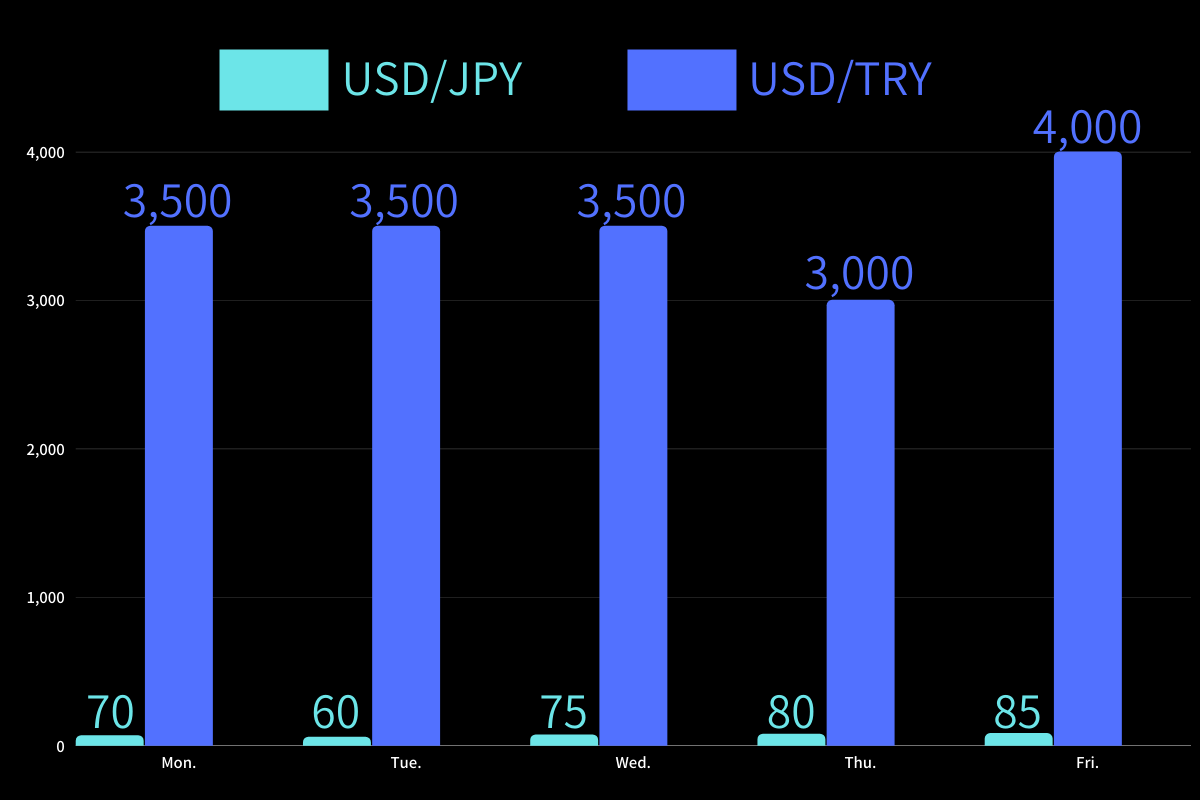

A Currency Pair with A Large Swap Point Is Subject to Volatility

A currency pair with a large swap point is very volatile compared to major currency pairs. For example, the average volatility of USD/JPY is 70 pips, while that of USD/TRY is as many as 3,500 pips (as of March 2022).

Sure, high volatility allows earning money. To the contrary, it poses a high risk and requires a quite delicate fund management.

When doing a swap trade, you should hold a position for a long period. However, a currency pair with a large swap point is not suitable for long-term holding due to its excessive volatility.

Average Volatility of USD/JPY and USD/TRY by Day (March 2022, pips)

Conclusion

XM is not suitable for swap traders for the following reasons;

- Cross order entry results in negative.

- A currency pair with a large swap point has a wide spread.

- A currency pair with a large swap point is subject to volatility.

Instead, XM is suitable for traders of scalping, day and swing trading. It is a strong ally for non-swap traders.

XM Official Website (Outside Europe)

Also, GEMFOREX is suitable for swap traders. If you are interested in utilizing the broker's advantage, please visit the following official site.

GEMFOREX official website

Thank you for sparing your time to read this article.